How Datadog Hit $2B on AWS Marketplace (9 Tactics You Can Copy)

Hi, it’s Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

In today’s newsletter:

Datadog’s $2B+ marketplace enablement playbook that helped to scale from zero partnership motion in 2019 to $2B+ AWS Marketplace revenue (9 tactics you can copy)

Gartner’s bold prediction: 90% of B2B buying intermediated by AI agents by 2028 — and why AWS’s new Agent Mode + Express Private Offers prove marketplaces are already building that future

$527B AI capex forecast for 2026: Goldman Sachs shows hyperscaler spending isn’t slowing (5 implications for your Cloud GTM strategy)

But before we dive in, in 2 hours (Jan 12, 9-10am PT) we’re hosting an online workshop with Laura Ripans, Senior Director, Global Cloud Alliances at Datadog (one of the elite $2B Marketplace Club members).

We’ll break down the 5 breakthrough signals from 2025 — and the 2026 playbook to scale GTM on marketplaces. Join us in 2 hours.

This kicks off our 2026 programming and leads into Cohort 14 of Cloud GTM Leader course starting January 20th.

Datadog’s $2B+ Marketplace Enablement Playbook: Copy it

When Laura Ripans joined Datadog in 2019 as cloud alliances employee #1, the company had zero partnership motion.

Today, she’s helped build the enablement engine behind Datadog’s $2B+ in AWS Marketplace revenue alone — and she recently shared her playbook in our Cloud GTM Leader course.

The core problem most teams miss:

Your Marketplace motion won’t scale until every seller can answer: “The customer wants to buy through Marketplace — what do I do now?” …and understand why it’s in their interest to learn this early (not at procurement).

Here are 9 takeaways that you should copy from Laura Ripans, Senior Director, Global Cloud Alliances at Datadog:

1️⃣ Enablement is the critical job of cloud alliances

“Enablement is our job… if we don’t do it, no one’s going to do it.”

Not a side project. The best alliance leaders run it as a deliberate operating cadence.

2️⃣ Start with the buyer’s money — not just your product

“Follow the money.” Train sellers to ask earlier than they’re used to: do you have cloud commits (EDP/PPA, MACC)?

If your team can’t speak that language, Marketplace shows up as a late-stage surprise.

3️⃣ Put alliances into onboarding

Laura runs this in new hire training so every seller starts with: there’s a cloud alliances team, there’s co-sell, and there’s Marketplace.

4️⃣ Create a “home” for repeatability

Slack channel + pinned assets + templates. Her phrase: make yourself “more extendable” when demand exceeds bandwidth.

5️⃣ Measure enablement by outcomes, not just attendance

One tactic: ask everyone in the room to bring one co-sellable account.

Then do the “forensics” later: “I did this Lunch & Learn in Sept… 6 months later we got 6 wins.” Tie activity to pipeline.

6️⃣ Teach sellers to prep before cloud calls

A simple one-pager before any cloud call: overview, pain hypothesis, “why now,” blockers, who you need access to, and one next step.

Not perfect — just prepared.

7️⃣ External cloud enablement is a flywheel, not a one-off

“Build mindshare, build trust, build momentum — repeat often.”

And if you’re doing it in-person: get a manager sponsor, or you risk the “nobody showed up” scenario.

8️⃣ Don’t sell your product to the cloud. Sell customer problem

“You’re not there to sell your product… talk about customer pain.”

Nobody has an “APM problem.” They have “our shopping cart stopped taking money on Cyber Monday.”

9️⃣ Design co-sell calls to be fast and focused

“A+ is: get on the call efficiently, get off the call in time (maybe even early), and you’ve got one next step.”

The result?

Datadog scaled from 1,000 to 7,000 employees with $2B in revenue on AWS marketplace alone, while growing rapidly on Microsoft and Google Cloud too.

Marketplace is now embedded in how they sell — not a special project.

Join live workshop with Laura Ripans (Jan 12, 9-10 am PT) — perfect timing to start 2026 with a clear Marketplace growth plan.

