Microsoft's AI-First Marketplace Consolidation: 3 Moves to Win Co-Sell & Commits

Hi, it’s Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week:

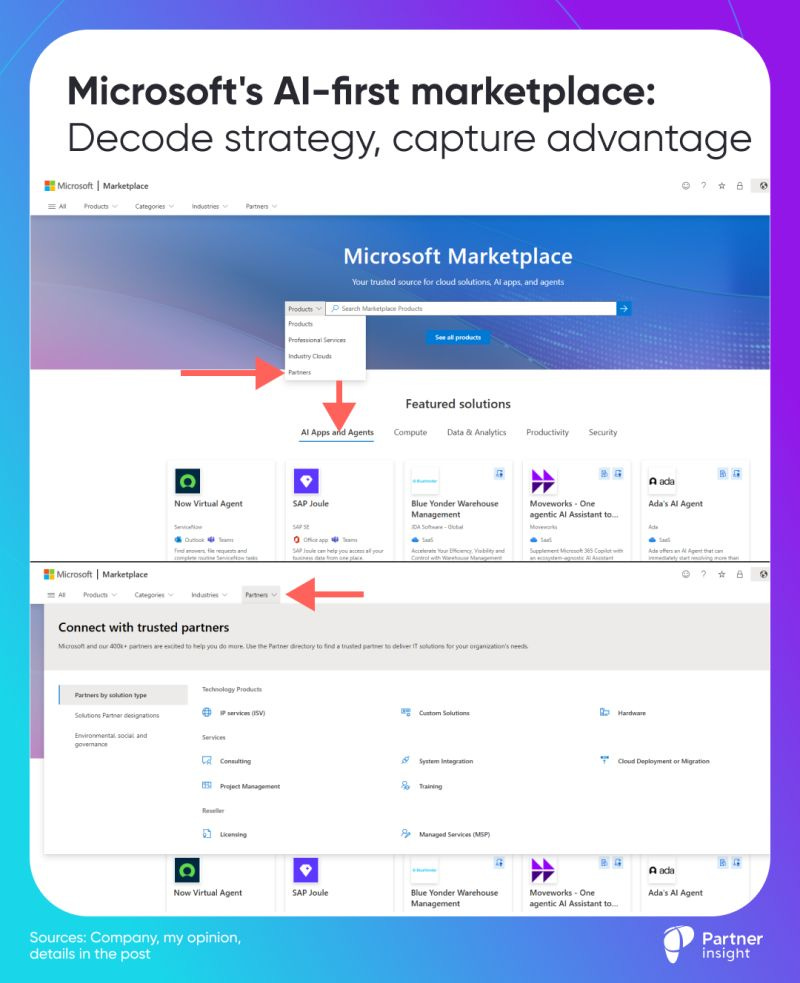

Microsoft’s AI-first marketplace: Azure Marketplace and AppSource collapsed into one, with AI Apps & Agents as the default aisle—what it means for discovery, co-sell and who captures commits.

McKinsey’s cloud waste finding: After reviewing $3B+ in spend, they found 10-28% waste—your opportunity to position offers as commit optimization.

The marketplace revenue gap: Why some ISVs hit 20%+ marketplace revenue while others plateau at 5% (our research with Clazar revealed high-performers automate 2X more).

Partnership-as-infrastructure: NVIDIA and OpenAI’s $100B deal added $170B in market cap in one day, demonstrating how the best partnerships architect capital, capacity, and distribution together.

Before we dive in, if you find these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.

Microsoft’s AI-first marketplace: Decode strategy, capture advantage

Microsoft last week collapsed its marketplaces into one front door. Fewer doors, more foot traffic. For alliance leaders, this signals discoverability, co-sell, and who captures commits is changing.

One doorway for buyers and sellers

Azure Marketplace + AppSource + the new AI Apps & Agents now live under one URL. Less confusion, clearer demand signals, and centralized publishing, search, and ranking.

AI apps & agents are now first-class

Microsoft is curating 3,000+ apps/agents and placing them inside Azure AI Foundry and Microsoft 365 Copilot surfaces.

Translation: Microsoft wants to be the default enterprise AI app store.

Enterprise trust stays tight

Listings pass security and compliance gates - procurement gets confidence; partners compete more.

What it signals to Microsoft partners

Nicole Dezen, Chief Partner Officer put it clearly: Marketplace sits “at the center of our partner strategy.”

Standardize AI offers

Package agents (and apps) as discrete offers so they can be listed and co-sold like any solution.

Multi-party is the default

MPO + CSP private offers + resale enablement formalize repeatable, channel-first motions tied to MACC (Microsoft Azure Consumption Commitment) drawdown.

