AI Now Writes >70% of Code in Anthropic: Cloud GTM Leaders Face New Reality

Hi, it's Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week we break down:

70-90% of Anthropic's code is now written by Claude — CEO reveals engineers have shifted from coding to orchestrating AI-managed fleets. This trend will flip the SaaS operating model and make marketplaces the critical control plane.

Why 60% of enterprises can't scale AI agents — and how hyperscaler marketplaces solve governance, integration, and compliance barriers that Deloitte identifies as the biggest blockers.

Microsoft's 7X marketplace sales secret — ISVs using Marketplace Rewards see dramatically higher revenue, yet many don't leverage the programmatic support that activates the moment you go transactable.

Netskope's 95% partner revenue wins Wall Street — their IPO trades >25% above launch price, proving partner-first GTM strategies can drive billion-dollar outcomes.

Before we dive in, if you find these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it's how this community shares what works.

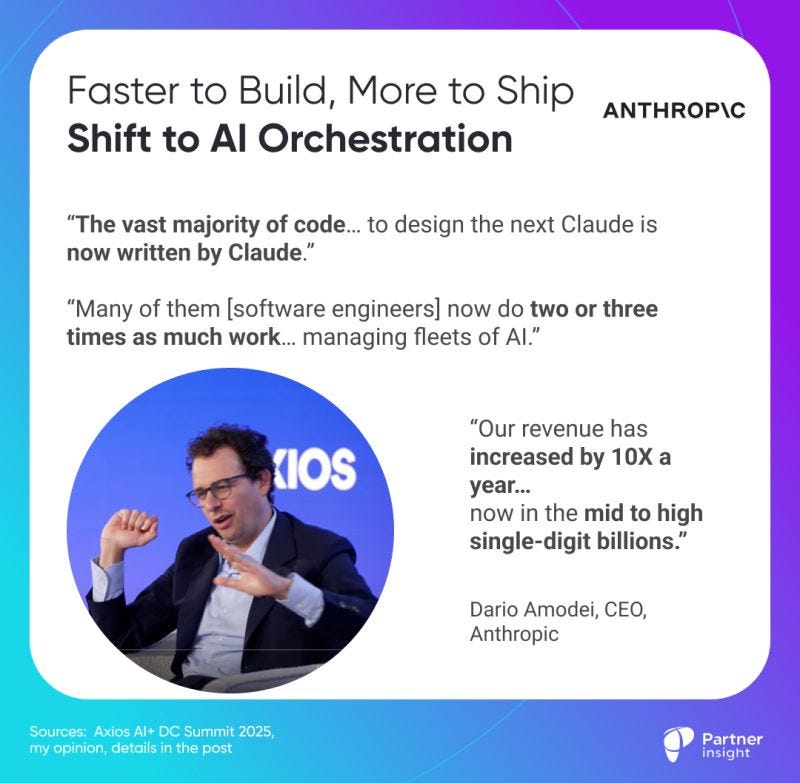

Faster to Build, More to Ship: Shift to AI Orchestration

If 70-90% of code at Anthropic is written by Claude - and engineers now manage fleets of AIs - our SaaS ecosystem operating model is about to flip.

This isn’t a feature wave; it’s a new way to build and distribute AI, already spreading across teams (even if more slowly elsewhere).

At the Axios AI+ D.C. Summit, Anthropic CEO Dario Amodei shared a candid, B2B-grounded view of AI adoption.

Anthropic studied 130 engineers: many have shifted from writing code to orchestrating agents.

“Many of them now do two or three times as much work… rather than writing code, they’re managing fleets of AI systems.”

10X revenue signals the B2B adoption story

“Our revenue has increased by 10X a year… it’s now in the mid to high single-digit billions.”

That implies roughly $5–8B today, up from $1B in 2024.

For skeptics: B2B customers don’t pay billions for novelty - they’re seeing measurable value.

What makes this wave different:

Self-improvement loop has begun

“The vast majority of code… to support Claude and to design the next Claude is now written by Claude.”

This starts a positive feedback loop where each generation helps build the next—accelerating capability beyond human-limited cycles.