[In 2 Hours]: Inside $2B Club — 5 Marketplace Signals Winners Use to Win 2026

Recent AWS re:Invent and Microsoft Ignite sent one clear message back-to-back: marketplaces are the most powerful GTM scaling engines for enterprise software.

Amazon Web Services (AWS) cited 4–5X larger deals and up to 40% net-new customers. Microsoft highlighted a $6.26 marketplace partner multiplier.

The marketplace bar is moving quickly: $1B was the headline, now $2B in revenue is the top benchmark.

And the $2B Marketplace Club is forming fast — with Datadog among the elite selling billions via marketplaces.

Today (Monday, Jan 12 at 9-10 am PT) we’re hosting online workshop to look inside $2B Club strategies and distill 5 marketplace signals winners use to win in 2026.

We’ll break down:

The 5 breakthrough signals from 2025 (and what they mean for your 2026 plan)

Practical GTM + co-sell strategies the field actually runs with

2026 blueprint to move from insights → execution (and avoid the common traps that stall teams)

Learn transformations from top operators:

Laura Ripans, Senior Director, Global Cloud Alliances at Datadog has built one of the most successful cloud alliance programs in the industry and has been recognized 5 times in CRN’s Women of the Channel.

Join us today (Jan 12, 9-10am PT) to get the 2026 Cloud GTM growth playbook

Learn the patterns winners are using to turn Marketplace into a repeatable growth engine.

See you in 2 hours!

P.S. This free workshop kicks off our 2026 programming and leads into Cohort 14 of Cloud GTM Leader starting January 20.

