Make Marketplace MEDDPICC-Native (So Sellers Use It)

Hi, it’s Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

In today’s newsletter:

If your sellers ignore Marketplace, the fix is simple: translate co-sell + Marketplace into MEDDPICC language they already use every day.

Firefighting may save a deal, but only systems scale a motion. Too many teams use Marketplace for last-minute closing—not as a repeatable Cloud GTM engine (the exact shift that drives adoption).

1-pager can speed Marketplace deals. A Partnerships leader with a FinOps background shares the customer-facing doc that turns “buy via Marketplace” into an easier internal yes.

Alphabet hit $4T — and Apple chose Gemini (the new AI alliance playbook: “frenemies,” hybrid stacks, non-exclusive moats).

A $2T divergence is reshaping software and Cloud GTM (hyperscalers added ~$2T in value while the SaaS basket fell ~13%).

But before we dive in:

Cloud GTM Leader Cohort 14 launches tomorrow (Jan 20 kickoff). If 2026 is the year you make Marketplace a real growth engine, this is your moment.

Join 300+ alliance leaders who’ve transformed their Cloud GTM motions on AWS, Microsoft, and Google Cloud.

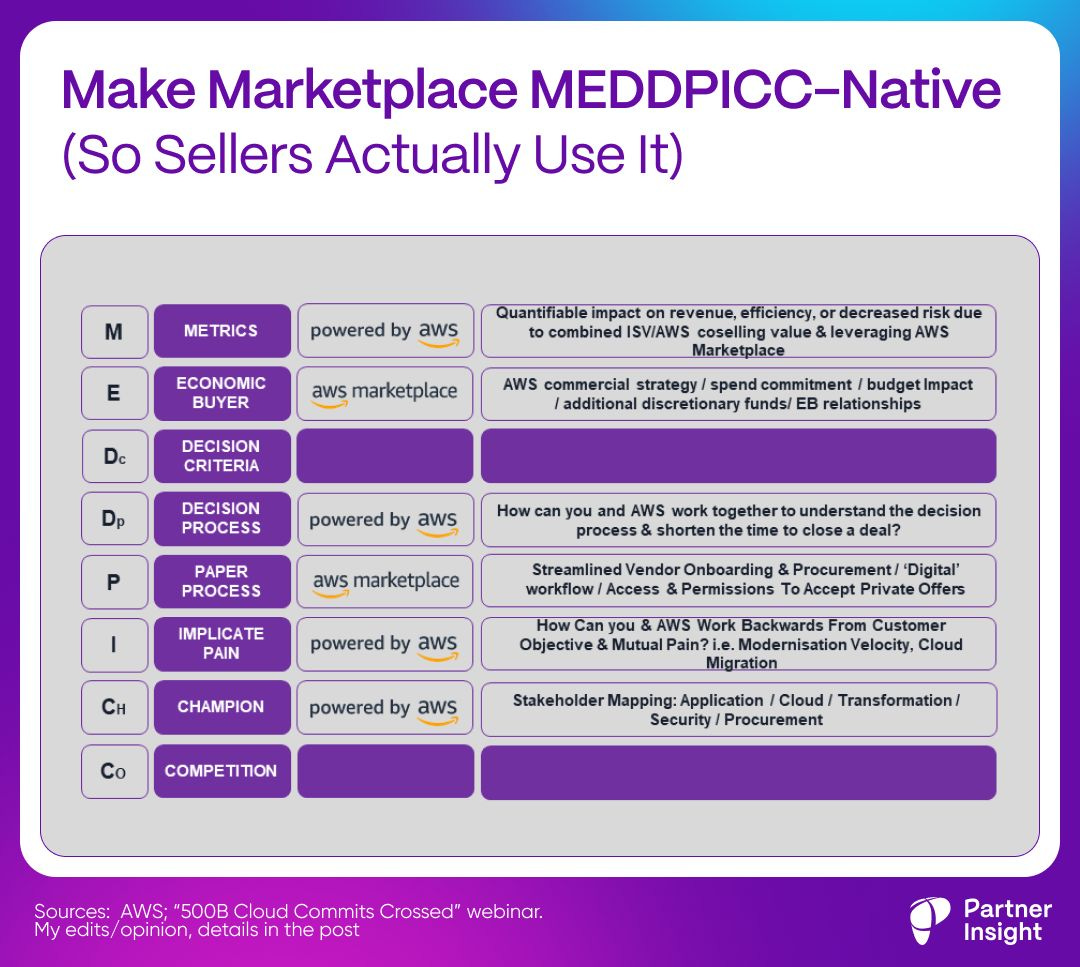

Make Marketplace MEDDPICC-Native (So Sellers Actually Use It)

Marketplace doesn’t need a new sales motion. It needs to become MEDDPICC-native. Most sellers already have a language for qualifying and closing deals.

Alliance teams often introduce Marketplace + co-sell as a separate track: new forms, new steps, new stakeholders, new “ask alliances.”

So even when a customer can buy through Marketplace, the default path wins: the one sellers already know.

The unlock is simple: translate Marketplace + co-sell into MEDDPICC so sellers feel like they’re running their normal process — just with more leverage.

Here’s a mapping we discussed in our recent webinars:

Metrics - 𝐌

Quantify the value of your ISV solution and the advantages of buying via marketplaces (using cloud commits, consolidated billing, less admin overhead for the customer’s finance team).

For sellers, marketplaces can unlock faster growth, efficiency and deployment.

But don’t just say “efficiency.” Use hard industry/internal data (see my previous posts, etc).

Economic Buyer - 𝐄

Your champion might be in the business unit, but the budget authority often sits elsewhere.

Use hyperscaler reach to understand the buyer’s commercial strategy, cloud commits, and who owns them. Clouds can also help you access higher levels (CIO/CTO) when the case is clear.

