How 3 Hyperscalers Outgrew the Entire Public SaaS Sector by 1.7X

Hi, it's Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week we break down:

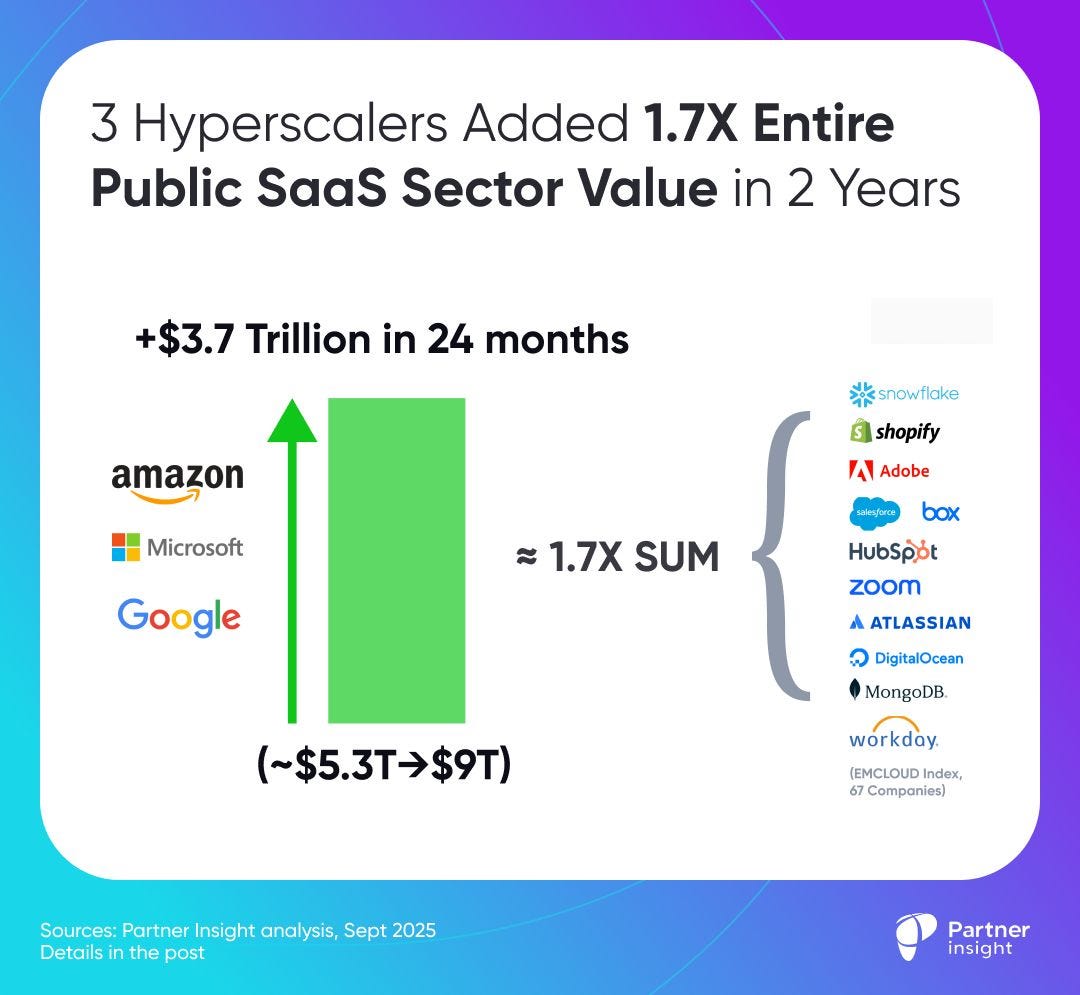

Hyperscalers added 1.7X the entire public SaaS sector's value in 24 months — Microsoft, Amazon, and Google gained $3.7T while all public SaaS combined is worth $2.2T

Accenture's $2.5B GenAI strategy and why the company collapsed 5 divisions into 1 — their GenAI revenue doubled to $1.8B in 9 months, driving a complete reorganization around integrated "reinvention" work

Cloud marketplaces captured 34% of non-SaaS software purchases — up from 28% last year, proving even traditional software buyers now expect marketplace procurement

But before we dive in, tomorrow (Tuesday, September 9th) kicks off Cohort 12 of our Cloud GTM Leader course. It’s your last chance to join our 2-year anniversary cohort with 250+ alumni who've turned top marketplace growth strategies into millions in revenue.

