Cloud Commits Blow Past $500B to $531B, Adding Record $63B in Q3

Hi, it’s Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week, we’ll break down the last quarter’s highlights:

Cloud commits blow past $500B to $531B (+$63B in one quarter)—the largest step-up we’ve recorded in three years of tracking

Google Cloud adds record $49B to backlog in a single quarter (+46% seq.) while Sundar Pichai reveals more $1B+ deals signed through Q3 this year than the previous two years combined

Azure surges 40% YoY as Microsoft’s total backlog grows 51% YoY and converts with record velocity—just ~2-year weighted duration as customers “intend to use it in relatively short order”

AWS reaccelerates to 20.2% growth on $132B run rate with October’s deal volume already exceeding the entire Q3—signaling the strongest momentum since 2022

Before we dive in:

Cloud commits just crossed $500B—but most ISVs still don’t know how to coach sellers to convert them into closed marketplace deals.

Join us November 12 (9-10 AM PT) for a tactical session with leaders from Contentsquare, Suger and AWS. We’ll break down proven sales plays to leverage commits with actual scripts, and workflows that accelerate marketplace close rates.

Cloud Commits Blow Past $500B to $531B+ (+$63B QoQ)

Customer cloud committed spend across AWS, Azure and Google Cloud just cleared the half-trillion mark, reaching $531B this quarter—adding $63B in a single quarter. Enterprises are signing multi-year commitments to secure cloud and AI capacity as demand stays ahead of supply.

We called this. For nearly 3 years we’ve reported the hyperscaler cloud backlog and forecasted a break above $500B in Q4 ‘25 or Q1 ‘26. They crossed it even faster than our scenario.

Across 3 years of tracking commits, this is the largest single-quarter step-up we’ve recorded—driven by Google Cloud’s record +$49B sequential increase, alongside accelerating backlogs at AWS and Microsoft.

The Big Three Side-by-Side

AWS

Commits: $200B (+$5B QoQ)

Revenue Growth: 20.2% YoY

Annual Run Rate: $132B

Notable: October (first month of Q4) already exceeded all of Q3 deal volume, signaling an even stronger bookings ramp into year-end. “As fast as we’re bringing [capacity] in right now, we are monetizing it,” said Andy Jassy.

Microsoft Azure

Azure Commits (est.): ~$176.4B (~45% of Microsoft commercial RPO)

Azure Growth: ~40% YoY

Microsoft Commercial RPO: $392B (+51% YoY)

Notable: Amy Hood: backlog has “nearly doubled over the past two years” with ~2-year weighted-average duration—contracts “being signed by customers who intend to use it in relatively short order.”

Google Cloud

Commits : $155B (+$49B QoQ, +46% seq.)

GCP Revenue Growth: 34% YoY

Notable: CFO Anat Ashkenazi tied the surge to enterprise AI; Sundar Pichai said more $1B+ deals were signed through Q3 than the prior two years combined; supply stays tight into 2026.

Why this matters

Milestone achieved early: The $500B threshold arrived ahead of schedule shows the cloud & AI accelerated momentum

Record velocity: This quarter is the largest QoQ increase we’ve seen in three years of tracking, led by GCP’s unprecedented backlog jump.

Faster conversion: Microsoft’s ~2-year average duration implies quicker revenue realization from backlog vs. long-dated contracts.

Capacity-constrained boom: All three remain capacity-tight even as cloud and AI infrastructure expands, reinforcing durability of the commit cycle.

For Cloud Alliance Leaders:

Backlogs are massive—and converting faster. Customers must burn their commits, and as much as 10–28% risks becoming “addressable waste” unless it’s redirected.

The cleanest path is buying qualified 3rd-party software via Marketplace. Make Marketplace a default close path on qualified deals, package crisp private offers, and align co-sell with cloud field sellers.

If you’re not transacting through Marketplaces, you’re leaving commit dollars—and competitive advantage—on the table.

Next, we dive into each hyperscaler’s growth drivers and highlights.

500B Cloud Commits Crossed: Coach Your Sellers to Convert Them on Marketplace

Cloud commits just crossed $531B—up $63B in a single quarter. Here’s how to turn that backlog into closed-won marketplace deals.

Translation for alliance leaders: customers have pre-allocated cloud funds they must spend. You can tap into these commits selling your software on cloud marketplaces.

But here is a gap: Most ISVs list on marketplaces, but their sellers don’t know when or how to actually run these deals with customers.