Capability compounds on schedule

“Every 3 months we’ve released a model that improves in a straightforward log-linear way… the curve is smooth; the wiggles are perception.”

Yes, Dario is talking his book.

But the question remains: what happens when software is 3X cheaper to create and starts improving itself?

We don’t get a bit more software.

We get 3–10X more products, agents, and automations—deployed where the data lives, woven into other apps, and evolving monthly.

The bottleneck shifts from production to security, governance, deployment, integration, and lifecycle management.

Three enterprise paths:

Internal app stores of approved agents - most flexible, tech heavy.

Cloud marketplaces (AWS/Azure/GCP) - familiar procurement, governance, and budgets

Large specialized platforms (Salesforce, Workday, Notion, CrowdStrike, etc.) - simpler start, scope limited to those ecosystems.

What this means for alliance leaders

Marketplaces become the control plane

Marketplaces evolve into AI management, governance, and deployment platforms. As teams run AI fleets, enterprises will use cloud marketplaces to procure, entitle, meter, evaluate, and retire AI apps and agents at scale.

Partner roles flip: reseller → orchestrator

When customers manage fleets of Agents instead of discrete apps, partners orchestrate workflows and outcomes, not just redistribute licenses. That demands deeper technical competency and outcome-based services.

The ecosystem is entering an exponential phase

“Every 3 months… log-linear improvement.”

The tech curve is predictable; the challenge is keeping the partner strategy in sync with new reality.

Alliance leaders who treat this as incremental change will be planning for a market that no longer exists.

Source: (video)

Why 60% Can't Scale AI Agents—And Marketplace Model That Can

Agentic AI is real - but the ROI is uneven. Recent research shows that adoption is still early, skepticism is high, yet the curve is up and to the right. And marketplaces are how Agentic AI will scale.

Where we are now

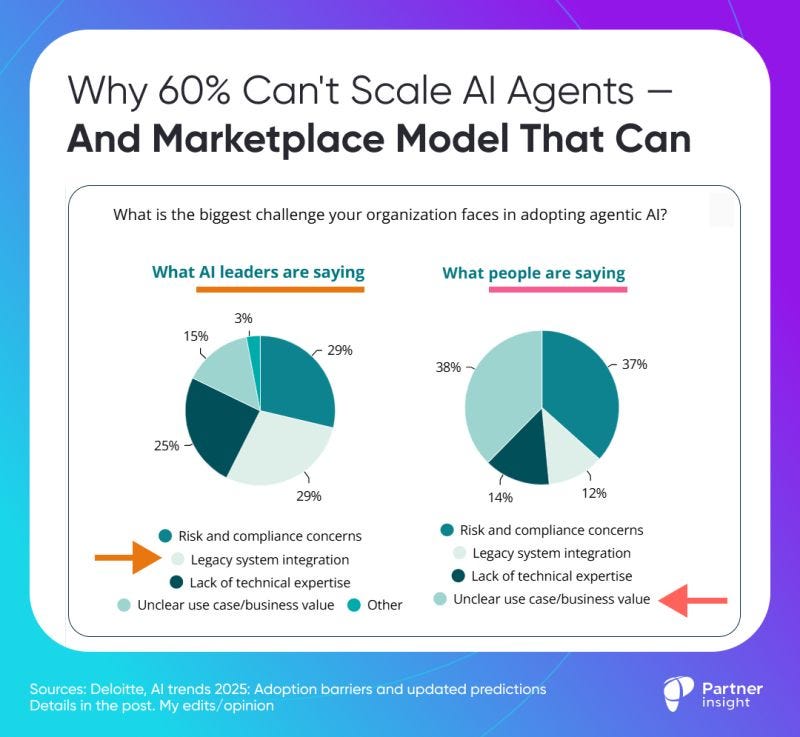

Deloitte recently polled two groups: enterprise AI leaders and the broader community.

Both see agentic AI’s promise, but the blockers differ:

Nearly 60% of AI leaders point to two practical hurdles— integration into legacy systems and risk/compliance—closely followed by talent gaps.

The broader community agrees risk is high but puts “unclear use case/business value” as the number 1 issue.

Translation: leaders are wrestling with plumbing and policy; users are still asking “what’s the first valuable job we can truly automate?”