Now, let's explore how the software market fundamentally shifted toward cloud ecosystems.

3 Hyperscalers Added 1.7X Entire Public SaaS Sector Value in 2 Years

In the last 24 months, the software market flipped. The 3 clouds (Microsoft, Amazon, Google) added ~$3.7T in market cap ~1.7X the value of the entire public SaaS sector

This shift marks a major change in the software world:

Value is concentrating around top cloud ecosystems that hold the keys to compute power, data, and now AI.

The rest of the software sector, built on top of these foundations, struggles to keep pace.

To see the divide, consider the BVP Nasdaq Emerging Cloud Index (EMCLOUD) as the cleanest proxy for the public SaaS sector.

It tracks 67 leading SaaS firms with over $500M in market cap, like Adobe, Salesforce, Shopify, Snowflake, and Workday, capturing the weighted performance of this entire group.

What changed (Sep ’23 → now):

⬆️ Big Three:

Amazon: $1.3T → $2.5T (+85%)

Microsoft: $2.3T → $3.8T (+62%)

Google: $1.77T → $2.84T (+60%)

Total: $5.43T → $9.09T (+67%, added $3.7T)

Hyperscalers: +$3.7T combined in the last 24 months. They also outgrew COVID peak valuations by 30-45%

➡️ EMCLOUD

The entire market cap of companies in Emerging Cloud Index is $2.2T.

Today the index at ~1,700; it grew just 15% from 2 years ago (~1,500).

It's still way below the COVID-era price peak of >3,000 at 2021.

The gap is still huge.

What the market is voting for with their dollars:

AI infrastructure at scale: Value accrues to the platforms that own compute, data, and distribution.

Ecosystems as strategy: Clouds compounded network effects across ISVs, services partners, and customers - faster than any single vendor could.

Marketplaces as the control plane for buying: A growing share of software spending routes through cloud marketplaces: consolidated billing, commit drawdown, fast procurement, and tighter integration.

So what? For software leaders & partners:

Align GTM and products with clouds: co-sell rigor, native integrations, and a packaging/pricing story that converts on marketplaces.

Partners win by solving the last mile: reference architectures, migration playbooks, security/compliance accelerators, and FinOps-ready deals.

Use marketplace to tap committed cloud spend and help buyers: Instrument the end-to-end: listing quality, private offers, field alignment, and post-sale consumption - not just top-of-funnel.

Zooming out

Clouds didn’t just help to build and host software anymore - they added an AI layer on top of their ecosystems and accelerated a powerful distribution layer underneath (marketplaces).

That twin engine explains the divergence: hyperscalers compound, while broad software is still re-rating to new buying patterns.

Exactly 2 years ago we launched our Cloud GTM Leader course

As these trends are accelerating, it equips alliance teams for this new reality.

We’re now at Cohort 12 (starts Sept 9), 250+ alumni, and countless stories of teams turning marketplace into revenue. If you’re doubling down on marketplace growth this half, join us.

“I wish I had this knowledge a year ago.”

That line keeps showing up in our course alumni feedback. The cost of figuring out Cloud GTM by trial-and-error? 12–24 months and millions in missed opportunities.

On Tuesday, September 9, we kick off the 2-Year Anniversary cohort of Cloud GTM Leader course - now 250+ alumni strong.

