Why Co-Sell Pitches Fail (+ 2 Frameworks That Win)

Hi, it's Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week we break down:

JFrog's pitch formula you can steal for co-sell – Why most partner meetings die in the first minutes and the exact "Challenge→Solution→Result" framework to make your partner conversations stand out.

Snowflake's field alignment strategy that accelerated its growth on Azure to 40% in 6 months – CFO reveals.

AWS Partner Profitability Framework– How smart partners climb from single-digit margins to 60%+ business outcome profits using this strategic ladder

These insights come from analyzing hundreds of marketplace transformations—which brings me to an exciting announcement.

Join our $100M Cloud GTM Playbook workshop on September 4th (this Thursday!) where I'll share battle-tested patterns from 250+ marketplace transformations—including why some companies 10X their results while others plateau.

This workshop leads to Cohort 12 of our Cloud GTM Leader course starting Sept 9th.

JFrog's value storytelling playbook: Steal it for your co-sell pitch

Many co-sell partner meetings die in the first minutes because they talk features, not customer transformations. The best pitches win by showing “customer value” and “why we win”. Here is a clean example from JFrog’s investor deck.

What to copy:

Start with Outcome-Oriented Customer Stories:

Look at how they position customer wins. Notice what's missing? No jargon. No feature lists. Just quantified business impact that anyone can understand.

"Challenge -> Solution -> Result" Formula

This is a classic and highly effective storytelling structure. It’s simple, logical, and focuses on what the customer actually cares about.

Quantifiable, Headline-Worthy Results

They don't just say "faster." They say "90x increase in release speed."

They don't just say "more efficient." They say "52 days to 6 minutes."

These are staggering, memorable metrics that a partner's sales team can easily recall and use in a customer conversation.

Logo Power

Using massive, respected brands like Box and Cisco provides instant credibility.

It answers the unspoken question: "Have you proven this at enterprise scale?"

Clear Competitive Differentiation

Make competitive positioning equally precise

Know Your Rivals

They don't just list competitors; they categorize them (Home-grown, DevOps vendors, Cloud Providers, etc.) and explain differentiation against each segment. This shows deep market understanding.

Simple "Why Us" for Each Category:

For each competitor type, they provide a concise, compelling reason why customers choose them instead.

Comparing with Cloud Providers (like Amazon Web Services (AWS), Microsoft Azure), they highlight "Hybrid," "Multi-cloud," and "Breadth and depth of functionality."

They turn potential weakness (competing with hyperscalers) into a strength (we offer what they don't: true neutrality and greater depth).

NB: this example is a “neutral” deck. Adjust your pitch to your audience.

Differentiated Value

The green box isn't just a list of "best-in-class features".

It's a list of advantages: “Unique focus on packages”, “Multiple patents” and "Deep developer mindshare."

Partners want to work with winners, and this underscores their leadership and differentiation.

3 principles for partner communication:

Start with customer transformation, not product capabilities

Quantify the "why you, why now"

Make differentiation scannable

Add the hyperscaler “better together”

If you’re building slides for co-selling with clouds, highlight their service attach to their field sellers (quantify this if you can):

“Runs on X services + integrates with Y services → drives consumption, migrations and accelerates security/compliance, etc. outcomes.”

You’re telling the cloud AE that helping you helps them.

Companies winning the biggest co-sell marketplace deals aren't those with the most features – they're the ones whose value cloud sellers can easily repeat.

What's your co-sell value framework?

Free Workshop: $100M Cloud GTM Playbook: 2 Years, 250+ Alumni, 5 Breakthrough Insights

Two years and 250+ course alumni later, the data reveals something striking about cloud marketplace success: Companies hitting $100M+ follow patterns most others yet to discover.

After analyzing hundreds of marketplace transformations through our Cloud GTM Leader course, I'm hosting our anniversary workshop to share what separates companies driving 10X results from those who plateau on marketplaces or never take off in the first place.

Here's what we'll cover:

The $100M Pattern Analysis - Data from 250+ transformations revealing the specific differences between companies that scale vs those that stagnate

The Strategic Commit Playbook - How top performers systematically access $469Bn in enterprise cloud commitments instead of waiting for random deals to appear

Case Study Deep-Dive - Live breakdown of companies that scaled on marketplaces to $MM+ using these exact frameworks, with specific tactics you can implement immediately

The Internal Champion Blueprint - Why most marketplace initiatives fail internally, and the proven methodology to turn your sales and other teams into advocates

Latest Marketplace Intel - Exclusive trends and opportunities many alliance leaders won't discover until it's too late

Learn from top operators who'll share real transformation insights:

I'm bringing together battle-tested leaders who've cracked the code—top mentors, speakers and alumni from our course with real transformation track records.

Alex Balcanquall, Senior Director of Marketplace Strategy & Operations at Cloud Software Group (includes Citrix)

Alex has driven a doubling of Total Contract Value through marketplaces each year since 2021.In 2024, his closed TCV growth via marketplaces was ~450% compared to previous year, representing 20% of Citrix's total TCV across all channels.