What’s next

Deloitte projects that about 25% of companies already using GenAI will launch agentic-AI proofs of concept in 2025, trending toward ~50% within two years.

That signals steady expansion—not hype—provided governance and business alignment come first.

But here where it gets interesting

Deloitte argues that the cleanest way to embed and manage agents is through AI agent marketplaces. This can be an internal “app store” that vets, versions, monitors, and governs agents before they go live.

Or this could be hyperscaler agent marketplaces, which Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have now rolled out.

Why marketplaces can scale AI Agents—without the chaos

Built-in guardrails, not bolt-ons: security, compliance, approvals, version control.

Clear visibility into who’s using what, where, and how: Built-in monitoring, tracking, and analytics features to provide visibility into AI agent usage across the organization.

A centralized management layer: A foundation for scaling the agent-driven management, monitoring, and optimization of other AI agents while keeping everything running smoothly.

Deloitte predicts that leading organizations will "simultaneously scale adoption, ensure compliance, and equip people to collaborate effectively with agents."

Practical path

Instead of promising “thousand agents”, perhaps we should start with the promise of a managed environment.

Start with a few high-value agents, prove ROI, and scale through a marketplace.

That’s the path from cautious pilots to durable, revenue-aligned adoption.

And this is where hyperscalers are focused now

As Deloitte notes:

“External marketplaces are starting to emerge as the open, go-to platforms for discovering, publishing, and subscribing to AI agents that can automate workflows, analyze data, and interact with customers….

As these platforms grow, they’ll likely play a big role in how enterprises source and scale AI capabilities—but only if integrated into a secure, governed internal environment.”

What’s your take?

Source: AI Agents Research & Why AI Agents need Marketplaces

7X Marketplace Sales Secret: How Microsoft Boosts ISVs

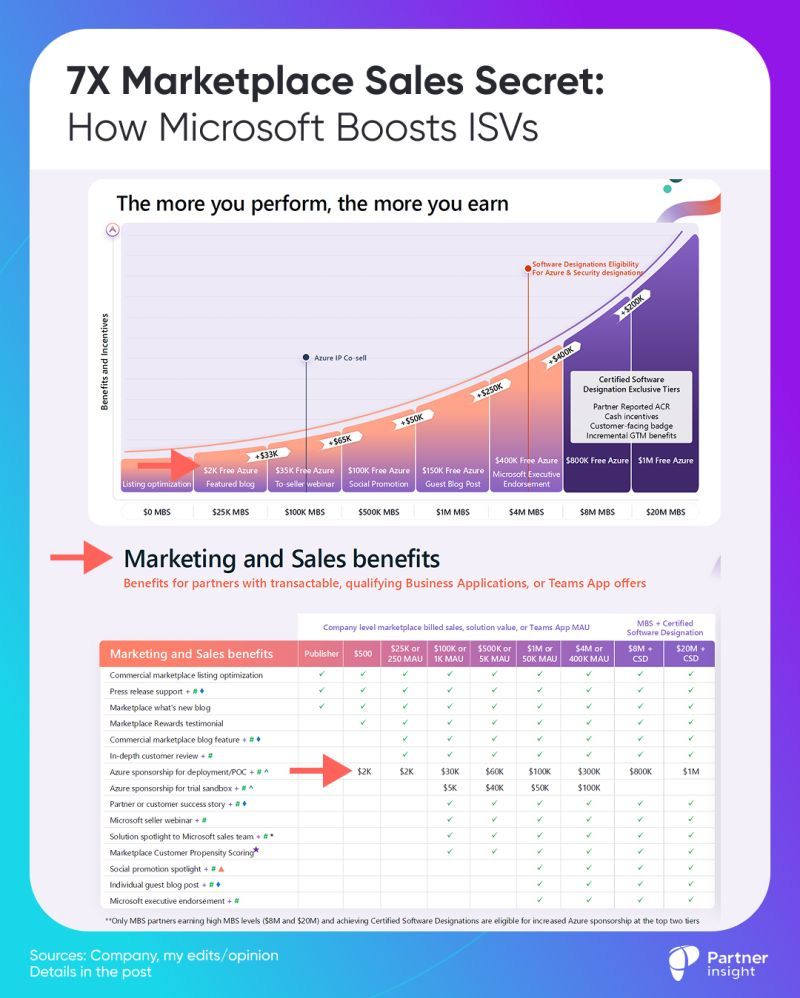

The moment you publish a transactable offer on marketplace, your programmatic marketing support system activates.