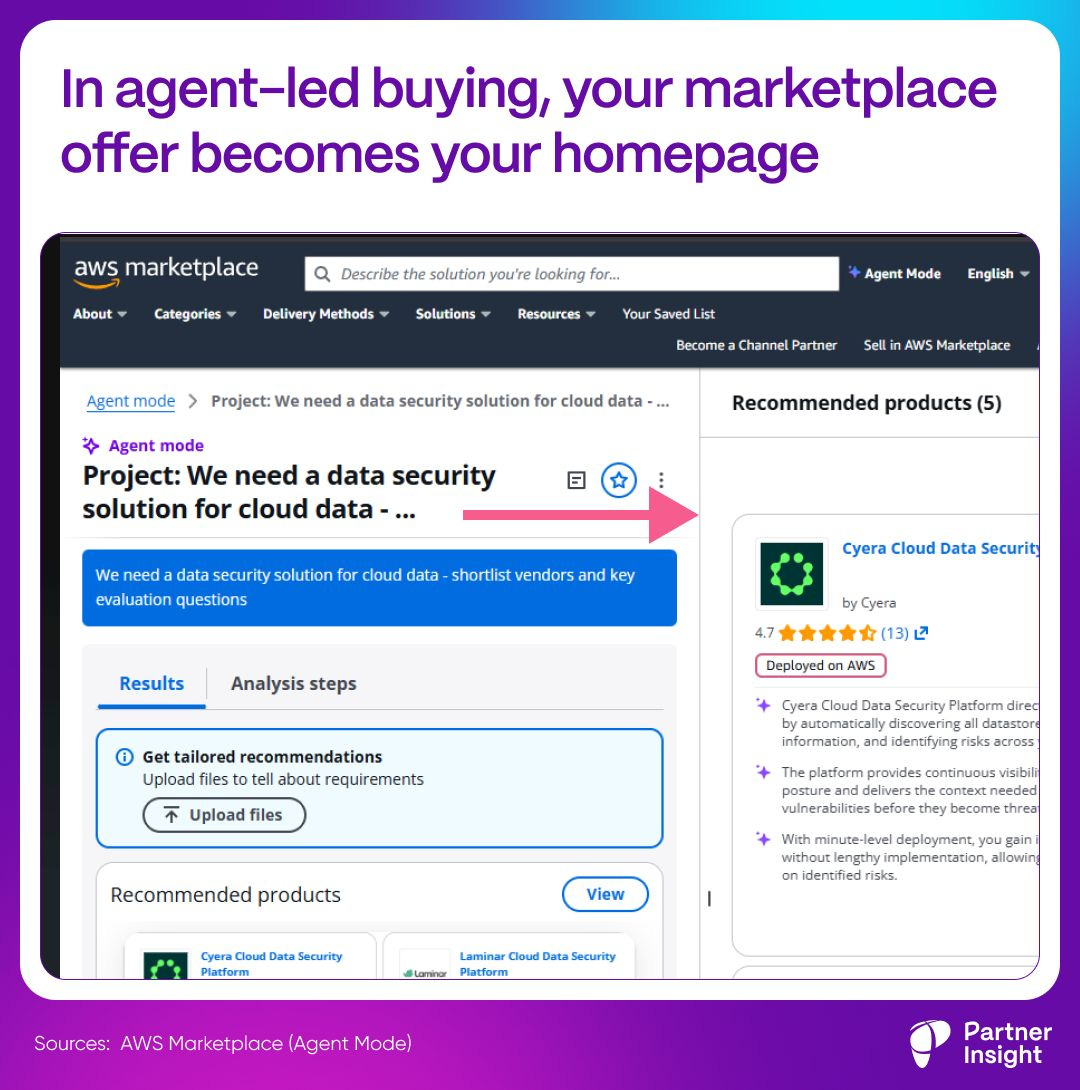

In agent-led buying, your marketplace offer becomes your homepage

In November, Gartner made a bold prediction: by 2028, 90% of B2B buying will be intermediated by AI agents - pushing $15T via “agent exchanges”. Sounds futuristic… until you look at cloud marketplaces.

In December, AWS Marketplace shipped what that future looks like:

Agent Mode: conversational discovery built for software procurement

Express Private Offers: custom private pricing that can be generated in minutes, not weeks.

That’s procurement being reprogrammed from “people reading pages” → “machines comparing offers”.

Agent optimization is just one practical implication that your product needs to be easy for software (not just humans) to understand and transact.

Here’s why cloud marketplaces are already ahead of the curve

1️⃣ Trust becomes the moat

Agents will route B2B spend through places with identity, billing, approvals, and compliance gates.

That’s what cloud marketplaces provide: a trusted wrapper around third-party software.

And we’re already seeing marketplaces evolve into “stores” not just for apps - but for AI tools, agents and services.

2️⃣ Your marketplace page becomes the AI decision screen

Agents don’t care about your homepage only.

They care about structured inputs: reviews, packaging, price logic, terms, activation steps.

Marketplaces force that discipline today. The sales cycle compresses — by default.

The slowest part of enterprise deals is often not “interest”, it’s procurement: supplier setup, legal, approvals, back-and-forth pricing.

Marketplaces collapse that path — and now even negotiation is getting automated: standard deals handled quickly; complex ones routed to sales.

AWS Express Private Offers example: sellers can preconfigure rate cards, qualification criteria, and deal parameters for SaaS contracts, so eligible buyers can receive an automated private offer in minutes.

3️⃣ Buyers were already asking for rep-free

61% of B2B buyers told Gartner they prefer a rep-free experience. Agents don’t create this behavior — they scale it.

But it’s not “rep-less”. It’s “rep where it matters”. Human sales don’t disappear.

They move up-stack to: problem framing, risk, high stakes decision, architecture, and the non-standard deal.

If you sell through cloud marketplaces, 5 things to audit this quarter:

Is your listing “machine-readable” (clear packaging, pricing rules, terms, proof)?

Can a buyer go from discovery → purchase without weeks of emails?

What “verifiable data” proves trust + value (security posture, outcomes, adoption signals)?

Do you support fast, controlled custom pricing (without manual chaos)?

Is activation/provisioning simple enough for an automated flow (if not, are you building it)?

The teams that win will have the cleanest inputs both for humans and AI - and the fastest path to transact.

Are you adjusting your marketplace GTM for an agent-driven buying flow?

