Marketplace adoption in SaaS jumps 34% → 40%

Hi, it’s Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week:

Marketplace adoption jumps from 34% → 40% in the latest KeyBanc survey — even smaller SaaS companies increasingly see marketplaces and ecosystems as a primary lead source

Zscaler recently crossed $1B on AWS Marketplace and is already planning the next phase — highlights from our London re:Invent debrief on what Cloud GTM leaders are prioritizing right now.

Riot Games targets 90% of software procurement via Marketplace — after 935% first-year growth and cutting cycles from 100+ days to ~30, here’s how enterprise marketplace buyers actually think.

Before we dive in:

If you want to turn these signals into a repeatable Marketplace GTM plan and make 2026 your Marketplace growth year, Cohort 14 of the Cloud GTM Leader course starts Jan 13. Details + the newsletter-reader promo code are below.

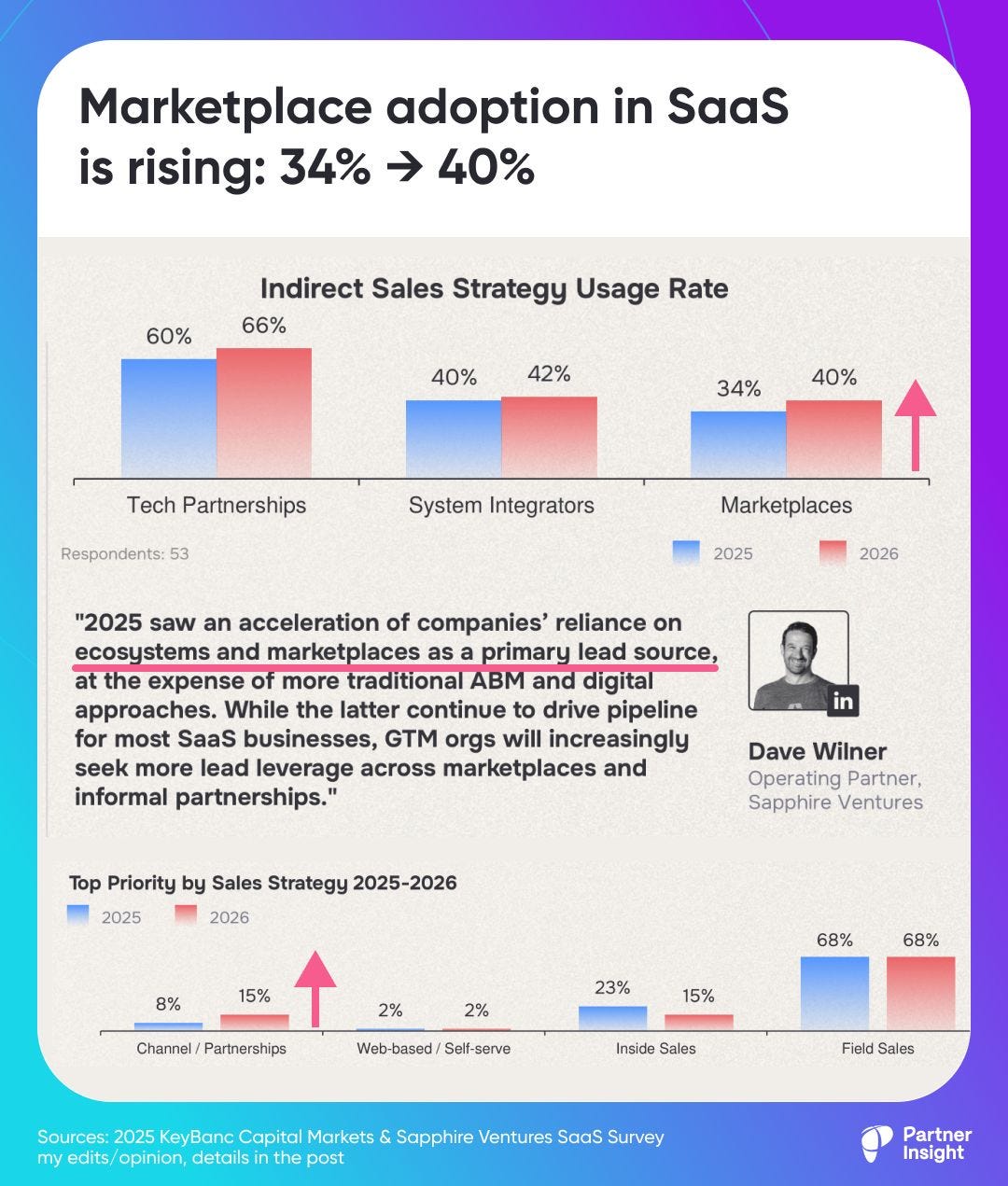

Marketplace adoption in SaaS is rising: from 34% to 40%

Marketplace adoption as an indirect sales strategy in SaaS is climbing from 34% to 40% - while reliance on tech partners is also rising. If you still think “marketplaces are for later, when we’re bigger” - this survey suggests the opposite.