We’re fixing that. In 60 minutes, we’ll go from breaking down commits to seller scripts.

Join us November 12 (9-10 AM PT) for a tactical session with Contentsquare’s Global Head of Cloud Alliances, leaders from Suger, AWS and others on converting the 500B+ milestone into your revenue.

We’ll break down:

The 3-question framework every seller should ask customers to qualify commit-retirement deals

Three proven deal plays with actual buyer + Cloud AE scripts

Automation and operations workflows that accelerate selling via marketplace and cloud co-sell

Why Q4 matters: procurement velocity is at all-time highs

You’ll walk away with scripts and templates —not just strategy slides.

If you’re leading Cloud GTM, alliances or responsible for activating sellers on cloud co-sell, this is the session that turns the 500B commits milestone into your pipeline.

AWS Hits $200B Backlog as Growth Reaccelerates to 20%—Fastest Pace Since 2022

Amazon’s AWS returned to its highest growth rate in nearly three years, posting 20.2% YoY growth on a $132 billion annualized run rate.

But the headline number only tells part of the story: AWS backlog reached $200B in Q3 , and October deals—the first month of Q4—already exceeded the entire Q3’s deal volume.

That forward momentum signals enterprises are racing to lock in multi-year cloud commitments as AI workloads drive cloud and AI demand.

AWS Momentum Driven by AI and Core Migration

CEO Andy Jassy emphasized AWS is “growing at a pace we haven’t seen since 2022, reaccelerating to 20.2% year-over-year.”

He noted this is “very different having 20% year-over-year growth on a $132 billion annualized run rate” compared to competitors with smaller revenue bases.

The growth spans both traditional cloud migrations and new AI workloads. “We’re really pleased with the results from this quarter,” Jassy said.

“We see the growth in both our AI area, where we see it in inference. We see it in training. We see it in the use of our Trainium custom silicon. Bedrock continues to grow really quickly. SageMaker continues to grow quickly.”

Cloud Commits at $200B, Q4 Opening with Record Velocity

AWS backlog grew to $200 billion by the end of Q3 (ending September 30). Even more significantly, new deals signed in October—the first month of Q4—already exceeded the total deal volume for the entire third quarter. That procurement velocity suggests Q4 could deliver substantial backlog growth, with enterprises pulling forward multi-year commitments to secure capacity and lock rates.

CFO Brian Olsavsky noted, “AWS revenue increased $2.1 billion quarter-over-quarter,” highlighting both strong new bookings and healthy consumption of existing commits.

AI Infrastructure at Scale: Trainium2 Fully Subscribed, Project Rainier Live

AWS’s custom silicon strategy is paying off. Trainium2 is fully subscribed and has become a multibillion-dollar business, growing 150% quarter-over-quarter, according to Jassy.

The company brought Project Rainier online—a massive AI compute cluster spanning multiple U.S. data centers with nearly 500,000 Trainium2 chips. Anthropic is currently using it to train Claude, with plans to scale to over 1 million Trainium2 chips by year-end.

“It’s not simple to be able to build a cluster that has 500,000 plus chips going to 1 million. That’s an infrastructure feat that’s hard to do at scale,” Jassy explained, highlighting AWS’s differentiation in deploying AI infrastructure.

On chip roadmap, Jassy revealed: “Trainium3 should preview at the end of this year with much fuller volumes coming in the beginning of ‘26.” He expects Trainium3 will deliver “about 40% better than Trainium2 and Trainium2 is already very advantaged on price performance.”

AWS is also building Bedrock “to be the biggest inference engine in the world and in the long run, believe Bedrock could be as big a business for AWS as EC2, and the majority of token usage in Amazon Bedrock is already running on Trainium.”

Agents Become Enterprise Reality with AgentCore

AWS launched AgentCore in Q3, a set of infrastructure building blocks for deploying secure, scalable AI agents. The response has been rapid: AgentCore’s SDK has been downloaded over 1 million times since launch.

“A lot of the future value companies will get from AI will be in the form of agents,” Jassy said. “Companies will both create their own agents and use agents from other companies. For those building their own, it’s been harder to build than it should be.”

Early enterprise adopters include Ericsson (deploying AI agents across their workforce), Sony (building an agentic AI platform with enterprise security), and Cohere Health (using AgentCore to reduce medical review times by 30-40%).

$125B in 2025 CapEx, Power is the Bottleneck

Amazon is investing at unprecedented scale to meet AI demand.