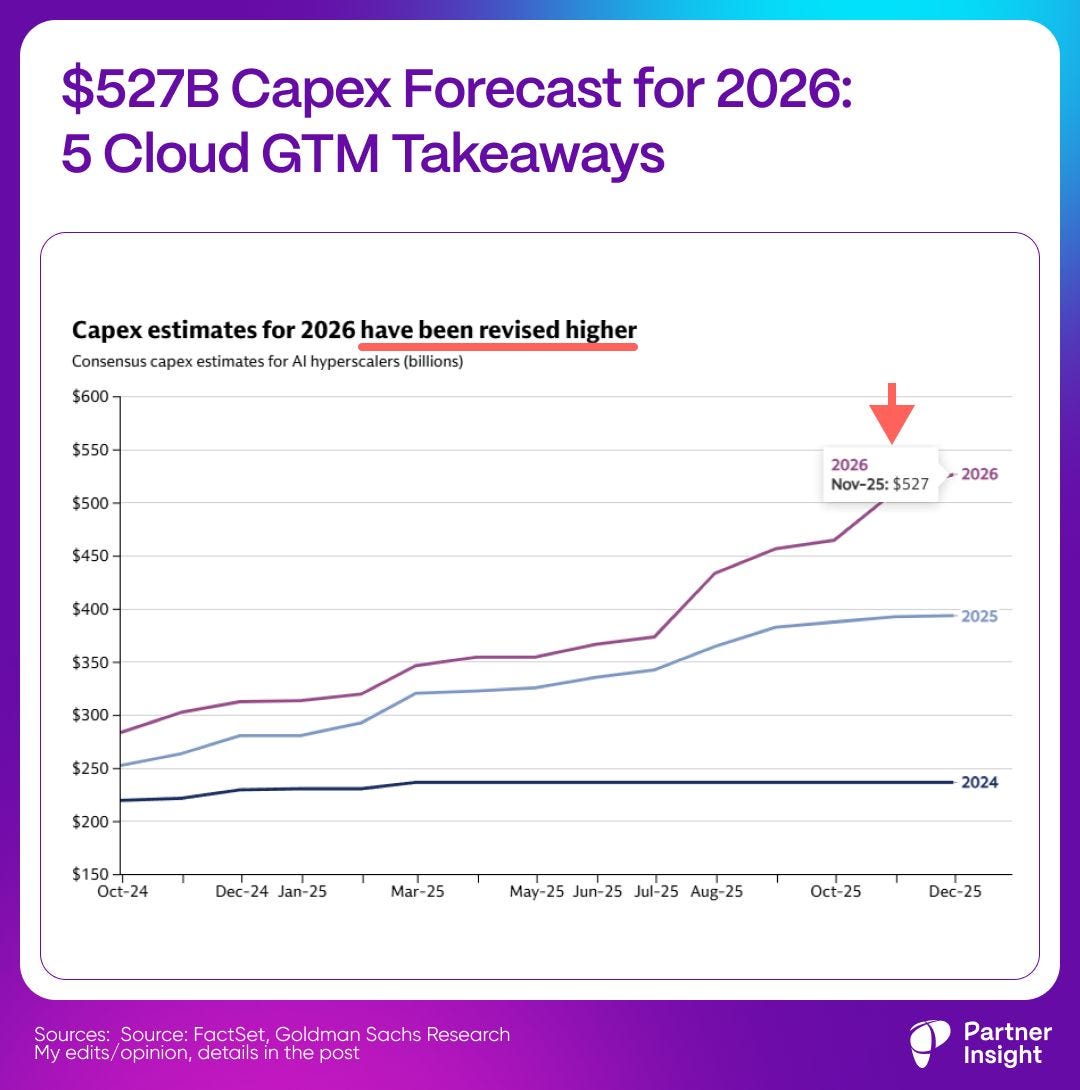

$527B Capex Forecast for 2026: 5 Cloud GTM Takeaways

Goldman Sachs's recent research has one message: the AI buildout isn’t slowing — the pressure to monetize is rising. But if investors now reward capex that turns into revenue, hyperscalers will pressure-test every GTM motion.

Marketplace-first + co-sell to drive consumption and AI will become even more “core.”

