9 AWS re:Invent Marketplace Signals to Rewrite Your 2026 Cloud GTM

Hi, it’s Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week we’ll break down key AWS re:Invent insights, plus new data on how AI and cloud are reshaping IT budgets:

9 re:Invent signals that AWS Marketplace is now the primary GTM engine for ISVs – from up to 4–5x larger deals, and Salesforce scaling from $2B to $3B in six months, to a new $7.13 partner multiplier and agentic AI specializations.

What we learned from our oversubscribed AWS Marketplace breakfast at re:Invent – PLG 2.0, making Marketplace feel “normal” to the rest of your company, and why automation is now the key scale enabler.

7 signals from BCG’s latest IT Spending Pulse – AI and cloud budgets rising in lockstep, AI ROI in the 11–14% range, and why platforms + specialists are quietly winning over do-everything providers (and what that means for your cloud GTM strategy).

Before we dive in:

Join us this Thursday in London (Dec 11, 6–8pm) for our re:Invent Strategic Debrief with AWS’s Phil Soane – turn key re:Invent insights into your AWS Marketplace growth in 2026

9 re:Invent signals that AWS Marketplace should be your primary GTM engine

After last week’s Partner keynote at re:Invent, it’s hard to see AWS Marketplace as anything other than the primary GTM engine for ISVs – and the numbers Ruba Borno shared back it up.

These are the signals that stood out to me last week:

1️⃣ Marketplace as the #1 GTM scaling engine

Amazon Web Services (AWS) called Marketplace “the most powerful Go-to-Market scaling engine” and “the highest performing, fastest growing GTM channel”, driving up to 4–5x larger deal sizes and up to 40% net-new customers.

If Marketplace isn’t at the center of your GTM strategy yet, you’re missing out.

2️⃣ Marketplace billionaires are rapidly growing

A group of partners are now doing $1B+ a year each through AWS Marketplace:

Datadog has crossed $2B

Snowflake and Salesforce are both over $3B

Not only is Marketplace supporting multi-billion-dollar motions for ISVs, but numbers are scaling fast too - I reported Salesforce crossing $2B in June, now they’re already at $3B.

3️⃣ Self-serve + AI reshape the sales motion

Over 80% of Marketplace transaction volume is already self-service. Express Private Offers use AI to issue custom pricing in minutes instead of weeks.

The default buyer journey is becoming increasingly product-led and automated.

4️⃣ Multi-product solutions enable more partnerships

AWS launched multi-product solutions that bundle multiple ISVs, professional services and AWS first-party services into a single package with one lead seller and unified procurement.

The real play is now solution orchestration, not just listing your product.

5️⃣ New partner multiplier: $7.13 for every $1 of AWS

For every $1 of AWS services a partner deploys, they see $7.13 in their own revenue.

With AWS talking about growing to a $300–400B business, they are signaling a 3 trillion dollar partner economy on top.

6️⃣ Competencies as real economic levers

Customers working with competency partners are 30% more likely to get AI workloads into production and do it 25% faster.

Competencies are no longer just a badge – it’s a measurable advantage in competitive deals.

7️⃣ Agentic AI becomes a formal specialization

AWS launched three new agentic AI competency categories (applications, tools, consulting services) and will give these partners 50% more MDF plus a specialization badge in Marketplace.

Signal: agents are a core category.

8️⃣ Startups compounding on Marketplace

Startup partners are growing Marketplace sales 130% year over year; companies like Vanta have seen private offers grow 700% YoY. You don’t need to be an enterprise to see Marketplace traction.

9️⃣ True global localization for Marketplace deals

AWS is rolling out “true local invoicing”: local currency, local banks and region-specific tax treatment, not just FX conversion. For partners, that removes a big part of the friction in scaling Marketplace deals globally

What else stood out to you from the keynote? Curious how this lines up with your own AWS GTM and Marketplace motion.

Insights from our Marketplace Strategic Breakfast @ AWS re:Invent

Last week at re:Invent, 50+ ISV and cloud GTM leaders filled the room at The Venetian to answer one question: what does AWS Marketplace GTM look like at scale?

Huge thank you to everyone who joined us (and to those who tried – we were oversubscribed).

Three themes from the conversation stood out.

1️⃣ PLG 2.0: from clicks to agents

Lewis Howarth highlighted that traditional PLG is no longer enough.

Many ISVs have been building strong PLG strategies leveraging marketplace features. The next wave is what he called “PLG 2.0”:

Agentic discovery (Agent Mode) that helps customers find the right solutions

Agentic solution building with Multi-Product Solutions

Agentic negotiated offers with Express Private Offers

In other words: the “product” is no longer just your SaaS – it’s the full Marketplace + agent experience that guides buyers from discovery to buying with far less human friction.