Yet many ISVs don't use its benefits.

As marketplaces mature and transact billions of dollars annually, marketing and sales support is more programmatic than ever. It’s now available from the start.

Microsoft Azure is a great example, they have a clear guide for ISV on how to use their Marketplace Rewards (part of ISV Success program).

Microsoft saw 7X higher Marketplace Sales from ISVs that used Marketplace Rewards vs. those who don't

It starts at “list”

Once your offer is live, you unlock baseline GTM help: listing optimization, toolkits, and “What’s New” placements.

When your offer is transactable, benefits become evergreen on a trailing-12-month basis as your Marketplace Billed Sales (MBS) grow.

Performance drives benefits

Marketplace Rewards include Azure Sponsorship that scales with your marketplace sales - credits you can use to fund trials, POCs, and close customer deals faster.

Plus in-kind marketing support like press releases, blog features, seller webinars, solution spotlights, etc.

Math is transparent:

Hit $25K MBS? You get $2K in Azure sponsorship plus blog feature.

Climbed to $100K? You unlock Customer Propensity Scoring (likelihood of your prospects to buy on marketplace) and solution spotlight to Microsoft sales team

Reached $4M? Microsoft gives you $400K in Azure credits and Microsoft executive endorsement, etc.

Microsoft wins when you win through their marketplace, and they reward you to climb further.

This also builds systematic marketplace muscle that many ISVs still lack.

Programs to check out for ISVs

ISV Success

Microsoft’s flagship track for software vendors building on Azure and selling via the commercial marketplace.

Advanced includes up to $50k in Azure credits, and up to $100k cash to build on Azure AI/Analytics.

Solutions Partner – Certified Software Designation (Azure/Security/Industry AI)

Badge + better discoverability in marketplace, accelerate co-sell, and added GTM/marketing benefits; is a prerequisite to unlock ISV Success Advanced.

Azure Accelerate (combined Azure Migrate & Modernize and Azure Innovate)

Provides Azure credits, partner engagement funding, funded assessments, sandbox/pilot environments, etc. For services partners and ISVs supporting customer deployments.

Playbook:

Make your product transactable

Pursue Certified Software Designation to access higher tiers and more support

Align with fiscal year priorities (e.g. AI) to accelerate

Treat marketplace rewards like a tactical deal support tool, not a giveaway

The more you align to Microsoft’s goals and bring new customers to consume on Azure through Marketplace, the more the system leans in.

