Co-Sell So Well They Can’t Ignore You: 5 Steps to 80% Larger Deals

Hi, it’s Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week:

Co-sell can drive 80% larger deals—but only if you get 5 fundamentals right. Most ISVs miss key steps (like aligning customer - cloud - ISV outcomes), which is why cloud sellers never engage. Full playbook inside.

AWS’s new whitepaper reveals AI agents won’t replace SaaS—they’ll upgrade it. The bigger shift? Who captures revenue in AI agent value chains. We break down what that means for your cloud GTM.

We distilled 40,000+ words of our Q3 Cloud GTM analysis into 10 Playbooks & Insights you can use now: Why AWS gives certain partners 15X more co-sell matches, Microsoft’s actual seller checklist, and JFrog’s value storytelling you can copy for co-sell.

October 30: “AWS Marketplace: Your 2026 Revenue Engine” - our biggest event of the year.

Jay McBain reveals why his marketplace forecast just doubled to $163B by 2030, why 59% of deals will be partner-led, how Agentic AI creates the biggest partner opportunity, and what Okta and others did to scale past $1B on AWS marketplace.

Join Jay McBain + 10 AWS/GTM leaders live on Oct 30th (free, 2.5 hours)

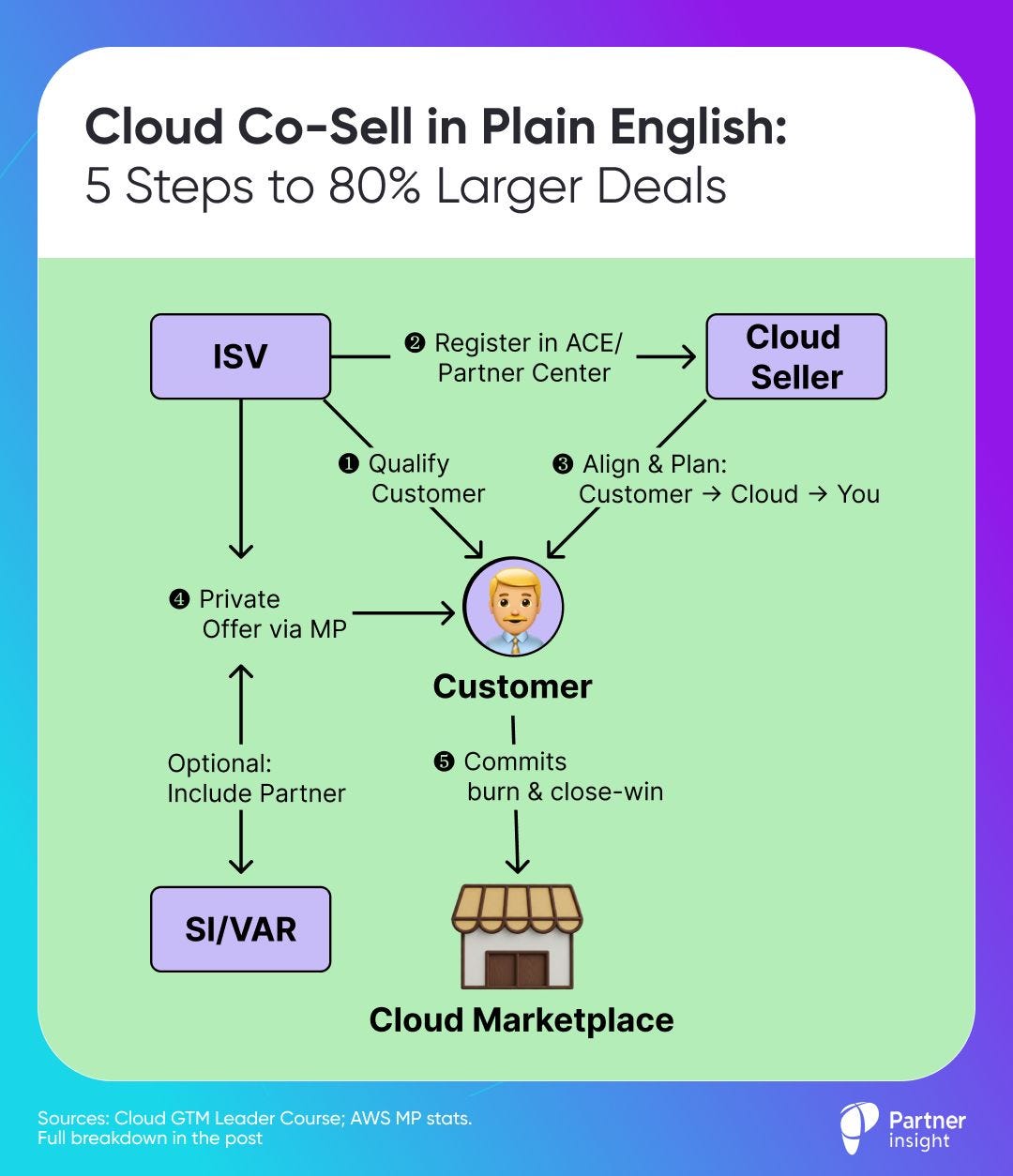

Cloud Co-Sell in Plain English: 5 Steps to 80% Larger Deals

Co-sell ≠ “cloud sells for you.”