2️⃣ Make Marketplace feel “normal” to the rest of your company to scale internationally

Phil Soane focused on the internal side of Marketplace scale.

The ISVs that grow fastest on AWS Marketplace globally don’t treat it as a side-channel. They work to normalize Marketplace globally:

Mirroring business entities and finance structures in their Marketplace setup

Localizing transactions so finance teams see familiar currencies and flows

Bringing finance, legal and operations into the journey early so trust builds over time

Marketplace stops being “that special thing the cloud team does” and becomes just how the company sells, across regions.

3️⃣ Scale needs automation, not just people

Reagan Koryozo’s message cut through very clearly.

Plenty of ISVs are now doing hundreds of private offers and tens of millions in GMV on AWS Marketplace. But many of those motions are still held together by people: manual quoting, bespoke approvals, spreadsheets behind the scenes.

To get anywhere near the “billion-dollar club”, the flywheel has to be automated, not just staffed. That’s where the Marketplace enabler ecosystem comes in – platforms like Suger that turn repeatable patterns (listing, co-sell, private offers, billing) into systems instead of heroics.

For me, two things stood out:

How honest the discussion was – from what’s working to what’s still improving

How much valuable insight comes from putting “operators” in one room before the main conference day kicks off

Big thank you to:

Lewis Howarth and AWS team for sharing their perspective

The ISV and channel leaders who pushed the conversation into real-world detail

Ingram Micro for hosting us, and Suger for partnering with us on this event

We’ll keep taking these conversations both online and offline – more working sessions coming soon

PS. Special thanks to our partner Suger that helps B2B software companies unlock revenue on cloud marketplaces.

Special re:Invent AWS Marketplace Strategic Debrief in London

After our oversubscribed AWS Marketplace breakfast at re:Invent last week, we’re bringing the most important marketplace insights to London for our final in-person GTM debrief this year.

On Thursday, 11 December (6-8pm, near Liverpool Street) we’re hosting a Re:Invent Strategic Debrief – AWS Marketplace GTM for ISVs & Partners:

It’s a focused, invite-only session for leaders who want to turn this year’s announcements into marketplace growth and co-sell plays for 2026.

Re:Invent is where AWS sets the agenda for the next 12 months. This debrief is about what that actually means for your GTM if you’re building on AWS Marketplace in the UK and Europe:

Which Marketplace and partner moves matter most for ISVs

How buyers are changing the way they purchase through AWS

Where ISVs are already seeing pipeline, co-sell, and revenue from marketplace motions

I’m excited that Phil Soane – Senior Manager, AWS Marketplace International Expansion – will speak at our London event.

Phil has one of the deepest views I’ve seen on how Amazon Web Services (AWS) Marketplace is scaling internationally, and what it takes for ISVs to make Marketplace feel “normal” for the rest of their company rather than a side channel.

With 5+ years helping ISVs scale across EMEA and globally via AWS Marketplace, Phil and the international expansion team help to transform complex international requirements into clear pathways for success.

We’ll keep the format practical:

Strategic context on key re:Invent Marketplace / partner announcements

Phil’s insights on growing internationally with AWS Marketplace

Q&A and discussion on what’s working (and what’s evolving) – and how to accelerate your Marketplace GTM in 2026

Networking in a curated group of ISV & cloud GTM / alliance leaders

📅 When: Thursday Dec 11, 6–8 PM UK time

Where: London, 77 Leadenhall St (near Liverpool Street) – small group setting over light drinks and nibbles.

Join us in London on Thursday evening and leave with:

A sharper view of AWS Marketplace direction after Re:Invent

A shortlist of actions for your 2026 GTM plan

New connections with peers who are also scaling their AWS business

See you this week in London!

PS. Thank you to our partners

Spektra SaaSify for supporting this event. SaaSify powers cloud marketplace operations of companies like Palo Alto Networks. It transforms traditionally heavy, high-touch processes into fully automated, no-touch marketplace systems.