Broader funnel, same counterparty

Distributors are highlighted in the catalog. Microsoft keeps the telemetry; the channel does the scale work.

What the UI tells you:

AI Apps & Agents are the default aisle

It’s the first tab under “Featured solutions.” Microsoft wants buyers to start with agents/Copilot add-ins, not generic SaaS.

4 buyer intents drive navigation

Products • Categories • Industries • Partners

What it is → what it’s for → who it’s for → who can help.

Search includes “Professional Services” and “Partners”

Services are not an afterthought. Microsoft expects solutions + services, often by vertical, delivered with partners.

Dedicated “Partners” hub

ISVs, SIs, MSPs, training, licensing, hardware—buyers can assemble multi-party deals from one place.

Industry is a primary filter

Being vertical-relevant wins shelf space.

Category-first featuring

“Featured solutions” lanes (Compute, Data, Productivity, Security) behave like editorial shelves. Pick one core category to own.

3 moves for alliance leaders

Re-brief your company and field on “why now.”

One store + Microsoft’s focus = more ways to attach, co-sell, and grow.

Packaging agentic workflows is now normal

Shift your story from “integration” to orchestrated outcomes.

Win the new battleground: search and curation

One storefront concentrates ranking, reviews, and “featured” slots. Treat category fit, metadata, badges, and review velocity as a program.

Bottom line:

This launch isn’t a new website; it’s a new distribution system.

If your offer shows up as AI app or an AI Agent , pairs with services, partners and rides a multi-party path, you’ll catch the algorithm—and the field—on your side.

How to Choose the Right Cloud Sales Platform

$1M question: Why do some companies generate 20%+ of revenue through marketplaces while others stay below 5%?

Winners know cloud GTM isn’t a listing problem- it’s a systems problem.

Here’s what data from our previous research with Clazar revealed (and why it matters for your revenue):

Co-Sell at Scale Is Now Table Stakes

High-performing companies are 2X more likely to automate marketplace workflows.

While 72% have started automating reporting, only 34% achieve high automation across sales and operations. and that gap correlates directly with revenue performance.

Teams that automated opportunity creation/updates (like ACE submissions) went from a few hundred opps a year to that in a month—without extra headcount.

That builds real pipeline and lifts win rates when hyperscaler reps engage.

The Visibility Problem Kills Co-Sell

54% of alliance leaders driving marketplace motions aren’t tracking actual transactions, according to Clazar.

Result: under-reported influence, missed chances to leverage customer cloud commits, and fewer hyperscaler referrals.

When your CRM and ACE don’t sync, field reps can’t see the full picture.

Automation Is the Sales Multiplier

Only 20% of ISVs automate revenue recognition today. That’s why closing is slow, Finance says “no,” and sellers avoid the motion.

Auto-reconciling payouts to contracts removes Finance friction and unlocks faster deal approvals.

Listings in Days, Not Months → More Shots on Goal

ISVs like Census and Gremlin launched or updated in ~2 weeks. Fast iteration means more opportunities to land deals that must flow through marketplaces.

Tactical Reality

Marketplace success requires solving 6 operational areas simultaneously:

listings

co-sell workflows

offer management

revenue reconciliation

integrations

compliance

Miss one, and the motion breaks.

If you want the deep dive, Clazar’s new 48-page Guide to Choosing the Right Cloud Sales Platform breaks down what operational excellence and automations should look like in the cloud GTM era.

It includes exact workflows to automate, ROI scenarios, and cross-functional strategies from alliance leaders generating millions through marketplaces (includes our joint State of Cloud GTM research).

What’s inside:

Role-by-role needs breakdown (Partnerships, RevOps, Finance, Sales) for marketplace automation

ROI frameworks for specific scenarios

Checklists and key questions to ask

Implementation roadmaps that avoid common pitfalls

Download the full 48-page guide here

When you fix the marketplace plumbing—listings, co-sell, private offers, revenue recognition—sales move much faster.