CapEx reached $34.2 billion in Q3, bringing year-to-date spending to $89.9 billion. Full-year 2025 CapEx is expected to hit approximately $125 billion, with an expected increase in 2026.

AWS stressed that it added more than 3.8 gigawatts of power capacity in the past 12 months—more than any other cloud provider—with plans to double total capacity by 2027. In Q4 alone, AWS expects to add at least another 1 gigawatt.

When asked about capacity constraints, Jassy was direct:

“We’re bringing in quite a bit of capacity today, overall in the industry, maybe the bottleneck is power. I think at some point, it may move to chips, but we’re bringing in quite a bit of capacity. And as fast as we’re bringing in right now, we are monetizing it.”

On chip supply specifically, he noted:

“We’re always going to have multiple chip options for our customers... We have a very deep relationship with NVIDIA. We have for a very long time. And we will for as long as I can foresee the future. We buy a lot of NVIDIA. We are not constrained in any way in buying NVIDIA, and I expect that we’ll continue to buy more NVIDIA both next year and in the future.”

Enterprise Wins Across Industries

AWS highlighted that it “continues to earn most of the big enterprise and government transformations to the cloud”. New customer agreements and expansions this quarter included: Delta Air Lines, Volkswagen Group, AXA, BT Group, and Perplexity.

“AWS is where the preponderance of company’s data and workloads reside and part of why most companies want to run AI and AWS,” Jassy said, emphasizing the platform’s stickiness as enterprises layer AI capabilities onto existing cloud foundations.

AWS’s 20.2% reacceleration on a $132B run rate—combined with record backlog and capacity expansion—positions the platform as the infrastructure backbone for enterprise AI at scale.