Decision Criteria - 𝐃

Understand how your prospect reviews, shortlists, and finalizes purchases. Collaborate with cloud teams to align decision criteria with Marketplace benefits.

Example: if “cost reduction” is a key criterion (and the customer has commits), frame the deal not as new spend, but as a way to use committed spend that may otherwise go unused.

Decision Process - 𝐃

Teams lose time because they map the approval chain too late.

Co-sell helps here: hyperscalers see customer buying patterns across accounts and can guide sellers through the internal decision-making maze.

When you engage cloud teams, share your status and specific requests (e.g., “Help us validate the legal review timeline”), not generic “any help is appreciated.”

Paper Process - 𝐏

Marketplace workflows can bypass traditional signature delays and grant user access faster. Push for standard marketplace agreements to cut redlines and shorten legal cycles.

Also: educate sellers to identify who can accept private offers early, not at the last moment.

Identify Pain - 𝐈

Work backwards from the customer’s goals and constraints: modernization, migration, etc. to understand how your solution fits best.

Co-sell can help connect your solution to cloud (and AI) priorities and frame the pain in the customer’s language.

Champion - 𝐂

When you cultivate champion/s inside the customer org, use hyperscalers to map stakeholders in areas like Security, Apps, AI and Procurement to strengthen internal support.

If your internal champion goes silent, cloud sellers can sometimes help to re-engage the account from a different angle.

Could your sellers explain how Marketplace fits in MEDDPICC without asking alliances?

Stop Firefighting Deals. Build a Cloud GTM System

If Marketplace only shows up at the end of the deal, it’s not a GTM motion. It’s firefighting.

It may feel productive, but it doesn’t compound.

And many teams stay stuck because they “perform” all quarter — and “train/build the system” one day at SKO/QBR.

Here’s the contrast I keep seeing across ISVs: firefighting vs building a repeatable Cloud GTM system.

Firefighting deals

Marketplace comes up at Stage 5/6: “Can we push this through Marketplace?”

Sellers ping alliances: “Need a private offer ASAP”

Cloud rep gets a messy co-sell request: no buyer context, no clear ask

Customer procurement involved in the last week: “Who can accept the private offer?”