In plain English: You (ISV) + cloud seller team up on a live deal. You bring the opportunity and problem you solve. They bring account intel, access, trust—and a fast way to buy via marketplace.

Who’s involved

ISV AE + SE → own the problem and opportunity (customer)

Cloud Sellers/PDM/SA/PSM → add credibility, customer insight, access

Channel partner (SI/VAR) → optional; boosts delivery & deal size

Customer sponsor → decision + marketplace purchase path

Core building blocks

Marketplace listing → how the customer purchases you

Commits (EDP/MACC) → pre-allocated cloud budget to tap into

Private Offer → enterprise contract with custom price/terms via marketplace

Portal registration (ACE / Partner Center) → seller credit + visibility

Workload mapping - which cloud services your deal grows (data, AI, security, compute)

Why it wins

Speed → marketplace = vetted vendor + fewer legal steps + fast deployment

Budget → could be funded by commits, not a new line item

Incentives → cloud field gets paid when partners win via marketplace, especially if it drives their service consumption

Key steps

Make it visible: Register the opportunity in the cloud portal with key details, and where you need help

Qualify commit: Does the account have commit they can use?

Align outcomes: “Customer outcome → Cloud outcome → Your outcome.”

“This helps our customer consume your [AI/Data/Sec] services—and we’re qualified to burn your commits.”

Get the intro: Ask cloud sellers for customer and budget intelligence, buying patterns, etc.

Propose purchase path: Private Offer on marketplace (multi-year if possible).

Add an SI/VAR when it increases confidence, outcomes, or services pull-through.

Close & claim: Reference the workload win, and share the story internally and with the cloud.

✅ Do

Lead with the customer + cloud consumption + marketplace/commits

Map to key services (e.g., Bedrock, Fabric, Vertex AI; or S3/EKS/BigQuery)

Show traction: dates, ARR, contacts—make it real

❌ Don’t

Don’t ask clouds to sell your product for you—it’s not their job

Don’t “fish” for intros without a qualified, registered opp

Don’t send generic decks; show account/industry-specific outcomes

KPIs to track

$ of opportunities co-sell eligible

Registered co-sell opps / won

Drag: Incremental cloud usage your product drives

Closing time & win rate: direct vs marketplace

3-Step Implementation Checklist

Pick 10 qualified accounts with a clear benefits (Customer → Cloud → You); register opportunities

Join calls with cloud sellers; include SI/VAR if helpful for closing

Close a lighthouse deal; promote the win internally/externally; repeat.

Co-sell is how you tap the cloud’s budget, distribution and credibility to win faster and 80% bigger deals (AWS). Do the simple things well - and it becomes your default GTM.

Oct 30: “AWS Marketplace: Your 2026 Revenue Engine”— Jay McBain Keynote +10 AWS/GTM Leaders Live

We’re hosting our biggest AWS event of the year on October 30th, and I’m thrilled that Jay McBain will deliver a special keynote on marketplace evolution, the $163B opportunity ahead, and AI convergence.

Jay McBain, Chief Analyst at Omdia (frm. Canalys), has been the most accurate voice on cloud marketplaces. Three years ago, his team forecasted hyperscaler marketplaces would reach $85B by 2028.

That prediction just got much bigger: $163 billion by 2030, with “AWS leading by a considerable margin”.

Here’s what matters for your 2026 strategy:

Partner Explosion

For Amazon Web Services (AWS) partners the math is compelling: for every $1 of AWS services sold, there’s $6.4 in partner multiplier to capture.

By 2030, 59% of marketplace deals will include or be led by channel partners—accelerating ecosystem-led plays.

Jay also highlights a hyper-growth example: “One company happens to grow 91% on a marketplace… they’re growing their partners 3,548%”

$467B Commits Reality

Cloud commitments are approaching $500B — a powerful consumption signal and a massive driver of private offers and co-sell momentum. Commits could be partially directed to buying your software.