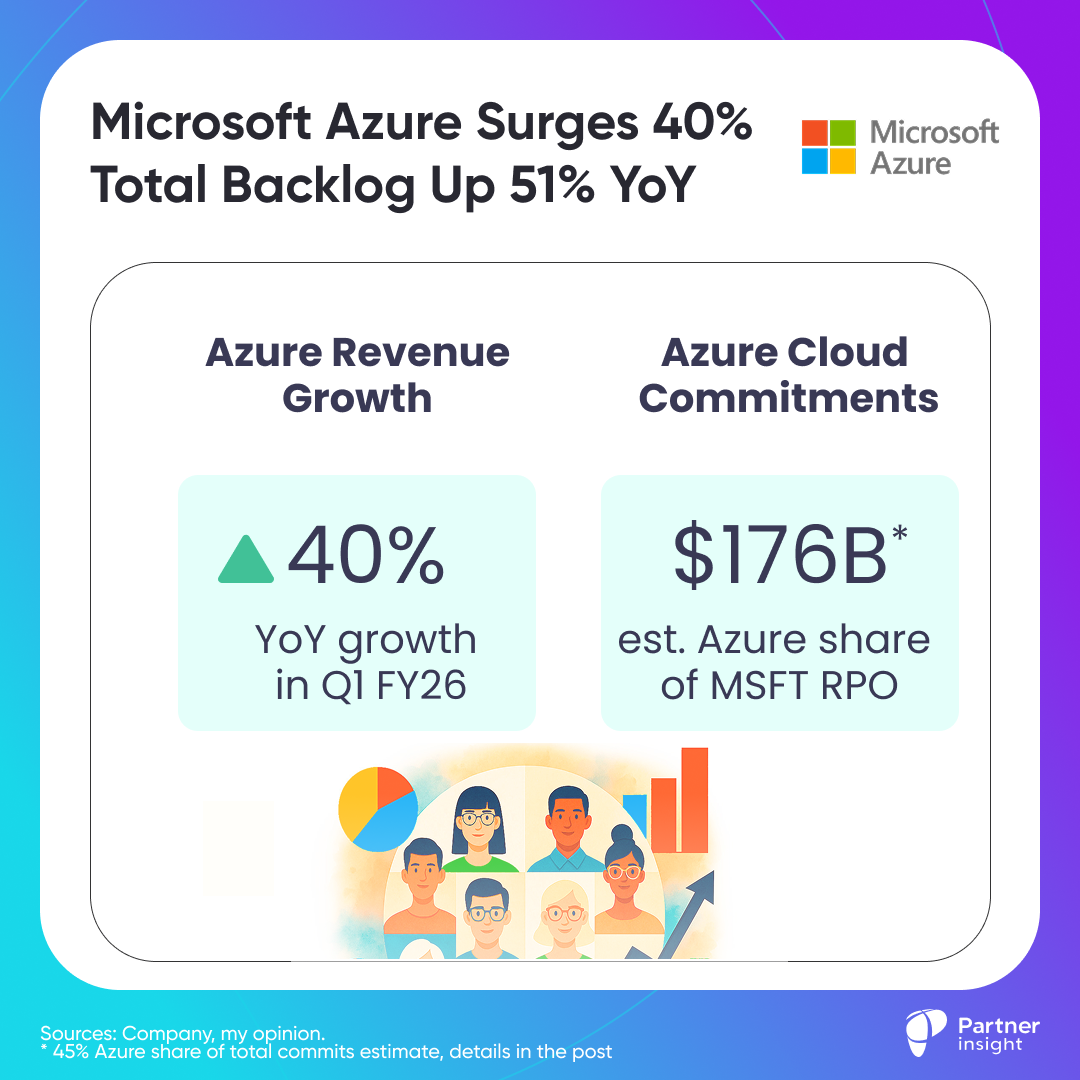

Microsoft’s $392B Cloud Backlog Grows 51% as Azure Surges 40%—Yet Still Capacity Constrained

Microsoft delivered a blockbuster Q1 FY26 with Azure growing 40% and total commercial RPO exploding to $392 billion—up 51% year-over-year—while revealing capacity constraints will persist through at least June 2026.

Demand for AI infrastructure is outpacing even Microsoft’s aggressive buildout, with the company set to increase total AI capacity by 80% this year and double datacenter footprint over the next two.

Cloud Commits Hit $392B with Only 2-Year Duration

Total commercial remaining performance obligation reached $392 billion (+51% YoY) with commercial bookings up 112% driven by Azure commitments from OpenAI and “continued growth in the number of $100M+ contracts for both Azure and M365.”

The story isn’t just the size—it’s the velocity and breadth.

CFO Amy Hood emphasized the backlog has “nearly doubled over the past two years” while maintaining a weighted average duration of approximately 2 years, meaning this massive contracted base converts to revenue fast.

“With a nearly $400 billion balance... it covers numerous products. It covers customers of all sizes. And that’s been a balance that we’ve been growing, obviously, at a good clip... Most of that is being consumed in relatively short order.” — Amy Hood, CFO

“These are contracts being signed by customers who intend to use it in relatively short order,” Hood emphasized, pushing back on concerns about commitments being either too concentrated or long-dated. “People are not consuming... unless there’s value.”

Post-quarter, Microsoft announced OpenAI contracted an additional $250 billion of Azure services, extending their partnership through 2030-2032 (depending on AGI milestones). This incremental commitment will hit upcoming bookings.

Azure: +40% YoY

Azure commits: $176.4B*

See my separate breakdown of Azure cloud commits above.

* Azure share calculated as 45% of Microsoft total backlog, based on CEO comments last quarter about Azure’s run rate and its share in Microsoft Cloud.

The AI Platform Hits Production Scale

Microsoft’s AI momentum is moving from pilot to production.

CEO Satya Nadella highlighted 900 million monthly active users across AI features and 150 million MAU for first-party Copilots spanning M365, GitHub, Security, Health, and Consumer.

Azure AI Foundry now serves 80,000 customers (including 80% of Fortune 500) with access to 11,000+ models—more than any other vendor.

“We offer developers and enterprise access to over 11,000 models, more than any other vendor, including as of this quarter OpenAI’s GPT-5, as well as xAI’s Grok 4.” — Satya Nadella, CEO

Nadella highlighted examples like Ralph Lauren using Foundry to build conversational shopping and OpenEvidence creating an AI clinical assistant—both production workloads at scale.

Copilot Adoption Accelerates

Microsoft 365 Copilot crossed a milestone: over 90% of Fortune 500 now use it, with adoption accelerating 50% quarter-over-quarter in Copilot Chat usage.

Major enterprise deployments this quarter:

PwC: added 155,000 seats in Q1 alone, now 200,000+ deployed globally with 30M Copilot interactions in six months

Lloyds Banking Group: 30,000 seats saving employees an average 46 minutes daily

Accenture, EY Global, UK tax authority, etc.: each purchased 15,000+ seats

GitHub Copilot reached 26 million users as the platform added a developer every second to hit 180 million total developers.

The stickiness signal: 80% of new developers on GitHub start with Copilot within their first week.

