$531B. 62%. $2B. Three numbers shaping Cloud GTM in 2026

Hi, it’s Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

2025 closed with cloud commits crossing $531B and marketplace revenue hitting new records. Now S&P Global Market Intelligence declares marketplaces the “app store of the GenAI era” — and the numbers show why 2026 is the year to scale with Cloud GTM.

In today’s newsletter:

Key numbers that defined Cloud GTM in 2025: $531B in cloud commits, 62% net-new marketplace revenue (not deal shift), measurable marketplace multipliers — and the $2B Marketplace Club expanding fast

S&P Global frames marketplaces as AI’s “predominant distribution network” — as 69% of enterprises plan to increase public cloud spend and S&P sizes the $60B AI opportunity for 2026

But before we dive in, we’re hosting an online workshop on January 12 with Laura Ripans, Senior Director, Global Cloud Alliances at Datadog (one of the elite $2B Marketplace Club members).

We’ll break down the 5 breakthrough signals from 2025 — and the 2026 playbook to scale GTM on marketplaces.

This kicks off our 2026 programming and leads into Cohort 14 of Cloud GTM Leader course starting January 20th.

Cloud GTM 2025 /26: Year Defined By Numbers

Three numbers defined Cloud GTM in 2025: $531B, 62%, $2B

If you’re planning 2026, here are the shifts that mattered most — and how to apply them.

1️⃣ Cloud commits accelerated, crossing $500B in Q3

Customer committed spend on AWS + Microsoft Azure + Google Cloud crossed $531B (+$63B in Q3 alone).

Translation: more cloud marketplace deals now start with “we have commits to use” than before

2️⃣ The $2B Marketplace benchmark went mainstream

Snowflake did $2B on AWS Marketplace in 2025 alone - and now ~45% of its revenue runs through it.

Datadog crossed $2B on AWS Marketplace and Salesforce hit $3B.

Palo Alto Networks reached $2B on Google Cloud Marketplace, adding +$500M in ~8 months.

“$2B Marketplace Club” is forming fast: winners turned Marketplace into a repeatable revenue path.

Startups are growing on Marketplaces too (130% YoY startup growth per AWS), while companies like Vanta saw private offers grow 700% YoY.

3️⃣ Marketplace multiplier is now measurable economics

Microsoft reported: Marketplace partners capture $6.26 in extra value for every $1 transacted (via Omdia).

AWS: $7.13 in partner revenue for every $1 of AWS technology sold (total, not just MP).

Google Cloud: $7.05 in partner revenue for every $1 of GCP consumption (total).

Translation: the “partner story” is now measurable on marketplaces, which are the best way to capture this multiplier. Marketplaces turn partner value into repeatable procurement + co-sell + services attach—at enterprise scale.