PS. This post is supported by Clazar

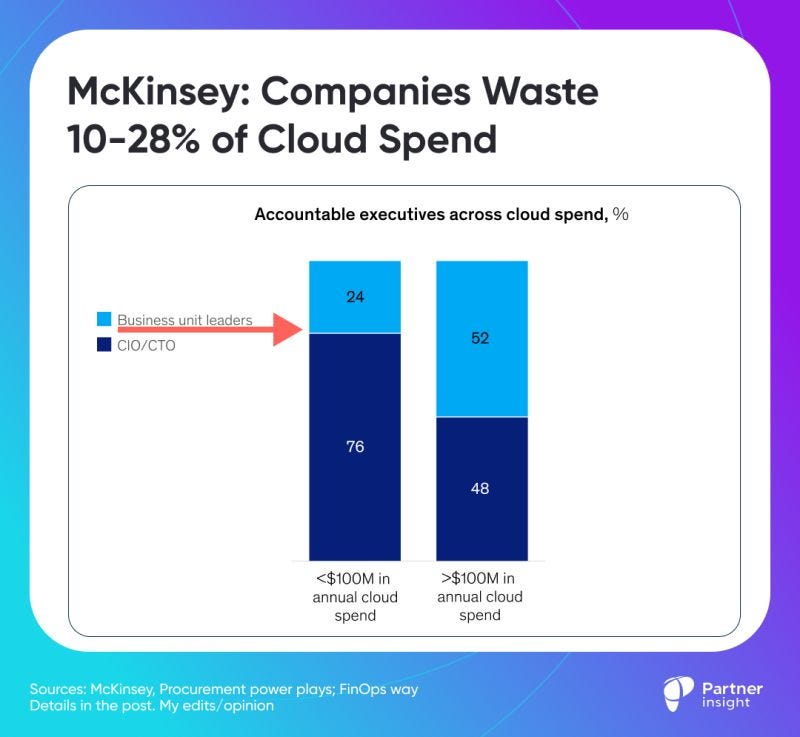

McKinsey: Companies Waste 10-28% of Cloud Spend

Cloud procurement has become so consequential that even McKinsey now advises clients on how to run it strategically. Not because cloud is “too expensive,” but because the buying is often inefficient—and that’s where Cloud GTM leaders win.

5 highlights from what McKinsey discovered:

After reviewing $3B+ of cloud spend, they found 10–20% additional savings hiding in plain sight—mostly from procurement and operating disciplines.

For many enterprises, cloud is now one of the largest categories. In a mid-sized tech/retail company spending $30–40M/yr, that’s $3–8M left on the table.

Business executives often engage only once annual cloud costs cross $100M—by then, consumption patterns are entrenched. In smaller firms, many business leaders simply aren’t close to the numbers.

Up to 28% of spend is addressable waste (Flexera). Procurement teams are racing to optimize what McKinsey calls a “hard-to-crack” category that demands deep technical and commercial understanding.

Most FinOps teams spend ~80% of time on operational tasks (e.g., tagging) instead of strategic work like unit economics, forecasting, and decision support—the bigger leak is weak financial management, not line-item pricing.

AI acceleration challenge

AI workloads make demand forecasting volatile. With cloud revenues tracking toward $2T by 2030, companies lock into multi-year commits without fully understanding consumption patterns—creating both risk and opportunity for alliances.

This is not an anti-cloud narrative. If anything, McKinsey frames cloud as a major profitability lever for organizations that connect technical drivers to commercial levers.

That’s exactly where marketplaces shine - helping companies to use $469B in committed cloud spend more efficiently.

Why this matters for Alliance & Cloud GTM leaders

Marketplace = spend optimizer, not just channel

Customers with large commits can route purchases through AWS/Azure/GCP marketplaces to utilize budget, de-risk under-consumption, and accelerate approvals. Position your deal as commit management + outcomes, not “another vendor.”

Budget arbitrage is real

If procurement is asked to find 10–20% offsets, your marketplace-aligned offer is the offset: faster cycle times, cleaner paper, standardized terms, and measurable unit economics.

AI makes forecasting harder- marketplaces make buying easier

As AI spikes usage, finance will favor vendors who make commits predictable and auditable. Tie private offers to ramp schedules with clear consumption milestones.

Takeaway

Cloud spend isn’t the enemy—undisciplined buying is. McKinsey’s playbook elevates procurement to a growth lever.

If you’re an ISV, meet that moment: package your value as commit optimization, prove unit economics, and transact where the budget already lives—the marketplace.