With Q4 approaching and 2026 planning underway, starting in September means you’ll have proven frameworks in place before your biggest opportunity windows.

What alumni are actually saying (last cohort):

“I wish I had this knowledge before I started my role in the GTM department last year.”

- Aga Gajda-Staszewicz, Senior Technical Project Manager, Pegasystems

“As someone who has built AWS alliances twice, driven marketplace success, and led cross-functional GTM motions, this program elevated my perspective and sharpened my thinking around cloud co-sell programs, marketplace motions, channel strategy, and scalable GTM frameworks… highly recommend.”

- Jeff Fink, Director, AWS Alliance, Securonix

“Super insightful and well-structured — a great kickoff for my new focus.”

- Gital Schneider, Senior Manager, Alliance Partnerships & FinOps, Sisense

“Featured 10+ expert workshops with in-depth insights… I highly recommend this course to anyone driving Cloud GTM and marketplace growth.”

- Temi Famurewa, Ecosystem Partner Manager, Console Connect (ex-AWS)

From an earlier cohort:

“This course is 100% essential… I wish I’d done it a year earlier — it would’ve saved me a lot of stress and given me a much clearer direction.”

- James King, Director of Alliances & Strategic Partnerships, Redgate Software

Reality check: James generated $200K+ revenue and $7M pipeline in 8 weeks after applying these frameworks.

Why this cohort (and why now):

Two years in, the pattern is clear: teams that break $MM on marketplaces build systems, not ad-hoc motions.

This 5-week program distills those systems into operator-taught frameworks you can implement immediately to accelerate your growth (Amazon Web Services (AWS), Microsoft Azure, Google Cloud).

What you’ll do and get after 5 weeks:

10 deep-dive expert sessions with VP-level Cloud GTM leaders

4 masterminds to solve your specific challenges with peers + mentors

Frameworks & templates that replace months of trial-and-error

Certificate showcasing marketplace expertise

12-month access to the Cloud GTM Leader Slack community

Ready to transform your growth on cloud marketplaces?

Cohort 12 kicks off on Tuesday, September 9th

- don't miss your chance to join this program recognized by Jay McBain of Canalys as a Top Education Program for Channel & Partnership professionals.

Special offer: Fit Check: I’ve opened a few 10-min Fit Checks on Monday (Sept 8th) to answer your questions and help you assess fit. Reply to this email to get a quick chat.

Accenture's $2.5B GenAI strategy: Why they collapsed 5 divisions into 1

Last week Accenture flipped the switch on its new org model. Growth is concentrating in AI, cloud, security and managed services—and Accenture just rewired itself to sell and deliver them in one motion.

What's working (and what isn't) in numbers:

🔝 GenAI is rapidly scaling (not stalling like some argue recently)

Accenture GenAI revenue hit $1.8B in the last 9 months FY25 YTD (Q1–Q3), with last quarter alone delivering "over $700M." That's already ~2X their entire FY24 total of "nearly $900M" and on track to reach $2.5B+ in FY25.

GenAI bookings jumped to $1.5B in Q3, up 50% in just 9 months from $1B in Q4 FY24. Hard evidence for CFOs debating AI payback.

⬆️ Cloud & Security are driving the growth

Cloud is growing strong double-digit YTD (Q3 FY25). Security is growing strong double-digit.

⬆️ Managed Services growth outpaces Consulting 67%

Managed Services growing +10% vs Consulting +6%—~67% faster growth for run/operate.

⬇️ What's softer

Bookings overall dipped 6–7% in Q3; discretionary projects remain mixed. Services market isn't easy overall, despite AI growth.

Why Accenture reorganized:

Accenture collapsed its five service lines (Strategy, Consulting, Song, Technology, and Operations) into a single Reinvention Services unit (effective Sept 1, announced in June).

The company is explicitly organizing around "reinvention" work—large, cross-functional programs where data, platforms and GenAI get embedded into processes and products—rather than selling services as separate units.