The “win” depends on one operator who knows the maze

It creates chaos:

Unpredictable outcomes

Sellers conclude: “Marketplace is extra work”

Cloud teams get flooded with low-quality asks (“spray and pray”)

Zero compounding: the next deal starts from scratch

Building a Repeatable System

Marketplace identified as a default path early (Stage 2/3 check)

Sales drives the motion; alliances enable + orchestrate where needed (not “save” deals)

Sales talk track + checklists is MEDDPICC-native

Deal sharing is structured: status + next step + specific asks

Procurement + private offer approver identified before endgame

Cross-functional support is pre-wired: Finance (comp neutral + rev rec), Ops (automations), Product (marketplace packaging), Marketing

It builds leverage:

Faster cycles, less noise

Higher adoption across the sales team

Better co-sell response from hyperscalers

Real compounding: every deal makes the motion stronger

Firefighting saves a deal. Systems scale a motion.

Don’t treat learning and system-building as the opposite of “performing.”

It’s the engine behind performance.

Scalable Cloud GTM system includes:

People: reps know the play; alliances enable and reinforce it; ops support it, finance/legal aren’t surprised later

Enablement: onboarding + refreshers + call templates + deal reviews that teach the motion

Process: stage rules, checklists, automation workflows

Cadence: enablement, co-sell rhythms + always-on channel for questions

Tools: CRM automations, templates, structured co-sell submissions

A simple gut-check:

Most teams: 90% firefight / 10% build

Scaling teams: 70% execute / 30% build the system

Reality check (baseline B2B):

Salesforce’s State of Sales says reps spend only ~28–30% of their week actually selling (the rest is admin + internal work).

Seismic found that without enablement, sellers spend ~10 hours/week just searching for content.

If that’s true in “normal sales,” it’s usually worse in Marketplace motions that don’t have a system.

Are you building your repeatable Cloud GTM system?

Ready to transform your growth on cloud marketplaces?

Join our 5-week course for Alliance and Cloud GTM leaders and build your repeatable marketplace + co-sell growth engine on AWS, Microsoft or Google Cloud.

Cloud GTM Leader Cohort 14 kicks off on Jan 20!