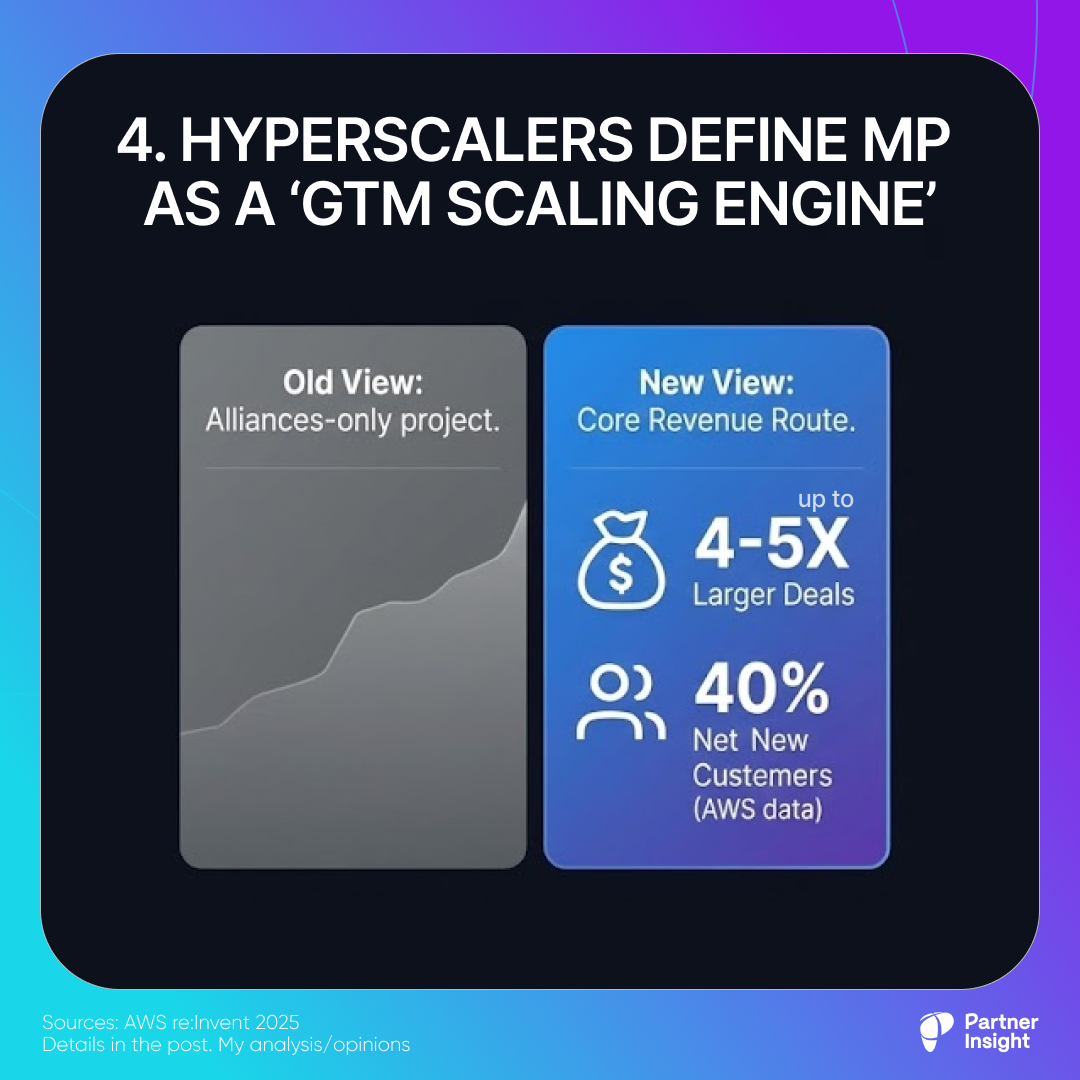

4️⃣ Hyperscalers started calling Marketplace what it is: a GTM engine

At re:Invent, AWS described Marketplace as “the most powerful GTM scaling engine”—citing up to 4–5X larger deals and up to 40% net-new customers for leading partners.

The message is clear: Marketplace isn’t an alliances-only project anymore. It’s a core route to revenue for the majority of software companies.

5️⃣ Net-new revenue > deal shift (data is clear)

In our Q1’25 research, 62% of companies reported net-new revenue from marketplaces—not just shifted deals.

How? 94% of top performers engage hyperscaler field teams consistently.

If you’re still waiting because of “cannibalization risk,” you’re likely waiting on the wrong problem.

Our community grew in the middle of this shift

1M+ views of our marketplace / cloud GTM insights in 2025

1,000+ leaders joined our virtual and in-person events in SF, Vegas and London

5,000 leaders now read our newsletter weekly

300+ course alumni applying our marketplace GTM playbooks

~100 experts spoke at our events and courses

Thrilled to continue building, learning and sharing insights with all of you.

These insights shaped our 2026 playbook — and we’re breaking it down in detail on January 12.