Their line: a single unit can ship integrated solutions faster and embed AI more easily across delivery.

That's also a better fit for large programs co-sold with cloud and security partners.

What it says about the market & ecosystem opportunities

AI ROI is showing up

Three quarters into FY25, Accenture's GenAI revenue already doubled last year's total. Hard evidence for CFOs questioning AI payback.

Ecosystems win deals

As CEO Julie Sweet put it on Q2's call: "we are the leader in ecosystem -- with our ecosystem partners and that has been a major differentiating factor when you look at our growth, particularly in these large deals where the ecosystem is absolutely at the heart of it."

Operate is the attach

Clients don't just want builds; they want outcomes run at scale. The +10% in Managed Services YTD versus +6% in Consulting shows budgets tilting to platform operations, security, data, and AI in production.

Bottom line for partners

Growth is concentrated where partners thrive—AI built on cloud, secured end-to-end, and operated as a service. Accenture's reorg is a blueprint for how to win those deals together.

Marketplaces Captured 34% of Non-SaaS Software—Why?

Even for non-SaaS software, 34% is now purchased on cloud marketplaces—up from 28% last year (Flexera, 2025).

This shows a shift in how enterprises buy software and how your GTM strategy needs to evolve.

Digital procurement pull is clear:

Traditional resellers are losing ground as buyers choose self-service, cloud-native procurement even for non-SaaS software (VMs, images, licenses ,etc.) via AWS/Azure/GCP marketplaces.

This 6% jump stands out in "State of the Cloud 2025" report where many metrics stayed flat.

But here's what caught my attention & how it translates into your Cloud GTM strategy:

Budgets are consolidating into cloud, creating co-sell opportunities

33% of companies now spend >$12M annually on public cloud (up from 29% YoY)

Cloud spend “expected to increase by 28% in the coming year”

34% of enterprises spend >$1M monthly on SaaS

Discounts encourage marketplace transactions

96% use at least one provider discount. Marketplaces natively connect to these constructs (commit drawdown/discount alignment), making them the path of least resistance.

FinOps teams grew from 51% → 59%, focused on cost efficiency (87%) and cost avoidance (28% → 64%)

Translation: Your hyperscaler partners have more budget influence and procurement leverage than ever. FinOps teams are now key stakeholders in software decisions, not just infrastructure.

GenAI will drive marketplace adoption

72% use GenAI public cloud services (up from 47%), with only 1% avoiding AI entirely (down from 14% last year).

As AI stack complexity rises, enterprises prefer integrated cloud-native experience over fragmented vendor relationships. Your cloud partnerships become more valuable as AI adoption accelerates.

Software & cloud waste is visible—marketplaces help control it

Estimated waste of 27% (IaaS/PaaS) and 24% (cloud software) drives demand for higher spend efficiency, centralized license management and cutting waste—again favoring marketplaces.

Organizations continue to exceed budgets by 17% despite growing them, making procurement efficiency critical.

What this means for your Cloud GTM strategy

For traditional software vendors

Marketplaces aren't optional anymore—they're where enterprise buyers expect to find you, complete with standard contracts and other benefits.

For SaaS

Even though this metric excludes SaaS, it signals broader Cloud GTM adoption as marketplaces normalize as procurement hubs for all software categories.

For procurement

This adoption validates marketplace-first strategies, especially when 96% use provider discounts that connect natively with marketplace transactions.

For alliances

With repatriation staying low (only 21% moved workloads back on-premises), doubling down on cloud GTM partnerships makes strategic sense.

The broader pattern is clear: procurement budgets are consolidating into cloud just as software complexity demands integrated solutions.

What's driving marketplace adoption at your org?

Ready to turn these trends into revenue?

Cohort 12 of our Cloud GTM Leader Course starts tomorrow (Sept 9) — your last chance to join 250+ alumni who've mastered these exact marketplace strategies.