David Mauer brings fresh battlefield insights from GitLab, where he led Ecosystem Cloud Programs and helped drive $100M+ in marketplace revenue.

Now Vice President of Channel & Alliances at LucidLink, he's mastered turning marketplace and channel partner complexity into competitive advantage.

Plus additional speakers sharing first-hand insights from our course community.

This isn't theory. These are proven frameworks from our Cloud GTM Leader community who cracked the marketplace code.

📅 Join me at $100M Cloud GTM Playbook Workshop: September 4th at 9-10am PT

This workshop leads into Cohort 12 of our Cloud GTM Leader course starting September 9th - our 2-year anniversary cohort.

The companies that leverage these patterns will capture higher marketplace share and outpace competitors. Are you one of them?

Snowflake's 40% Azure Growth: Why Field Alignment Matters

Snowflake's stock surged 20% last week following its impressive Q2. At $80B market cap, few companies reaccelerate growth to 32%.

One key driver? 40% Azure growth after six months of field alignment.

Snowflake delivered a standout Q2: product revenue hitting $1.1B and RPO surging 33% to $6.9B.

The company is also "investing in our partnerships," CEO highlighted. "Today, more than 12,000 global partners, including leading cloud providers, technology innovators, and system integrators, are part of our ecosystem."

NRR improved to an impressive 125%

Field Alignment Drives Cloud Wins

CFO Michael Scarpelli revealed the Azure acceleration driver:

"Azure was our fastest-growing cloud. It actually grew 40% year over year... I would say a lot of that is attributable to better alignment between our field and Microsoft. We've been spending a lot of time the last six months there."

Microsoft partnership also fuels global expansion: "Microsoft is very strong in EMEA. We're seeing some good uptick in EMEA in our business as well with some large accounts."

This isn't just sales coordination

CEO Sridhar Ramaswamy emphasized their technical depth:

"We work very closely with the Azure team at an infrastructure level, at the level of OneLake, but also at the level of the end-user products like Office Copilot and Power BI. And the go-to-market partnerships that Mike referenced just now are an additional, like, cherry on top of that."

This strategy is paying off — "clearly, the Azure cloud is the fastest growing, but it's off a lower base. AWS is still the biggest, but Microsoft is moving up," CFO explained.

AI Adoption Strengthens

Enterprise AI adoption remains strong despite industry concerns. Ramaswamy highlighted: "We are seeing budgets get allocated from large customers for AI projects."

Snowflake's AI now influences nearly 50% of new customer wins and powers 25% of all deployed use cases, with over 6,100 accounts using AI weekly.

When pressed on AI's enterprise adoption and ROI, Ramaswamy shared personal experience:

"The kind of questions that we can ask of a sales agent that we develop on Snowflake Intelligence has become pretty remarkable...

being able to do cross-cutting analysis, for example, of the most popular use case top trends and use cases, questions that I would normally need to go to an analyst for."

"The world's best model, combined with the data about their business that they have often painstakingly put into Snowflake, and that's where we are seeing massive value get realized," he explained.

Replicate This Playbook

Invest in field alignment for cloud GTM results

Co-engineer beyond APIs to address specific customer use cases

Layer AI to drive adoption

At Snowflake's scale, 32% growth with 125% NRR shows their cloud strategies aren't just distribution —they're competitive moats.

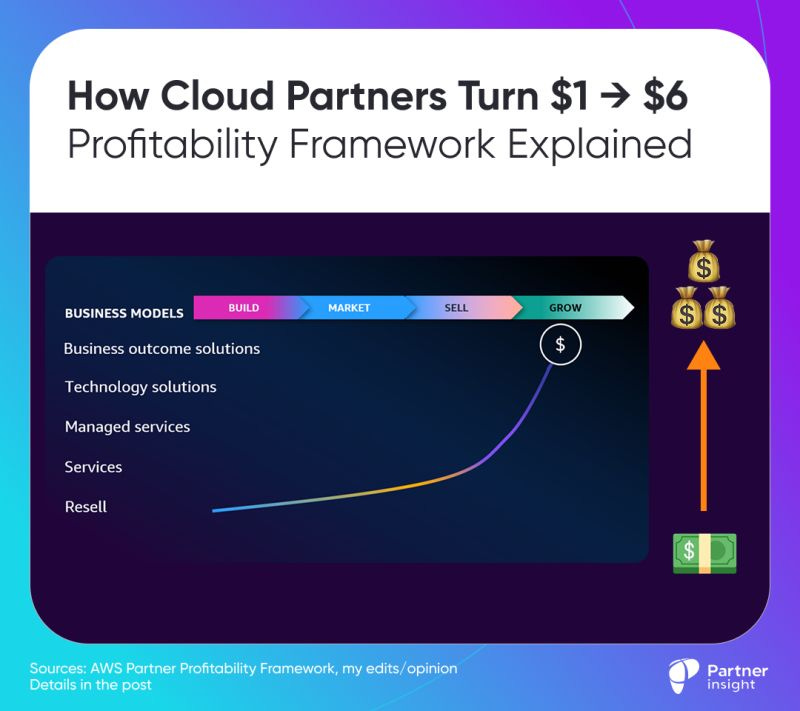

How Cloud Partners Turn $1 → $6 Profitability Framework Explained

Why some cloud partners capture 60%+ margins while others struggle with single digits comes down to one thing: where they position themselves on the value ladder.

