Alphabet Hits $3T & Oracle's $455B Backlog Rivals All Hyperscalers

Hi, it's Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week we break down:

Alphabet hits $3T valuation - it's now an AI story, not a search story anymore. We break down the role GCP's 32% growth plays and how it stacks up with other megacaps.

Oracle's $455B backlog rivals AWS+Azure+GCP combined - Multi-cloud database revenue exploded 1,529% in one quarter through strategic collaboration, not competition.

DocuSign's marketplace megadeal weeks after listing - From Q1 partner relaunch to Q2's largest deal via Azure Marketplace (and what alliance teams should copy).

Why marketplace blockers aren't tech - Cohort 12 insights reveal culture and seller resistance, not technology, stall cloud GTM at scale.

Before we dive in, if you find these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it's how this community shares what works.

Alphabet’s $3T Milestone: From Search to AI Cloud Monetization

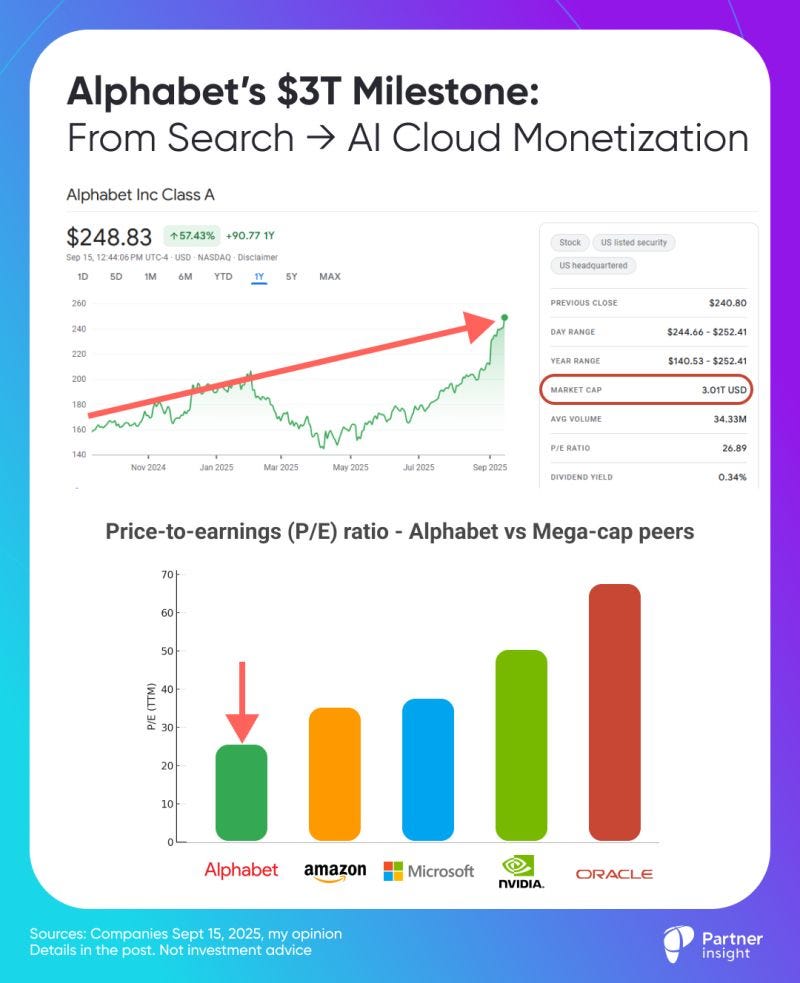

Alphabet reaching 3T today is an AI story, not a search story anymore. It just joined the $3T club with Apple and Microsoft, trailing Nvidia at $4T.

This signals investors now price in durable AI monetization across Search, Cloud and YouTube - while key headwinds ease.

The latest leg up followed:

a favorable U.S. ruling letting Google keep control over Chrome/Android

outsized Cloud and AI momentum

In many ways this $3T mark validates Alphabet's pivot from mostly dominant search engine to AI-cloud powerhouse.

But how much of this success is Google Cloud?

Where Google Cloud Stands Out

Growth Rate

Fastest among Alphabet businesses and one of the fastest among major global cloud providers.

AI Leadership

Google Cloud excels in AI and machine learning infrastructure, recently earning large deals and partnerships (e.g., with Salesforce and OpenAI) and leading generative AI integration for enterprises.

Most of the largest AI labs —including OpenAI and Anthropic—now use GCP.

Margin Improvement

Cloud’s operating profit more ~2X in a year due to scale and efficiency improvements, marking a shift from years of operating losses to sustained profitability.