Over 500 million pull requests merged in the past year, driven by AI coding agents.

The Agent Ecosystem Takes Shape

Microsoft’s bet on agents as the next platform layer is now boosted by ISV adoption and co-build.

“We are seeing a growing Copilot agent ecosystem, with top ISVs like Adobe, Asana, Jira, LexisNexis, SAP, ServiceNow, Snowflake, and Workday all building their own agents that connect to Copilot.” — Satya Nadella

Infrastructure Buildout Matches Unprecedented Demand

Microsoft’s capacity expansion is aggressive but still falling short of demand.

“We will increase our total AI capacity by over 80% this year, and roughly double our total datacenter footprint over the next two years, reflecting the demand signals we see.” — Satya Nadella

This quarter they announced Fairwater, Wisconsin—the world’s most powerful AI datacenter at 2 gigawatts capacity, going online in 2026. Microsoft also deployed the first large-scale cluster of NVIDIA GB300s.

Q1 Capex: $34.9 billion (+74% YoY)

~50% short-lived assets (GPUs/CPUs matched to contract durations)

~50% long-lived assets (datacenters, 10Y+ long term monetization)

Amy Hood confirmed FY26 capex growth will be higher than FY25, with sequential increases.

“With accelerating demand and a growing RPO balance, we’re increasing our spend on GPUs and CPUs. Therefore, total spend will increase sequentially, and we now expect the FY26 growth rate to be higher than FY25.” — Amy Hood

Critically, Hood noted Microsoft expects to be capacity constrained through at least end of fiscal year (June 2026), even as they bring more capacity online. Demand continues to exceed supply across workloads.

Azure growth expectations

37% growth in Q2 & capacity-constrained through FY26 (at least)

CFO Amy Hood: “In Azure, we expect Q2 revenue growth of approximately 37% in constant currency as demand remains significantly ahead of the capacity we have available…”

On “AGI” and Microsoft’s Platform Advantage

Addressing whether advances like AGI could weaken Microsoft’s positioning, Satya Nadella emphasized the enduring need for orchestration:

“Even as the intelligence capability increases, let’s even say, exponentially, model version over model version, the problem is, it’s always going to still be jagged... You may even have a capability that’s fantastic at a particular task, but it may not uniformly grow... Even when the model is magical, all powerful, I think we will be in this jagged intelligence phase for a long time.” — Satya Nadella

Even as models become more powerful, they’ll maintain “spiky” performance—exceptional at some tasks, weak at others. This creates persistent demand for orchestration systems that smooth out the jagged edges.

Microsoft is betting that platforms like GitHub Copilot, M365 Copilot, and Security Copilot become the trusted enterprise orchestration layers—more valuable than raw model access alone.

“Whether it is GitHub Agent HQ or the M365 Copilot system... it’s a system that, in some sense, smooths out those jagged edges and really helps the capability.” — Satya Nadella

ISVs building agent frameworks, workflow integration, and governance layers are likely stronger positioned to capture this value too.

Google Cloud Hits $155B Backlog, Revenue up 34% and AI Reaches “Billions in Quarterly Revenue”

Alphabet’s Q3 performance was excellent, but it was strongest in Google Cloud. revenue accelerated to 34% growth, and AI demand pulled backlog to $155 billion—a $49 billion sequential jump.

“Alphabet had a terrific quarter… We delivered our first-ever $100 billion quarter,” said CEO Sundar Pichai.

He added: “Our full stack approach to AI is delivering strong momentum… our first party models, like Gemini, now process 7 billion tokens per minute… Google Cloud accelerated, ending the quarter with $155 billion in backlog.”

But the headline number only tells part of the story—Google has signed more billion-dollar deals in the first nine months of 2025 than in the previous two years combined, signaling enterprise cloud and AI procurement is rapidly accelerating.

Cloud Commits: The Largest Sequential Jump on Record

Google Cloud’s backlog reached $155 billion, adding $49 billion in a single quarter— this represents the largest sequential backlog increase Google has disclosed.

CFO Anat Ashkenazi directly connected the surge to AI momentum:

“Google Cloud’s backlog increased 46% sequentially and 82% year-over-year, reaching $155 billion at the end of the third quarter. The increase was driven primarily by strong demand for enterprise AI.”

CEO Sundar Pichai emphasized the deal velocity shift “We have signed more deals over $1 billion through Q3 this year than we did in the previous two years combined.”

The backlog surge comes amid persistent capacity constraints.