KeyBanc Capital Markets + Sapphire Ventures recently published their 2025 SaaS Survey.

It’s especially relevant for alliance leaders because the median company is only $23.3M ARR, with respondents spanning < $10M to > $50M ARR.

These aren’t traditionally channel-heavy orgs… yet their go-to-market (GTM) center of gravity is shifting.

Here’s what stood out for me for marketplace + channel:

1️⃣ Ecosystems + marketplaces are becoming a primary lead lever

“2025 saw an acceleration of companies’ reliance on ecosystems and marketplaces as a primary lead source…” - underscored Dave Wilner, Operating Partner of Sapphire Ventures

2️⃣ Marketplace adoption is rising as an indirect sales strategy

Marketplace adoption: 34% (2025) → 40% (2026)

Tech partnerships: 60% → 66%

SIs: 40% → 42%

Marketplaces are already used by over a third of companies surveyed — and they’re growing fast, catching up with other ecosystem channels.

3️⃣ Channel is still “small” in ARR… which is why the trend matters

New ARR mix — how companies get revenue:

Field sales: 56%

Inside sales: 28%

Channel/Partnerships: 11%

Web/self-serve: 3%

The report highlights a shift toward channel/partnerships in 2025/26 at the expense of inside sales.

4️⃣ Companies want ecosystem leverage without building huge teams

Channel/Partnership Managers are only 6% of sales headcount in this dataset.

Practically, this means ~1 person below $10M ARR, 2 below $50M, and 3 at ~$50M.

If your partner team feels understaffed, you’re not alone.

Businesses expect advantage to come not from “more partner managers,” but from tighter partner + marketplace leverage.

5️⃣ Net-new economics are getting brutal

New-only CAC payback hit 37 months in 2024 (up from 31 months in 2022).

That’s why higher-intent routes (marketplaces, co-sell, partner referrals) are now critical — they can compress payback by tapping existing budgets + trusted paths.

6️⃣ AI is accelerating pricing complexity (and marketplaces benefit)

~50% of respondents are AI-native or AI-enabled. The rest are AI-interested.

Among AI-native/enabled respondents: 67% monetize AI; strategies split 58% subscription / 25% hybrid / 17% usage-based.

As pricing gets more complex, marketplaces + partners get more strategic because packaging and procurement become part of “the product.”

💡 For alliance leaders:

Marketplaces are becoming a distribution + customer acquisition engine earlier in the company lifecycle - exactly when teams are lean and efficiency pressure is high.

Curious: Is your 2026 plan built around scaling this channel?

Insights from our Re:Invent Strategic Debrief in London

When a company like Zscaler crosses $1B on AWS Marketplace and is already planning the next phase of adoption, it shows how quickly Marketplace is reshaping GTM.

Last week in London we wrapped our final in-person session of the year with ISV alliance and cloud GTM leaders.

They joined our insightful speakers Phil Soane (AWS), Vineet Parmar (Zscaler) and Manesh Raveendran (Spektra SaaSify)

Here are a few signals that stood out:

1️⃣ Marketplace is becoming “normal” for sellers

Zscaler shared how Marketplace is now built into how their sellers think. Their analysis confirmed that deals are in fact larger via AWS Marketplace and close faster.

Sellers see it as a way to unlock more customers and budget, not only a procurement shortcut. Their conversation is no longer “should we use Marketplace?” – it’s “what does the next level of Marketplace adoption look like?”

2️⃣ Early-stage Marketplace adoption: don’t oversell it internally

For companies earlier on the curve, one theme kept coming up:

the goal isn’t to win a big internal debate about Marketplace – it’s to land a first set of deals through Marketplace.

Keep the story simple:

Lead with customer benefits and deal velocity, get a few wins via Marketplace. Let those deals prove the case to sales, finance, and ops.

Once there’s real revenue in the reports, adoption conversations become much easier.

3️⃣ Channel and Marketplace are getting tightly linked

For more mature ISVs, we heard strong agreement that channel partners are now key to Marketplace scale.

Partners in the room were very enthusiastic: Marketplace is becoming a way to

strengthen their AWS alignment

simplify procurement for joint customers

participate directly in cloud-commit–driven deals.

4️⃣ PLG is getting a bigger role on Marketplace

Importance of PLG elements is growing – especially free trials, but also self-serve flows on Marketplace listings.

For many buyers, this is now the expected way to start: try the product, then scale via private offers and co-sell.

5️⃣ New AWS capabilities that will shape 2026 GTM

A few product moves that people in the room were paying attention to:

Agent Mode – buyers will be discovering products via conversational agents.

Makes keywords, messaging and SEO (& AI optimization) on Marketplace listings more important.

Multi-Product Offers – the ability to bundle multiple vendors into a single offer and transact as one. Big enabler for alliance plays that feel seamless for customers.