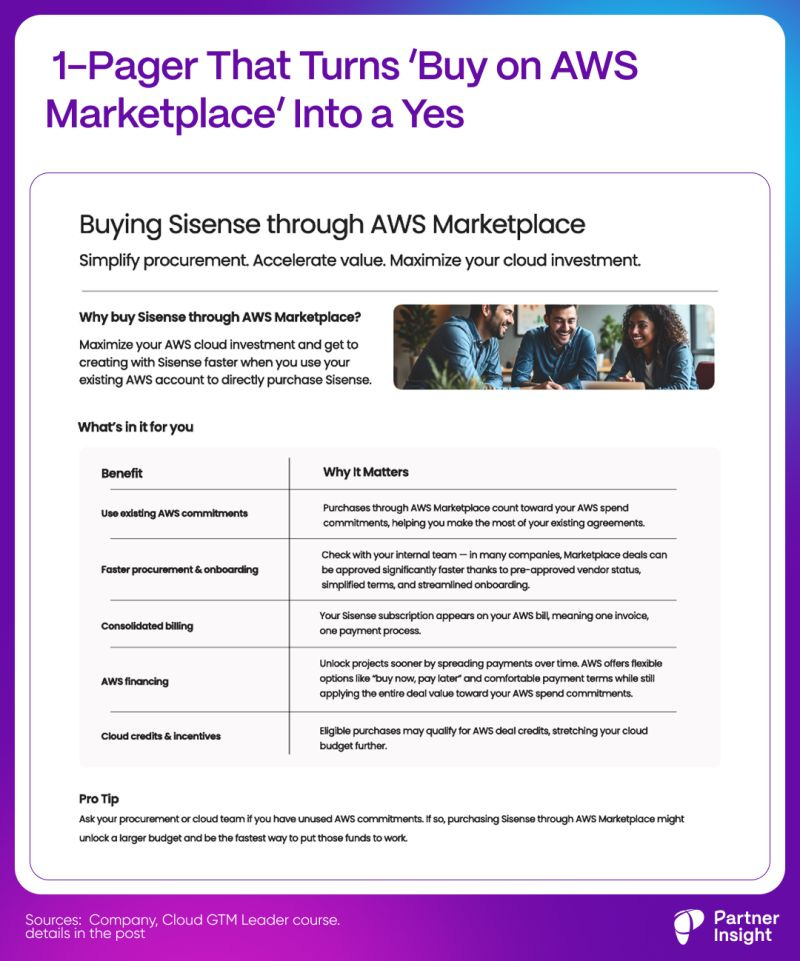

1-Pager That Turns ‘Buy on AWS Marketplace’ Into a Yes

Some of the best Marketplace GTM templates come from… former finance leaders who learned Cloud GTM.

Because they know exactly what procurement needs to hear.

Because when you’ve lived in finance, you don’t describe Marketplace as “another channel.”

You describe it as what it really is: A procurement + budget unlock that can accelerate deals if the buyer can explain it internally.

One of our Cloud GTM Leader alumni, Gital Schneider, showed a great example.

Gital started at Sisense leading Cloud FinOps. Then she got pulled into Amazon Web Services (AWS) Marketplace work, saw the momentum up close, moved into Alliances, and is now Head of Partnerships.

Sisense is an AI-powered embedded analytics company, currently expanding its ecosystem and growing on AWS Marketplace.

“Small” problem that blocks real Marketplace deals

A seller says: “You can buy us via AWS Marketplace.”

The customer asks internally: How does it work? Why would we? What changes for procurement and billing?

Most companies hand-wave this conversation.

But the champion is rarely a Marketplace expert. So the deal stalls. Not because the customer doesn’t want the product, but because they can’t explain this path with confidence.

Sisense’s fix: a one-pager that translates Marketplace into buyer language.

Gital built a one-page customer-facing doc that is basically a procurement/FinOps translation layer for AWS Marketplace.

It might sound trivial. It’s not. Because Sisense saw AWS Marketplace deals going >20% faster through the sales cycle.

What their one-pager covers (and what you can copy)

It’s written in customer procurement language, not partner language.

1️⃣ Use existing AWS commitments

Purchases count toward AWS spend commitments.

This makes finance people pay attention.

2️⃣ Faster procurement and onboarding

Often approved faster due to pre-approved vendor status, simplified terms, and streamlined onboarding.

Speed is key for everyone.

3️⃣ Consolidated billing

The subscription shows up on the AWS bill.

One invoice, one process, fewer vendor setup headaches.

4️⃣ AWS financing

Options like “buy now, pay later” and flexible terms, while still counting the full value toward commitments.

For many buyers, this is the bridge between “want” and “can buy now.”

5️⃣ Cloud credits and incentives

Eligible purchases may qualify for AWS deal credits and programs.

Pro tip (the line most sellers forget)

Ask if the customer has unused commitments or a “use it or lose it” dynamic. Marketplace can unlock budget and speed at the same time.

The takeaway for Alliance leaders

Most Marketplace content is written for sellers. This one-pager is written for the buyer’s internal teams: finance, procurement.

That’s why it works.

If you don’t have your own version of this one-pager, build one.

Because it’s deal plumbing - the kind of asset that turns Marketplace into a repeatable buying motion.