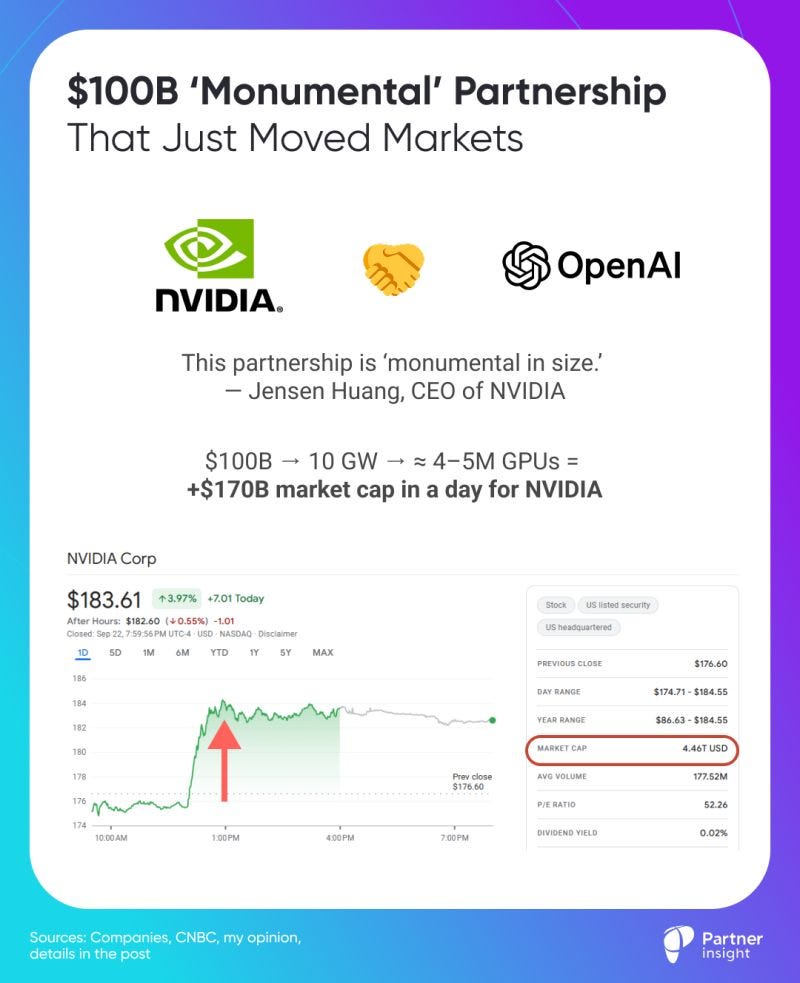

$100B ‘Monumental’ Partnership That Moved Markets

NVIDIA and OpenAI just reset the bar for partnership strategy. $100B will flow to OpenAI while NVIDIA instantly gained $170B in market cap - a masterclass in co-opetition where AI titans collaborate and compete simultaneously.

When circular investments create exponential value

The deal structure reveals a sophisticated partnership strategy

Nvidia invests $100B in OpenAI through non-voting shares, which OpenAI uses to purchase Nvidia’s data center chips.

What analysts flag as “circular” investment is brilliant ecosystem alignment.

Nvidia secures its largest customer while OpenAI gets compute infrastructure for 10 GW of processing power, ~ like serving 8M households.

This would involve 4-5M of Nvidia chips. Total cost of this 10 GW of AI infra would be ~$400B including chips, land and physical infrastructure (FT).

NVIDIA is getting hands-on across the entire stack

It recently took a $5B stake in Intel Corporation that will cause tighter GPU/CPU integrations, plus targeted bets on datacenter infrastructure startups. The blueprint: finance demand, secure capacity, lock in distribution.

The customer scale justifies everything

OpenAI now serves 700M weekly active users, demonstrating AI demand that warrants this partnership level.

Since the OpenAI deal is additive to everything previously committed, AI infrastructure buildout is accelerating faster than even most optimistic forecasts.

Market validation meets growing co-opetition

The market’s immediate response validates the partnership logic. On the announcement Nvidia jumped ▲4%, Nasdaq ▲0.5%.

Oracle, which is building datacenters, surged ▲6% alongside Nvidia’s gains, recognizing how this investment amplifies commitments for cloud infrastructure spending.

Nvidia’s move pressures other major players

Google, Amazon, Microsoft and Meta now face a choice: match these AI capex investments or risk falling behind. Spending decisions could mean tens or hundreds of billions annually.

What’s more, they all closely work with Nvidia and (many of them) with Open AI.

Meanwhile, hyperscalers were already in a CapEx arms race:

Amazon investing $100B+ annually, Microsoft guided “over $30B” per quarter, Google lifted FY25 CapEx to ~$85B, plus $72B commitment from Meta.

Combined, the four were already expected to spend $400B+ on capex in the coming year (WSJ).

For perspective: the entire Apollo project cost ~$280B (over 13 years), adjusted for inflation.

Partnership Playbook for the AI Era

Meet partnership-as-infrastructure model.

Winners won’t just build great products—they’ll architect capital, capacity, and channels together.

They compete and collaborate fiercely in equal measure, participating in each other’s ecosystems while building their own.

How are you adjusting your GTM to this new era of AI-cloud partnerships?

P.S. If you found these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.