Consensus 2026 capex for the AI hyperscalers keeps rising. It’s now $527B (up from $465B at the start of Q3 earnings). And consensus has been underestimating spend for 2 years (20% implied growth; vs >50% actual).

For context: Amazon, Microsoft, Google and Oracle spent $105B+ in capex in calendar Q3 2025 alone.

Here are 5 implications for Cloud GTM leaders:

1️⃣ The constraint is not cash. It’s capacity + investor patience

The real constraints are “supply bottlenecks or investor appetite,” not cash flow / balance sheet capacity.

Alliance-leader translation:

Hyperscalers are still in “build mode,” and they’re not slowing because they can’t spend — they’ll slow only if they hit supply bottlenecks or if markets force discipline.

That’s a very different planning environment for partner GTM than a normal IT cycle.

2️⃣ When spend is this high, monetization becomes a core metric

Investors are now rewarding companies that show a clear link between capex and revenues.

So hyperscalers will push harder on the monetization:

marketplace-first deals

co-sell tied to consumption

attach plays that pull through GPU + data + platform usage

3️⃣ Hyperscalers are not moving as one

Average stock price correlation across AI hyperscalers fell from ~80% to ~20% since June — as investors separate “spend” from “revenue outcomes.”

Goldman highlights dispersion: investors aren’t rewarding all big spenders equally; confidence in revenue outcomes matters.

Partner takeaway: expect more selectivity in who hyperscalers amplify.

Translation: hyperscalers will increasingly prioritize partners who:

drive measurable consumption

have repeatable enterprise wins

show fast time-to-value (and low-friction procurement)

4️⃣ The spotlight is moving from infra to platforms and apps

Goldman sees AI monetization now involve AI platform companies (database + dev tools) and expects the next phases to include AI “productivity beneficiaries,” not just infrastructure.

5️⃣ We’re still early in the buildout cycle

AI capex is at 0.8% of GDP now vs 1.5% peaks in prior tech cycles; Goldman says capex would need to reach $700B in 2026 to match the late-90s telecom peak.

Meaning: more urgency, more building, more programs, more marketplace expansion.

If 2026 is “build mode,” partner leverage is to be the distribution + monetization engine: help hyperscalers to make buying simple, prove consumption impact, and remove friction in marketplace + co-sell. This is when you’ll likely see most support from them.

Make 2026 Your Marketplace Growth Year: Join Cohort 14 Starting on January 20th

Enterprises have committed $531B to AWS, Microsoft, and Google Cloud — budgets you can tap into via cloud marketplaces. For SaaS and AI companies, Marketplace GTM can make or break scale in 2026.

The most advanced GTM orgs – from scaleups to public companies – are rewriting the rules. They’re using marketplaces and co-sell to scale revenue faster, compress sales cycles by 40-60%, and make buying frictionless.

Real results from real companies

Over the past two years, 300 alliance leaders have completed Cloud GTM Leader course and built this capability. Examples of what alumni have achieved:

Launched from zero marketplace motion to $200K revenue + $7M pipeline in 8 weeks

Closed their first $1M+ marketplace deal and turned it into a repeatable motion

Scaled marketplace revenue 4X YoY from an already high eight-figure base

These aren’t outliers. They’re alliance leaders who invested 5 weeks to master the frameworks, tactics and relationships that drive cloud GTM success.

What we master in 5 weeks:

How to tap into cloud commits + marketplace buying processes

Co-sell patterns with hyperscaler field teams that actually create pipeline

How to position on marketplaces so sellers choose you among thousands of vendors

Frameworks to align sales, product, finance, and ops around one cloud GTM plan

How to accelerate deals with smart co-marketing (and more)

If 2026 is the year you want Marketplace to become a real growth channel — join our cohort starting on January 20.

What alumni are saying

“I wish I had this knowledge before I started my role in the GTM department last year.”

“As someone who has built AWS alliances twice, driven marketplace success, and led cross-functional GTM motions, this program elevated my perspective and sharpened my thinking around cloud co-sell programs, marketplace motions, channel strategy, and scalable GTM frameworks. Highly recommend.”

P.S. If you found these insights valuable, please forward this newsletter to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.