Online Workshop: Inside $2B Club — 5 Marketplace Signals Winners Use to Win 2026

With recent AWS re:Invent + Microsoft Ignite back-to-back, one message is clear: marketplaces are the most powerful GTM scaling engines for enterprise software.

And the $2B Marketplace Club is forming fast — with Datadog among the elite selling billions via marketplaces.

Join us next week to get the 2026 Cloud GTM growth playbook.

In this session, we’ll break down:

The 5 breakthrough signals from 2025 (and what they mean for your 2026 plan)

Practical GTM + co-sell strategies the field actually runs with

2026 blueprint to move from insights → execution (and avoid the common traps that stall teams)

Learn transformations from top operators

Laura Ripans, Senior Director, Global Cloud Alliances at Datadog has built one of the most successful cloud alliance programs in the industry and has been recognized five times in CRN’s Women of the Channel.

She brings a multi-cloud perspective on building durable relationships with Microsoft and other hyperscalers — while keeping GTM anchored to customer outcomes.

Join us for on January 12th, 9-10am PT to get the 2026 Cloud GTM growth playbook

P.S. This free workshop kicks off our 2026 programming and leads into Cohort 14 of Cloud GTM Leader starting January 20.

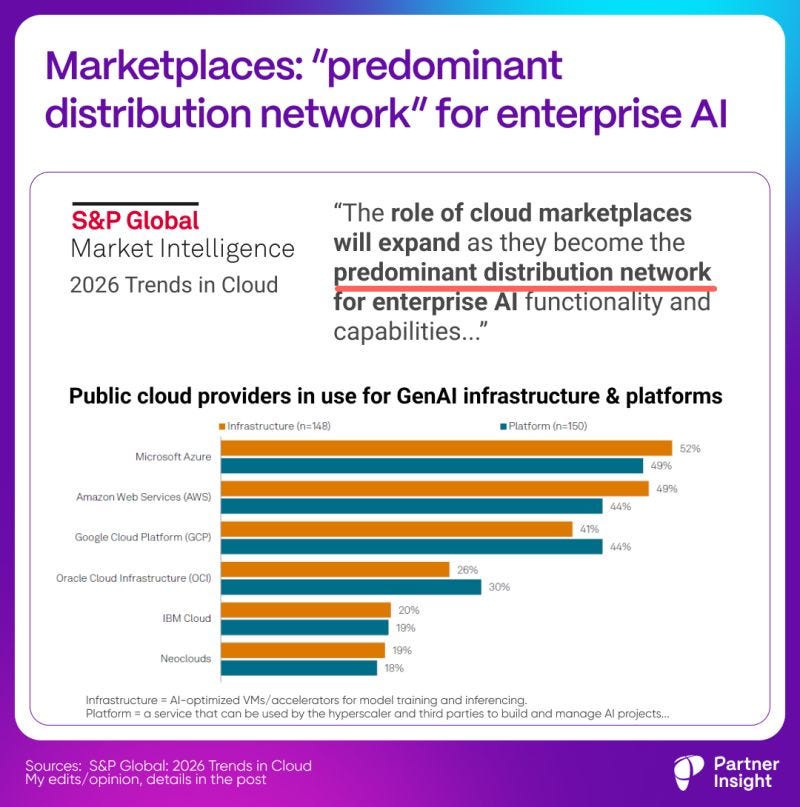

Marketplaces: “predominant distribution network” for enterprise AI

In 2026 “cloud marketplaces will solidify their role as the app store of the GenAI era” - latest S&P Global Market Intelligence research highlights. If you’re in alliances, that’s the clearest signal you need.

“The role of cloud marketplaces will expand as they become the predominant distribution network for enterprise AI functionality and capabilities….” - S&P underscores.

Here’s my breakdown of what they’re saying:

1️⃣ Marketplaces = “app store” for enterprise AI

Cloud marketplaces are framed as a place where:

vendors + developers sell

enterprises discover + procure

integrators deliver advisory, implementation, optimization

Value exchange is clear: vendors monetize faster, buyers deploy faster, hyperscalers drive more consumption.