Scale & growth (last Q2 numbers)

Google Cloud revenue hit $13.6B in last quarter Q2, growing +32% YoY,—reaccelerating from Q1's 28% and surpassing estimates.

Its annual run-rate is $50B+, driven by booming AI demand.

Cloud is now ~14% of Alphabet revenue.

Profit engine

Cloud operating income was $2.8B with 20.7% margin (up from 11.3% a year ago).

That margin expansion is the “profit flywheel” investors were waiting for.

Cloud is ~9.0% of Alphabet’s total operating income in the last quarter.

Backlog

GCP backlog (customer cloud commits) hit $106B, growing 38% YoY and 18% sequentially.

Commits jumped an incredible $15B+ in just the last quarter alone.

Essentially next 2 years of GCP revenue is already signed by customers.

Among the largest CapEX among hyperscalers

The $85B 2025 capex plan they announced is helping to cement their strong position in AI to serve training/inference demand.

Why the $3T milestone matters (ecosystem, ISVs, partners):

Google now has stability, capital and ecosystem for more aggressive investments in the fastest growing parts of its business - AI and cloud

Budget gravity as Alphabet is channeling record CapEx into AI + Cloud

More capacity, more regions, more GPUs/TPUs, more data centers = more room for ISVs riding AI-adjacent workloads

Even at $3T valuation, Alphabet trades at a significant P/E ratio discount to its mega cap peers.

This suggests there is still a lot of room for growth and AI acceleration.

Price-to-earnings ratio (P/E, Sept 15)

Google - 26

Amazon - 35

Microsoft - 38

NVIDIA - 50

Oracle - 68 (!!!)

What's your take on this growth story?

PS. Not investment advice

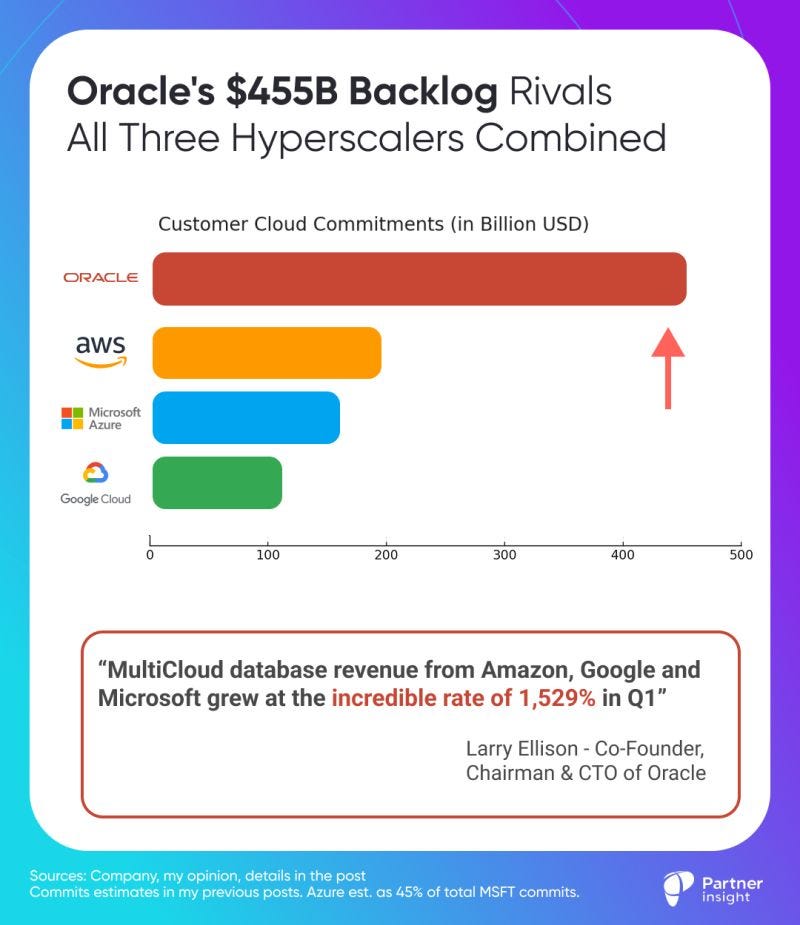

Oracle's $455B Backlog Rivals All Three Hyperscalers Combined

Last week Oracle rewrote the AI-cloud narrative.

Oracle's MultiCloud database revenue exploded 1,529% in a single quarter, while its $455B revenue backlog (+359% YoY) proved enterprise AI demand isn't hype—it's contracted business spanning years.

In their latest quarter, Oracle booked so much long-term demand that remaining performance obligations (RPO) hit $455B.

The earnings impact was so significant that Oracle jumped ~40% on the results, pulled other AI stocks with it, and made Larry Ellison the world's richest person.