Cloud Partnership Ladder: Where Your Money Lives

AWS's Partner Profitability Framework breaks down exactly where partners generate returns at each stage:

Resell (Single-digit margins)

Simple cloud service reselling. Low differentiation, high competition. Most partners start here, but staying here limits growth potential.

Value-Added Services (High teens to 20% margins)

Partners add their services on top of native AWS capabilities. Migration consulting, implementation services, custom platforms built on AWS.

Managed Services (30-40% margins)

Range from basic IT operations management to performance monitoring and backup recovery, to completely running a customer's entire infrastructure.

Customers avoid CapEx while partners capture recurring revenue.

Co-sell your own IP

Partners selling their own IP alongside AWS get extra margins, because hyperscalers actively seek these partnerships to extend their total addressable market.

Business Outcome Solutions (highest margins, 60%+ previously reported)

End-to-end solutions that directly impact customers' top line. Real-time retail analytics, predictive maintenance systems, revenue-generating applications.

Compounding Effect Partners Miss

Amazon Web Services (AWS) has a $6.40 partner multiplier for $1 of its cloud services. Importantly the value only starts in year one:

39% of the multiplier is gained after first year. Partners can drive major upside beyond 12 months with the same customer.

79% of partners report customers increased cloud consumption after 1 year. This creates a large opportunity for expansion revenue.

Where are AI and Agents?

The AI wave is creating unique opportunities at every tier of the ladder and boosting value of the right partners.

Capgemini's study showed that 62% prefer partnering with solution providers rather than building agents in-house.

Just published MIT research confirmed companies purchasing AI tools from specialized vendors and building partnerships succeed 67% of the time, while internal builds succeed only 1/3.

Three Strategic Moves:

Climb the margin ladder systematically

Each tier builds on the previous one. Use resell to learn, managed services to create recurring revenue, then move to outcome-based and AI solutions

Design for compounding growth

60% of revenue happens during advise, design, and build phases, but expansion after year 1 is where revenue scales

Leverage the AI advantage

Position yourself as the trusted guide for AI transformation, not just another vendor selling tools

Partners who master business outcome delivery while capitalizing on AI will capture most of growth.

Source: AWS Partner Profitability Framework

Unlock Your Growth on Cloud Marketplaces: Join Cohort 12 Starting Sept 9

After guiding 250+ cloud alliance leaders to marketplace success, our landmark 2nd anniversary cohort of the Cloud GTM Leader course opens Sept 9. With software sales on cloud marketplaces projected to reach $85B in just 3 years (Canalys), mastering them has become essential for companies looking to scale.

The Marketplace Opportunity Is Massive

Hyperscalers have accumulated $469 billion in committed customer spend – pre-allocated budgets you can tap into by selling your software through marketplaces.

Cloud marketplaces also give you instant access to hundreds of thousands of enterprise customers actively spending on cloud platforms. Positioning your solution effectively in this ecosystem isn't just an advantage—it's a necessity that also requires transforming your go-to-market motion.

What Our Alumni Are Saying

"This course is 100% essential for anyone starting on this journey. Even for those who are already there, they should take this course. I wish I’d been able to do this a year ago - it’d have saved me a lot of stress." - Director of Alliances & Strategic Partnerships, Redgate Software

James went from having his marketplace strategy shot down by his board to generating $200K in revenue + $7M pipeline in just 8 weeks.

"Cloud marketplaces are complex and continually changing. This course offers a wide variety of speakers and topics to address this complexity and specifically create strategies to drive value…" - Jordan Spiers, VP of Strategic Alliances, Cloudaware

What You'll Get Over 5 Weeks

10 Deep-Dive Expert Sessions with VP-level cloud GTM leaders who've built million-dollar marketplace motions

4 Mastermind Sessions to solve your specific challenges with peers and mentors

12-Month Access to our exclusive Cloud GTM Leader Slack community

Frameworks & Templates that normally cost thousands in consulting fees

Certificate showcasing your marketplace expertise

Free Workshop: Sept 4th

Before the course begins, join our free workshop "$100M Cloud GTM Playbook: 5 Breakthrough Patterns" on Sept 4th (9-10am PT) where we'll share the frameworks our most successful alumni have used to transform their results.

Secure Your Spot in Cohort 12

The Cloud GTM Leader course begins Sept 9th. With just 7 days until launch and limited spots remaining, now is the time to transform your cloud marketplace strategy.

Our program has been recognized by Jay McBain of Canalys as a Top Education Program for Channel and Partnership professionals, with alumni from companies like GitLab, Citrix, Darktrace, and Wiz consistently rating it 9/10.

P.S. Not sure if this is right for you? Attend our free workshop on Sept 4th to experience our teaching approach and meet community members before deciding.