Deel (one of the fastest-growing companies in history, surpassing $1B ARR within just 6 years) & WeWork for hosting us in London

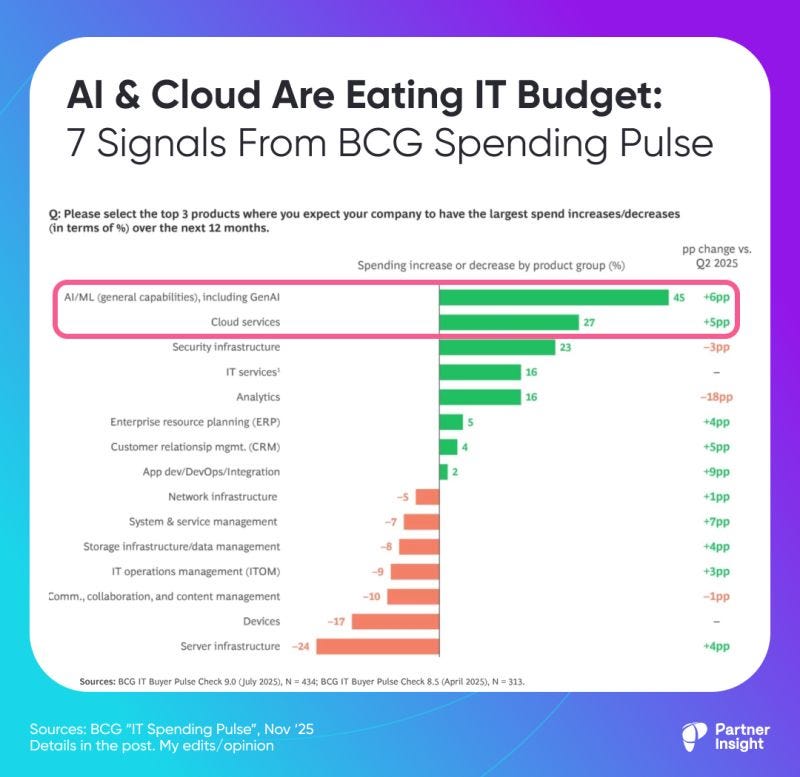

AI & Cloud Are Eating IT Budget: 7 Signals From BCG Spending Pulse

Enterprise buyers are pragmatically rewriting IT budgets around AI, cloud, and security. BCG’s latest IT Spending Pulse shows the shift that is actually happening behind the catchy headlines dominating media.

Here are 7 signals that stood out for me:

1️⃣ AI and cloud are growing in lockstep

AI/ML is the top net expansion area, with 45% of buyers planning to increase AI/ML spend

Cloud services are number 2 at 27%

Both are up strongly vs the last pulse (+6pp for AI/ML, +5pp for cloud), while devices, servers, and standalone analytics are flat or shrinking.

AI growth is coming with cloud growth, not instead of it.

Security is closely following cloud.

2️⃣ Digital transformation, growth and security are back on top

Cost-cutting is fading. CIOs now name digital transformation, growth, and security as their top three priorities.

As AI begins to prove its value; they modernize the core to grow it.

“Budgets are stabilizing and buyers are returning to strategic initiatives with renewed confidence” (BCG)

3️⃣ Budgets are rising again – with a maturity gap

IT leaders expect to grow spend by 2.9% in 2025 and 3.6% in 2026. This is cautious optimism, not a return to blank-cheque projects

More mature organizations dedicate 4.1% more revenue to IT vs less mature peers and expect 2X the ROI from GenAI and AI agents.

4️⃣ AI is delivering real – and measured – ROI

Current GenAI deployments show ~11% ROI, with expectations to rise to ~14% over the next 3 years (14.7% for AI agents).

Average ROI has moved slightly up from 10.6% at the end of 2024, pointing to a real growth rather than hype.

5️⃣ From “AI everywhere” to 3-5 winning use cases

Leaders are cutting the number of AI initiatives and concentrating on 3-5 use cases that work for them, e.g. analytics, customer service, marketing.

Fewer experiments, more tuning and scaling.

6️⃣ Platforms and specialists beat “do-everything” providers

“Satisfaction with technology providers varies sharply” (BCG).

8 out of 10 buyers are satisfied with digital platforms - most satisfied group

SaaS and specialist services sit around 63%.

It drops to 48% for MSPs - clearly buyers prefer focused experts.

7️⃣ Supplier consolidation is accelerating

“Supplier consolidation reflects a pragmatic push to simplify portfolios, fund innovation, and reduce risk.”(BCG).

Even in security, where spending remains robust, “buyers are consolidating vendors as they seek fewer but stronger tools to ensure resilience and manage complexity.”

Why this matters for alliance & marketplace leaders

Treat AI, cloud, and security as one conversation, find a way to join it

Align your product in marketplaces as the easiest path to (enable) scale pragmatic AI programs on top of trusted clouds

Lean into consolidation: be the focused, high-ROI specialist on your hyperscaler’s platform, and surround yourself with a curated list of high-caliber partners (not a long tail of noise)

Source: BCG

P.S. If you found these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.