“While we have been working hard to increase capacity and have improved the pace of server deployments and data center construction, we still expect to remain in a tight demand/supply environment in Q4 and 2026,” Ashkenazi cautioned.

Deal Velocity Accelerating Across All Dimensions

Google Cloud’s growth is broadening beyond just expanding existing accounts.

Customer acquisition: “The number of new GCP customers increased by nearly 34% year-over-year,” Pichai reported.

AI adoption penetration: “Over 70% of existing Google Cloud customers use our AI products, including Banco BV, Best Buy, and FairPrice Group,” Pichai said.

Product diversification:

“Today, 13 product lines are each at an annual run rate over $1 billion, and we are improving operating margin with highly-differentiated products built with our own technology,” Pichai noted.

The newest product making waves is Gemini Enterprise.

“Earlier this month, we launched Gemini Enterprise, the new front door for AI in the workplace, and we are seeing strong adoption for agents built on this platform,” Pichai said. “We have already crossed two million subscribers across 700 companies”—a remarkable pace for a recently launched enterprise product.

AI Revenue Reaches Scale & 1.3 Quadrillion Monthly Tokens

Google’s enterprise AI business is now driving billions in quarterly revenue. CFO Anat Ashkenazi confirmed:

“GCP’s growth was driven by enterprise AI products, which are generating billions in quarterly revenue.”

Their Gen AI products revenue specifically are tripling:

“In Q3, revenue from products built on our generative AI models grew more than 200% year-over-year,” Pichai stressed.

The scale of AI workload adoption is staggering

“Over the past 12 months, nearly 150 Google Cloud customers each processed approximately one trillion tokens with our models for a wide range of applications,”

Pichai said, citing examples like WPP achieving 70% efficiency gains in campaign creation and Swarovski seeing a 17% increase in email open rates with 10x faster campaign localization.

Token processing volume tells the adoption story:

“In July, we announced that we processed 980 trillion monthly tokens across all our surfaces. We are now processing over 1.3 quadrillion monthly tokens, more than 20x growth in a year. Phenomenal,” Pichai emphasized.

The Full-Stack AI Differentiator

Google positioned its unique vertical integration as a competitive moat. “We are the only Cloud provider offering our own leading generative AI models, including Gemini, Imagen, Veo, Chirp and Lyria,” Pichai stated.

On infrastructure, Pichai highlighted their dual-track approach:

“We are scaling the most advanced chips in our data centers, including GPUs from our partner NVIDIA, as well as our own purpose-built TPUs, and we are the only company providing a wide range of both.”

The TPU strategy is gaining serious traction.

“We’re investing in TPU capacity to meet the tremendous demand we are seeing from customers and partners, and we’re excited that Anthropic recently shared plans to access up to one million TPUs,” Pichai announced.

CapEx Surge to Meet Strong Demand

Google raised its 2025 capital expenditure guidance to $91-93 billion, up from the previous estimate of $85 billion. “Looking out to 2026, we expect a significant increase in CapEx,” CFO Ashkenazi stated.

Q3 alone saw $24 billion in CapEx, with “approximately 60% of that investment in servers and 40% in data center and networking equipment,” Ashkenazi detailed.

Despite this massive buildout, supply constraints persist.

“while we have been working hard to increase capacity and have improved the pace of server deployments and data center construction, we still expect to remain in a tight demand/supply environment in Q4 and 2026,” Ashkenazi emphasized.

The demand visibility gives Google confidence to invest aggressively.

“We’re continuing to invest aggressively due to the demand we’re experiencing from Cloud customers as well as the growth opportunities we see across the company,” Ashkenazi said.

The Infrastructure Stakes

Google’s earnings reinforced the scale of AI infrastructure demand and the supply constraint reality.

The competitive positioning is clear. Pichai noted that nine of the top ten AI labs choose Google Cloud, driven by “a decade of experience building AI Accelerators and today offer the widest array of chips.”

Gemini Momentum Reinforces Cloud Story

While outside core cloud infrastructure, Google’s Gemini adoption provides important demand signal.

“The Gemini App now has over 650 million monthly active users, and queries increased by 3x from Q2,” Pichai highlighted.

Google’s 46% sequential backlog jump—suggests enterprise AI and cloud procurement cycles are compressing dramatically. With Google confirming the “tight supply environment” will persist well into 2026, strategic positioning in the GCP ecosystem becomes increasingly valuable.

P.S. If you found these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.