Contracted demand, not pipeline

“We signed four multi-billion-dollar contracts with three different customers in Q1, This resulted in RPO contract backlog increasing 359% to $455 billion…” - said Oracle CEO, Safra Catz

This is booked revenue.

Growth is still concentrated among a few top customers, but in the coming month they expect to sign more customers with RPO “likely to exceed half-a-trillion dollars”.

Oracle broke down the entire OCI projected revenue until 2030 in black and white, because “most of the revenue in this 5-year forecast is already booked”:

$18B in FY26 (+77%) → $32B → $73B → $114B → $144B by FY30

Multi-cloud strategy delivered breakthrough results

"MultiCloud database revenue from Amazon, Google and Microsoft grew at the incredible rate of 1,529% in Q1," highlighted Larry Ellison.

They “expect MultiCloud revenue to grow substantially every quarter for several years as we deliver another 37 data centers to our three Hyperscaler partners, for a total of 71.”

This isn't competition with AWS, Azure, and Google Cloud - it's strategic collaboration and embedding Oracle's database layer in the dominant cloud platforms.

You can buy them via cloud marketplaces and this will count towards your cloud commits. E.g. Oracle Database@Azure counts toward MACC commits.

Infrastructure trumps apps for Oracle

OCI revenue hit $3.3B (+55%) while applications grew just 11%. Oracle is betting on AI-ready infrastructure and database services powering enterprise AI workloads.

Its upcoming AI Database will let customers use Google's Gemini, OpenAI's ChatGPT, xAI's Grok, etc. directly on existing Oracle databases. Rather than forcing costly data migrations, Oracle brings AI models to where enterprise data already lives.

“Oracle AI Cloud Infrastructure and the Oracle MultiCloud AI Database will both contribute to dramatically increasing cloud demand and consumption over the next several years.”

“AI Changes Everything,” stressed Larry Ellison

Key takeaways:

Collaborate and embed vs compete

Data gravity drives AI adoption

Infrastructure leads software for now

Oracle's $455B backlog now rivals other hyperscalers combined.

Their insight: enterprise AI transformation isn't about choosing clouds - it's making AI accessible wherever customers and their data reside.

From Q1 Partner Relaunch to Q2 Marketplace Megadeal

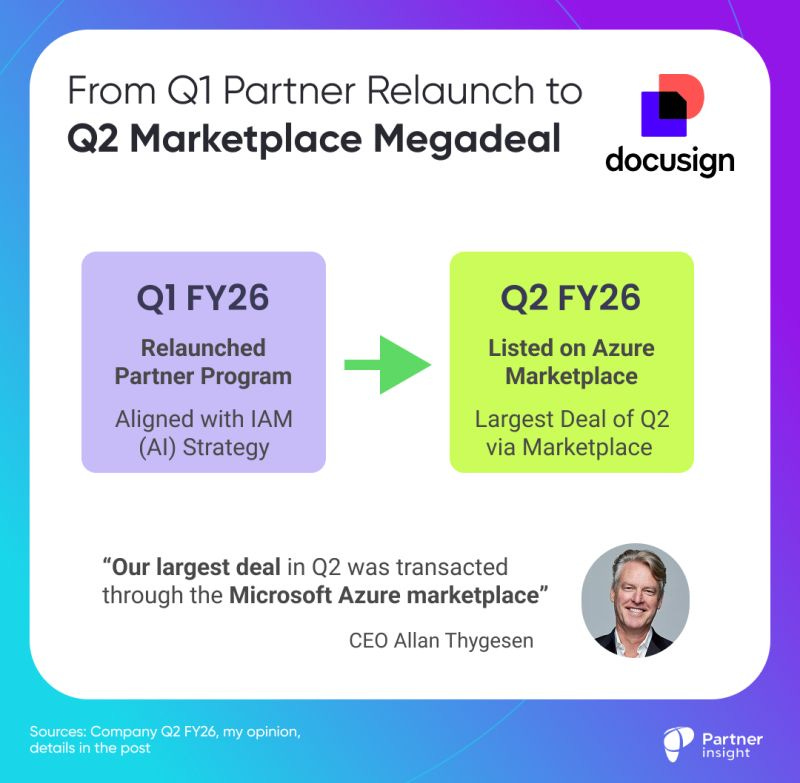

DocuSign’s biggest deal of the quarter closed through Microsoft Azure Marketplace - just weeks after listing. That speed tells you everything about where enterprise buying is moving.

Here’s the story and why it matters for alliance leaders:

In Q1, DocuSign rebuilt its partner program around its new Intelligent Agreement Management (IAM) platform.