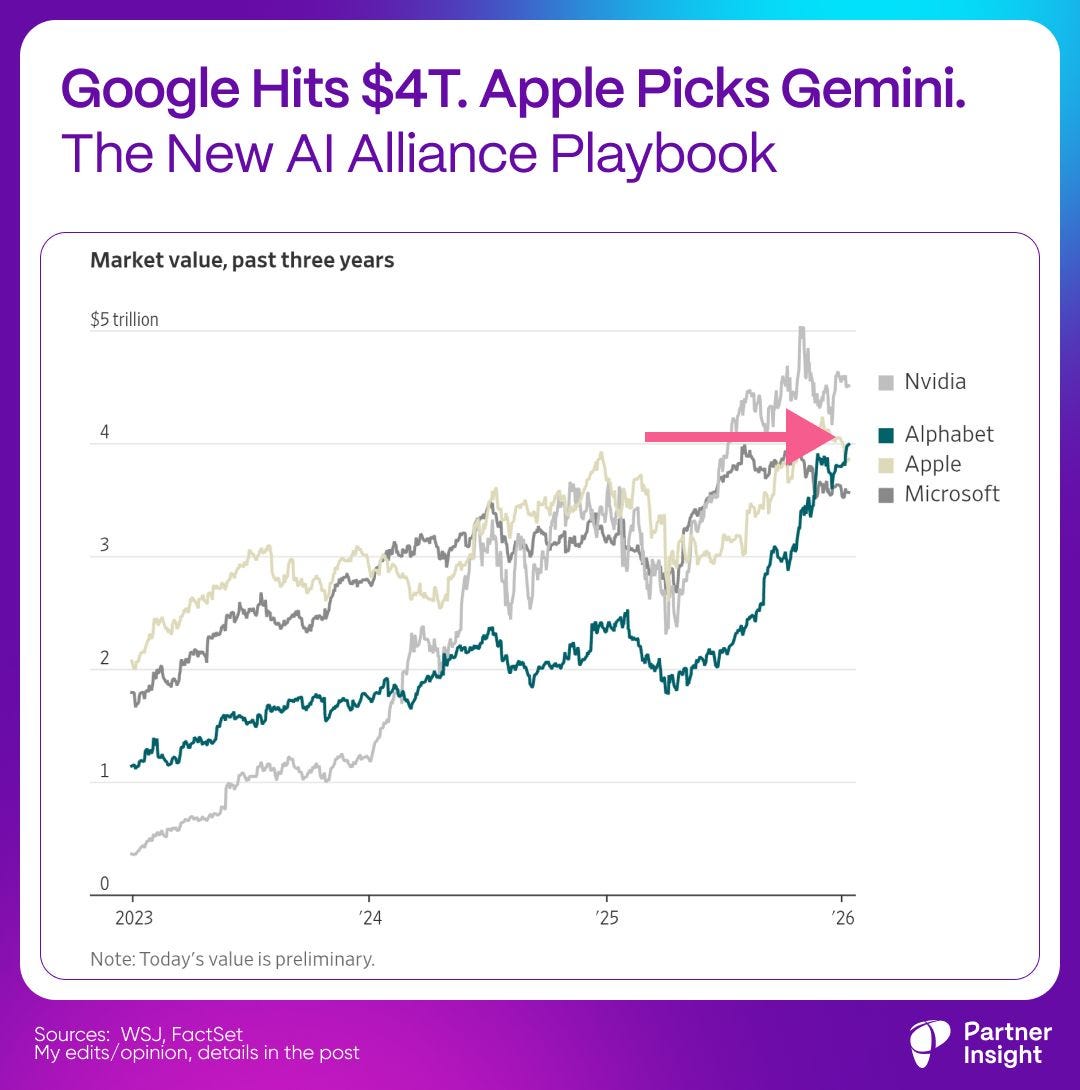

Google Hits $4T. Apple Picks Gemini. The New AI Alliance Playbook

Alphabet Inc. crossed a $4T market cap last week and landed the kind of alliance that reshapes an ecosystem: Apple. This deal shows how platform alliances will be built in the AI era.

What happened

Apple signed a multi-year agreement where parts of Apple Intelligence (including a revamped Siri) will run on Google’s Gemini models and Google Cloud infrastructure.

Apple called Google’s AI the “most capable foundation” for future Apple Foundation Models.

The partnership is explicitly non-exclusive, leaving Apple room to rebalance with OpenAI and others—but Google just won the flagship slot in the world’s most valuable consumer ecosystem.

And it helped push Alphabet past the $4T market cap threshold, joining Nvidia, Apple, and Microsoft in the four-comma club.

What this deal means & what alliance teams can learn:

“Frenemy” alliances work when you decouple functions

Google and Apple are fierce rivals across mobile OS, browsers, and hardware.