AI-Marketplace Convergence

Jay recently stressed that Agentic AI is on track to $267B opportunity for partners by 2030. It is growing at 35.3% CAGR, “making it one of the largest partner opportunities”.

In our last event he also explained that: “Agentic AI is starting to look like micro-consumption, a dollar or $2 per thing… The only way it’s going to work is through marketplaces… because you’re selling outcomes.”

Jay’s prediction?

“Within 5 years [the] entire channel partner [ecosystem]… lands at the marketplace, where the customer is going to be delivered in terms of their outcomes and their journey.”

Winners Scale to $1B+ on AWS

CrowdStrike, Snowflake, Okta, and others have built $1B success stories on AWS Marketplace. The platform’s partner-friendly approach creates unique advantages.

Join us October 30th to hear Jay’s latest analysis first hand.

The All-Star Lineup

Our “AWS Marketplace: Your 2026 Revenue Engine” event also features:

Keynote from George Maroulakos - Senior Leader, AWS Marketplace Center of Excellence, Buyer Experience

Panel: AWS Growth with Co-Sell and Global Expansion → AWS and ISV leaders will break down co-sell and global scaling strategies

Panel: Driving Ecosystem Sales with Channel Partners → Learn from top ISVs, AWS and partners how to capture the shift where 59%+ of marketplace sales will be partner-led by 2030

Panel & Q&A: Marketplace Operations Playbook for Cloud GTM Growth

Join us on October 30th, 9-11:30 AM PT

In just 2.5 hours, 10+ top experts will break down how to turn AWS Marketplace into your revenue engine in 2026.

Thanks to our partner Clazar

Clazar is the leading cloud sales acceleration platform that helps Go-to-Market teams scale revenue on AWS, Azure, and Google Cloud Marketplaces.

From listing to co-sell to revenue recognition, Clazar automates the entire cloud sales journey in one unified platform. Trusted by companies like Pinecone, Honeycomb, Zapier, CloudZero and Perplexity.

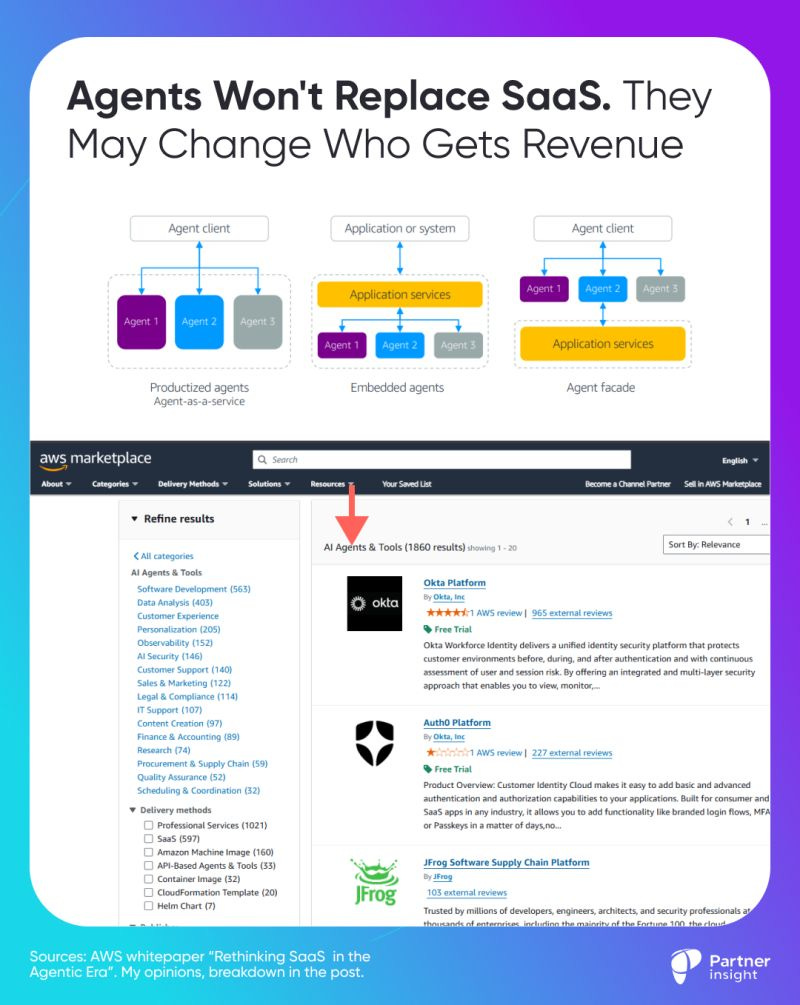

Agents won’t replace SaaS. They may change who gets revenue

Agents won’t sell your product. Smart packaging and GTM will.