This AI-powered end-to-end agreement platform is very different from their simple e-signature offering—and that complexity required a partner-led GTM.

In May, they announced availability on Azure Marketplace. By the end of Q2, their single largest deal was transacted via that same marketplace.

From "listed in May" to "largest deal of the quarter" in one cycle—this demonstrates what an aligned Cloud GTM can achieve.

CEO Allan Thygesen highlighted in last week’s call:

"In Q1, we relaunched our Partner program to align partners with our IAM strategy and build solutions with IAM that deliver value to customers. Our largest deal in Q2 was transacted through the Microsoft Azure marketplace" .

Cloud marketplaces aren’t just a small-ticket channel

Marketplaces are now a credible path for megadeals when the field is engaged and the offer is cloud commits-friendly.

This win signals tight execution between DocuSign and Microsoft, plus a customer leveraging committed cloud spend to accelerate procurement.

Broader DocuSign business metrics support this partner-first approach:

Revenue hit $801M

Net Dollar Retention improved to 102%

IAM momentum shows AI adoption gaining real traction:

Over 50% of enterprise reps closed at least one IAM deal in Q2, average deal sizes increased, and IAM customers are on track to represent a low double-digit share of the subscription book by year-end.

What enterprise alliance teams should copy

Align your partners program to the AI product shift

Engineer the marketplace path for enterprise scale

Private offers, pricing mapped to customer consumption, and clear commits retirements. Remove internal friction so your AEs choose the marketplace route.

Treat co-sell as an operating system, not a campaign

Equip cloud sellers with territory-relevant wins, consumption growth angles and reference architectures. Make it easy for them to champion you.

Orchestrate services attach

AI platforms demand configuration and change management—bring GSIs and services partners into the opportunity early to de-risk adoption and raise ASP.

Lead the motion

Track: % of pipeline via marketplace, close-rate vs direct, time-to-close, NDR uplift for marketplace accounts, and attach of services/usage growth.

DocuSign shows that when you realign partner strategy to AI move and make the marketplace a key transaction path, large enterprise deals more likely happen there.

Are you meeting buyers where their budget already sits?

Cohort 12 Insights: Marketplace blockers aren't tech. They're strategy and culture change.

Quick test: if your customer said "Can we put this through a cloud marketplace?" today—would your sales team cheer… or stall?

Our new cohort's kickoff made it clear: the blockers aren't tech. They're strategy and culture change.

Cloud GTM Leader Cohort 12 just launched, bringing together alliance leaders from across the ecosystem. The diversity reveals where cloud partnerships are heading next.

While hyperscalers double down on marketplaces, many companies are still adapting to get the most out of them.

A cross-section of leaders—hyperscaler, ISV, SI, advisors—mapped the same arc: early wins → messy middle → (how to?) scale.

The 1-to-100 Challenge

Moving from accidental marketplace success to systematic cloud GTM that generates predictable revenue. Many still see organic wins followed by struggles to replicate them.

Seller Resistance

Converting traditional sales teams who view marketplaces as "just procurement" rather than strategic growth engines.

The reality: Field sellers are hesitant about marketplace. That resistance slows deals until incentives and language match how they sell.

Sales managers protect legacy margins (especially without comp neutrality) while CEOs push cloud transformation..

Internal Adoption Friction

Buy-in varies by CRO, RevOps, alliances, product, - so messaging and process must adapt by role to get key departments on board

Veterans have witnessed the executive split when CRO or Head of Sales not getting on board… couldn’t see the value, even with CEO support. Culture beats slideware.

Global Scaling Complexity

Taking marketplace wins from one region or cloud and systematically expanding across the entire GTM organization.

The knowledge exchange dynamic is already live in the group

When marketplace leaders with years of insights into what works (and doesn't) share strategies with leaders building new programs or working to overcome specific challenges, the tactical depth is immediate.

What struck me most was how consistently internal resistance surfaced as the core challenge. Multiple participants described the same pattern: culture trumping strategy.

Operations emerged as equally important—practitioners learned that the hard way through scaling complexities.

Net takeaway

The hardest work isn't the listing - it's building and implementing strategy, rewiring culture, incentives, and last-mile operations so marketplace becomes the default motion, not a special case.

Ultimately, enterprise budgets, C-suite priorities, and hyperscaler focus are all tilting toward marketplaces.

When buyers prefer to buy this way, companies and their sellers follow the money.

Thank you to all incredible leaders in Cohort 12 for trusting us—excited to learn together!

The next five weeks will be transformative.

PS. If you missed this one, we’ll host one last cohort of 2025 in November.

P.S. If you find these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it's how this community shares what works.