Yet they were able to compartmentalize competition and partner where it mattered most: best-in-class AI models + infrastructure capability.

When the functional value is high enough, the rivalry becomes manageable.

Hybrid AI is becoming the dominant architecture

The biggest partnerships may not be pure cloud offloads. They’ll be split-stack: sensitive context stays on-device or in a private cloud, while heavy AI workloads run on hyperscaler infrastructure.

Control + privacy on one side, frontier capability + scale on the other.

The “default AI provider” narrative is weakening

The deal is framed as non-exclusive. Translation: even the largest platforms will run multi-model stacks.

In AI, you’re competing for workload share, not permanent exclusivity.

Privacy is table stakes, not a feature

Apple’s insistence on keeping core data processing local is the real constraint for many enterprise deployments too.

Winning large alliances increasingly requires flexible deployment options and credible privacy guarantees, not just raw model quality.

Platform leverage compounds

This is validation of Google’s vertically integrated AI stack: custom TPUs, Gemini models, and cloud infrastructure working as one system.

It also gives Google’s enterprise partner narrative a major credibility boost.

Alphabet’s $4T milestone reflects a sharpened AI focus, improving Gemini reception, and custom silicon — with the Apple deal as the capstone.

For GTM leaders, the takeaway is simple: build flexible, high-trust partnerships that can win in a hybrid, multi-model AI world.