In AI era, what’s being distributed shifts to: models, data platforms, pre-defined agents, and enterprise AI software pre-integrated with cloud infrastructure.

Result? Marketplaces become the bridge between AI demand and AI supply.

2️⃣ Commit budgets create a flywheel

The report ties marketplaces to cloud spend commits: customers can use committed dollars to buy AI software, agents, and platforms.

Marketplaces fit AI especially well: GenAI projects are evolving fast, and buyers want to fund them with already-allocated budgets (commits) rather than net-new procurement cycles.

Marketplaces become the shortest path from “AI project” → “procurement” → “deployment”.

3️⃣ Partners: massive AI upside - in a world of co-opetition

Everyone is trying to own more layers of the AI stack (hyperscalers, neoclouds, hardware vendors, MSPs, ISVs, GSIs) — and S&P sizes the 2026 AI opportunity as a $60B market.

But two dynamics are happening in parallel:

“Most surveyed organizations will require considerable transformation of their IT environments over the next five years to support AI workloads at scale.”

AND:

“Alongside fierce competition, the market will also exhibit increased collaboration, partnerships, ecosystem development and acquisition/equity investment activity…”

Translation: massive services + solutions + partnerships opportunities while everyone is fighting for their place in the AI stack.

4️⃣ Cloud demand keeps rising

If someone says “cloud is slowing,” the workload data points the other way: companies are prioritizing public cloud for their innovations.

39% are deploying net new workloads to public cloud (top destination for new apps)

69% plan to increase public cloud spend (with AI/ML as the top driver)

78% are moving data between clouds (up from 40% last year), signaling a major maturing of the cloud ecosystem

What this means for Alliance leaders:

Treat Marketplace as the key distribution rail (agents/apps + marketplace now converge)

Package partner motions around “commit spend > marketplace purchase > services attach”

Expect fiercer co-opetition — design your GTM to win on speed + integration

If you own alliances: what are you changing in your 2026 GTM because of this shift?

Make 2026 Your Marketplace Growth Year: Join Cohort 14 Starting on January 20th

Enterprises have committed $531B to AWS, Microsoft, and Google Cloud — budgets you can tap into via cloud marketplaces. For SaaS and AI companies, Marketplace GTM can make or break scale in 2026.

The most advanced GTM orgs – from scaleups to public companies – are rewriting the rules. They’re using marketplaces and co-sell to scale revenue faster, compress sales cycles by 40-60%, and make buying frictionless.

Real results from real companies

Over the past two years, 300 alliance leaders have completed Cloud GTM Leader course and built this capability. Examples of what alumni have achieved:

Launched from zero marketplace motion to $200K revenue + $7M pipeline in 8 weeks

Closed their first $1M+ marketplace deal and turned it into a repeatable motion

Scaled marketplace revenue 4X YoY from an already high eight-figure base

These aren’t outliers. They’re alliance leaders who invested 5 weeks to master the frameworks, tactics and relationships that drive cloud GTM success.

What we master in 5 weeks:

How to tap into cloud commits + marketplace buying processes

Co-sell patterns with hyperscaler field teams that actually create pipeline

How to position on marketplaces so sellers choose you among thousands of vendors

Frameworks to align sales, product, finance, and ops around one cloud GTM plan

How to accelerate deals with smart co-marketing (and more)

If 2026 is the year you want Marketplace to become a real growth channel — join our cohort starting on January 20.

What alumni are saying

“I wish I had this knowledge before I started my role in the GTM department last year.”

“As someone who has built AWS alliances twice, driven marketplace success, and led cross-functional GTM motions, this program elevated my perspective and sharpened my thinking around cloud co-sell programs, marketplace motions, channel strategy, and scalable GTM frameworks. Highly recommend.”

P.S. If you found these insights valuable, please forward this newsletter to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.