Source: ISV Success and Marketplace Rewards

Netskope IPO: 95% Partner Revenue Wins Wall Street

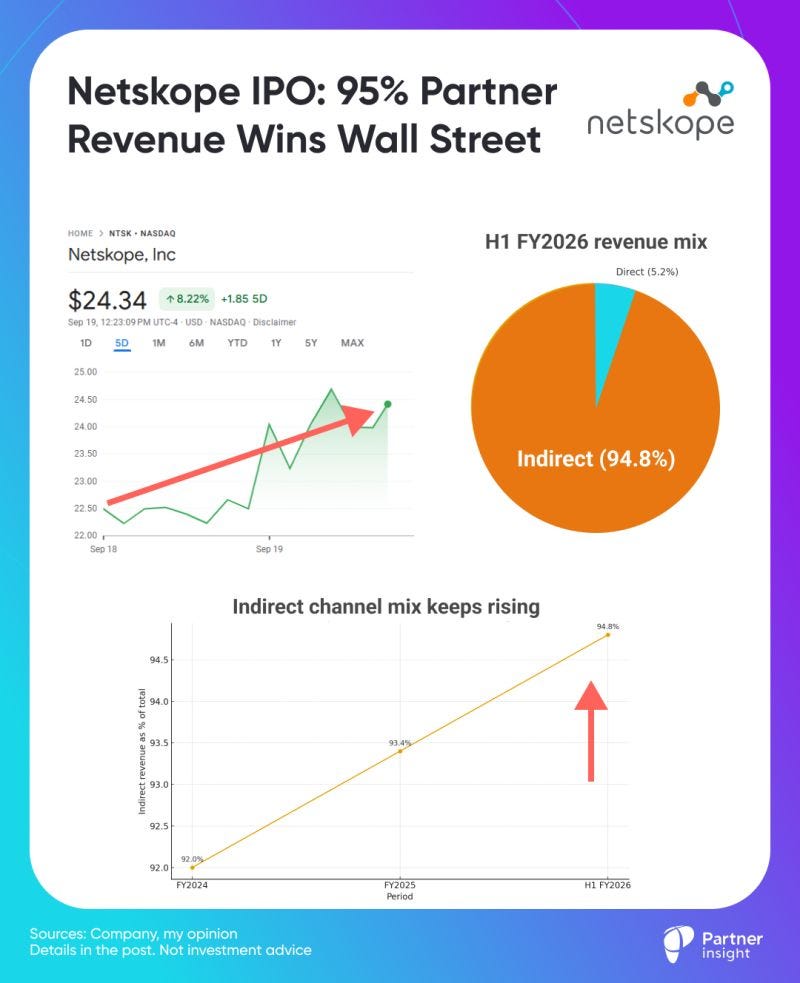

Netskope just showed that a partner-first GTM can win over Wall Street.

If a 94.8% indirect revenue mix sounds extreme, look at the tape: Netskope is trading >25% above its IPO price last week.

Oversubscribed IPO creating awareness flywheel

Netskope raised $908M, valuing it at ~$9B with the book reportedly ~20X oversubscribed.

CEO Sanjay Beri positioned IPO as marketing amplifier rather than need to fundraise: "The big reason why we would go public is not for capital... It's for awareness". Smart strategy.

Partner-first: 95% of revenue is indirect

Partner contribution climbed from ~92% in 2024 to 94.8% in H1 FY26—meaning the channel drives virtually all growth at Netskope.

ARR hit $707M (growing +33% YoY) as of Jul 31, 2025.

Top-5 partners drive 33% of company revenue, supporting a "sell-through partners, co-sell on big deals" GTM thesis. But it's also about scale, not just hero deals.

Scale of the partner ecosystem

Netskope works with 1,600 channel partners worldwide across VARs, MSPs, distributors, GSIs, and MSSPs. (CRN)

Top five drive 33% of total revenue—a concentrated bet on key relationships. So enablement and joint execution with a focused core really matter.

The largest single partner represents 13% of sales, creating both efficiency and dependency risk.

Geographically, international partners are delivering:

EMEA revenue surged 48% to represent 24% of total sales, while APAC contributes 19%.

In Asia-Pacific specifically, Netskope operates 100% through partners with zero direct sales—a pure channel model as international markets outpace domestic growth.

Marketplaces and hyperscalers are core to GTM

Netskope showed strong Amazon Web Services (AWS) Marketplace traction, doubling revenue QoQ as early as 3 years ago.

Ahead of the IPO, they added Netskope One DSPM to AWS Marketplace's new AI Agents & Tools category—smart focus on agentic AI and packaging for how buyers want to purchase now.

Netskope is also selling via Google Cloud Marketplace and integrated in broader Google ecosystem (Workspace Marketplace), plus integrations across Cloud WAN and Google SecOps.

Why the channel actually wins

SASE projects need POCs and implementation services - partners make it repeatable. Canalys noted ecosystems like Netskope's let partners create $2 in services per $1 of product, rising to $4-$6 on platform plays—exactly why channel-first models compound over time.

The company works with global distributors and GSIs (WWT, Exclusive Networks, Ingram Micro, Deloitte/TCS), MSSPs, cloud alliances, etc. That structure reaches Fortune/Global 2000 at scale, not just isolated logos.

Netskope becomes the second pure-play SASE firm publicly traded alongside Zscaler (March 2018 IPO).

Notably, Zscaler just reached $1B TCV in AWS Marketplace sales - validating the partner-first and Cloud GTM approach Netskope is pursuing.

P.S. If you found these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it's how this community shares what works.