AWS’s new whitepaper argues that Agentic SaaS ≠ new SaaS —it’s SaaS upgraded. Here’s my read and what it means for Cloud GTM leaders.

“Rethinking SaaS in the Agentic Era” is a great framework, but it reads like architecture, so here is my GTM take.

What the paper says:

Agents don’t replace SaaS—they upgrade it

Agents add autonomy and reasoning on top of SaaS benefits (scale, agility, efficiency) rather than replacing them.

AWS cites a Gartner view that 15% of work decisions will be made autonomously by agentic AI by 2028—a balanced take.

3 agent delivery patterns

Productized agents - agent-as-a-service you can list and sell on marketplace

Embedded agents - inside your SaaS

Agent façade - agents orchestrate an existing app as a GenAI overlay. Lets you ship an “agentic experience” quickly and learn usage patterns.

Multi-agent systems (MCP/A2A) are “the next level of power and possibilities for agents”

Expect agent swarms across multiple vendors with distributed identity/authorization and context passing between agents.

Dedicated vs. shared vs. multi-tenant agents

The paper contrasts per-customer agents with shared, multi-tenant agents. The shift is to treat users as tenants, so every request runs with tenant-specific context, data, and policies—requiring robust isolation.

Key product plays

Near-term Embed/Extend to defend base and expand users.

Medium-term Expand (new agentic product for current accounts).

Selective Build bets for net-new segments your agents unlock.

What this means for Alliance leaders

Decide your Agent strategy

If you can deliver a coherent outcome with minimal setup, ship a productized agent and list it (with outcomes, guardrails, and pricing).

If adoption hinges on existing workflows/data moats, keep it embedded and sell “agent-enabled” tiers.

Use a façade agent to test demand before re-building.

Value prop shifts to outcomes

We’ll moving beyond “seats + features” towards selling tasks completed—but we need AgentOps and new KPIs to track completion/accuracy, token efficiency, cost per tenant, etc.

Pricing will change, but expect hybrid models and careful transitions.

Ecosystem GTM = multi-agent GTM

Partnership plays where your agent collaborates with others become important.

I’m watching how security and revenue sharing evolve for multi-agent value chains—this may shape a new form of co-deliver and co-sell.

What Amazon Web Services (AWS) is trying to say

It offers a blueprint for ISVs to think through—and de-risk—enterprise agent adoption.

It nudges to package agents as sellable SKUs (listed and sold via Marketplace) while standardizing on AWS primitives for identity, data boundaries, and observability.

If you productize agents, marketplaces become a distribution and monetization channel. Embedded agents stay within existing GTM but still change positioning and pricing

What’s your take?

Source: AWS Whitepaper

Cloud GTM Quarterly Q3 2025: 10 Playbooks & Insights You Can Use Now

In Q3 we analyzed $469B in cloud commits. 150+ pages (40,000+ words) published on cloud GTM. I could have turned it into a book. Instead, I distilled them into:

🔟 moves that actually mattered—what changed, where budgets shifted, and the motions top teams used to win on cloud marketplaces.

What went into this:

Hundreds of earnings calls we’ve analyzed across hyperscalers and leading ISVs

Insights from our online events with hundreds of leaders in live audience

Operator feedback on what worked in the field

This isn’t a theory. It’s what companies like JFrog, Docusign and others actually did to drive marketplace revenue.

Inside Cloud GTM Quarterly — Q3 2025:

Market Intelligence: $469B in cloud commits analyzed; which software categories grew while others shrank:

The visibility multiplier: AWS’s AI now gives partners with specializations 15X more co-sell matches than those without

Microsoft seller’s checklist: what cloud sellers actually champion in co-sell

JFrog’s value storytelling playbook: a clear structure to copy for your co-sell

Partner AI agent opportunity: 62% of enterprises prefer partners to build agents for them — a $250B+ market taking shape

Cloud waste-to-revenue play: Up to 30% of enterprise cloud spending sits underutilized; how to turn it into your revenue via marketplace

How leaders are using this:

Use the slides and numbers in your sales enablement and business cases

Use the talk tracks/checklists in renewal and co-sell calls this week.

Align your Q4 plan to the budget flows that actually moved in Q3.

Leaders from our course use these data and frameworks to save dozens of hours of research and months of trial and error.

Download 20+ pages of key playbooks and marketplace insights that you need to know from the last quarter — and what to do about it in Q4.

P.S. Thank you to Clazar for supporting this edition of Cloud GTM Quarterly.

P.S. If you found these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.