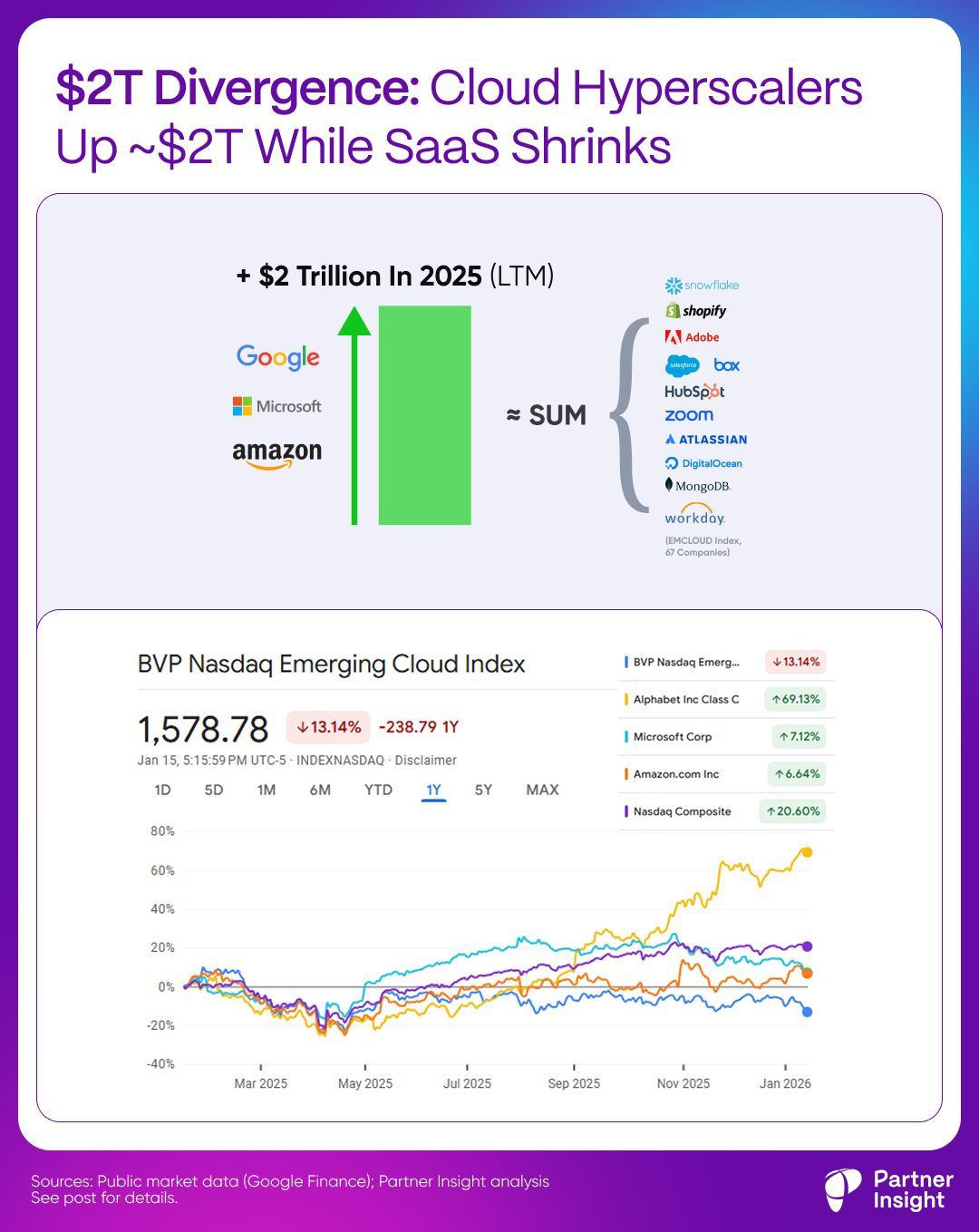

$2T Divergence: Cloud Hyperscalers Up ~$2T While SaaS Struggles

If you feel like the last 12 months in SaaS have been hard, you aren’t imagining it. The market is uneven, and the data is stark so it feels like a major divergence.

I looked at public market performance over the last 12 months (Jan 2025 – Jan 2026), comparing the Hyperscalers against the BVP Nasdaq Emerging Cloud Index.

”SaaS Recession” feels real

The BVP Emerging Cloud Index—which tracks a composite of ~75 of the most promising public cloud SaaS companies (see logos) - is down ~13% over the last year.

While the broader Nasdaq rose ~20%, the cloud SaaS basket didn’t just lag; it actually shrank.

At the same time, the hyperscalers moved the other way:

Alphabet Inc. +69%

Microsoft +7%

Amazon +7%

Quick math:

Today, Alphabet + Microsoft + Amazon are worth ~$10T combined.

Based on their 12-month stock moves, they added roughly ~$2T of market value over the last year.

Now compare that with the SaaS cohort: BVP’s index is down ~13%. That’s ~$0.3T erased.

So while the SaaS universe shrunk, hyperscaler platforms grew — massively.

In fact, they added value roughly equal to the entire BVP index, which represents the cloud SaaS universe with ~$2.1T of total market cap.

Not all hyperscalers grew equally. And yes, these are diversified businesses. Same with SaaS companies - some are really winning now. But the directional trend has been now consistent for a couple of years:

Markets are pricing in that AI and cloud are the two growth engines — and the value is accruing around the platforms that control distribution, drive AI adoption and host customer data.

And here’s the part we shouldn’t ignore:

Those same hyperscaler platforms are now reinvesting $300B+ per year into AI infrastructure.

So we’re not just looking at today’s market caps — markets are pricing the future scale of these ecosystems.

This also isn’t just “AI hype.” It’s wallet consolidation.

CIOs and CFOs are under immense pressure to rationalize their stacks. They’re cutting discretionary point solutions and doubling down on platforms where they already have committed cloud spend.

Does it all mean that SaaS is dying? Not quite.

SaaS is changing and realigning to an AI-first world:

Buyers are consolidating spend

Point solutions face more scrutiny

Platforms that control data, distribution, and budgets have more gravity

You need to become AI-first, and it’s actually non-trivial

The top alliance leaders know this.

They grow through hyperscaler marketplaces, attaching to budgets that keeps growing: $531B in cloud commits.

They’re treating cloud alliances and marketplaces as a core GTM motion to accelerate SaaS realignment and tap into AI/cloud boom.

If 2026 is the year when you want Marketplace to become a real growth channel - join our cohort starting on January 20.

During the 5 weeks we’ll break down top marketplace + co-sell growth strategies on AWS, Microsoft and GCP with 10+ top alliance leaders.

P.S. If you found these insights valuable, please forward this newsletter to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.