Express Private Offers – for deals that are too big for pure self-serve but not big enough for a heavy sales cycle you can train AI to negotiate

6️⃣ Integrators as critical infrastructure

Marketplace enablers like Spektra SaaSify are becoming essential infrastructure for Marketplace scale – to automate co-sell, private offers, PLG and now funding requests so GTM teams don’t get stuck in operations.

Huge thank you to everyone who joined, and to Spektra SaaSify for helping us close the year with such a high-signal session.

Also, thanks to Deel for supporting us. Deel is the all-in-one payroll and HR platform for global teams. You can get a 10% off all Deel products here.

Riot Games targets 90% of software procurement via Marketplace — here’s why

Riot Games is aiming for 90% of software procurement via Marketplace. After 935% growth in year one and their buying cycles shrinking from 100+ days to under 30, it tracks.

What’s remarkable isn’t just the speed—it’s how they engineered internal adoption without mandates.

“We didn’t mandate that you had to purchase through AWS Marketplace,” explained Mozammil Aslam, Director of Strategic Sourcing at Riot Games during the last AWS re:Invent. “We made AWS Marketplace the least path of resistance for new software requests.”

This isn’t a small buyer testing a new channel. Riot has 4,500 employees across 20+ offices, their EMEA entity alone reportedly had €1.85B in 2024 revenue.

When their Strategic Sourcing leader shares procurement strategy, alliance leaders should pay attention.

From Detective Work → Strategic Power

Their Marketplace transformation started with a painful realization: Riot’s procurement team was drowning in tactical vendor verification while engineers waited months for tools. InfoSec reviews alone consumed 4-6 weeks just validating basic certifications.

“We didn’t want to play detective to see if this SaaS vendor was legitimate or not,” explained Mozammil Aslam.

By leveraging marketplace’s pre-vetted suppliers with SOC 2 certifications readily available, procurement stopped hunting vendors and started doing what creates value: verifying whether tools solve real business problems and negotiating better terms.

The speed advantage compounds

Engineers launch trials immediately, validate requirements, and have tools ready before the old process would’ve completed InfoSec review. This prevents a costlier problem: shadow IT from engineers finding workarounds.

All-In on Marketplace

Most enterprises test marketplace cautiously. Riot went all-in. After their breakthrough in 2022, they saw triple-digit growth in 2023, another 20% in 2024 even as the base expanded massively.

They’re also expanding beyond SaaS into AI.

“We’re looking at machine learning models, purchasing containerized images,” Aslam revealed, signaling marketplace is becoming their default procurement layer for all technical assets.

The impact extends beyond large enterprises

Aslam suggested startups might benefit even more: “The capital that you would normally invest towards TPRM tools, you can leverage AWS Marketplace for these pre-vetted suppliers and reallocate that capital towards chasing the market opportunity.”

3 moves for ISV alliance leaders:

Optimize listings to compress reviews —highlight certifications, compliance, security architecture, etc.

Build frictionless trial paths on marketplace, so buyers can validate tools before formal procurement starts

Enable your sales team to ask and answer questions “Can we buy this on marketplace?” - Riot’s procurement now asks this question for every new request

Where are your top enterprise accounts in their marketplace journey - and are you ready when they set a 90% target?

Make 2026 Your Marketplace Growth Year: Join Cohort 14 Starting on January 13th

Enterprises have committed $531B to AWS, Microsoft, and Google Cloud — budgets you can tap into via cloud marketplaces. For SaaS and AI companies, Marketplace GTM can make or break scale in 2026.

The most advanced GTM orgs – from scaleups to public companies – are rewriting the rules. They’re using marketplaces and co-sell to scale revenue faster, compress sales cycles by 40-60%, and make buying frictionless.

Real results from real companies

Over the past two years, 270+ alliance leaders have completed Cloud GTM Leader course and built this capability. Examples of what alumni have achieved:

Launched from zero marketplace motion to $200K revenue + $7M pipeline in 8 weeks

Closed their first $1M+ marketplace deal and turned it into a repeatable motion

Scaled marketplace revenue 4X YoY from an already high eight-figure base

These aren’t outliers.

They’re alliance leaders who invested 5 weeks to master the frameworks, tactics and relationships that drive cloud GTM success.

What we master in 5 weeks:

How to tap into cloud commits + marketplace buying processes

Co-sell patterns with hyperscaler field teams that actually create pipeline

How to position on marketplaces so sellers choose you among thousands of vendors

Frameworks to Align sales, product, finance, and ops around one cloud GTM plan

How to accelerate deals with smart co-marketing (and more)

What’s included

10 expert sessions with VP-level marketplace & alliance leaders from category-leading SaaS companies and hyperscalers

5 weekly masterminds to workshop your strategy and challenges with peers

Slack community with 270+ alliance leaders

Frameworks, templates, and playbooks companies typically pay consultants to build

Newsletter reader price lock (through Dec 20)

As a thank-you to newsletter readers, I’m holding last year’s price for the January cohort: $599 (instead of $649) — valid through Friday, Dec 20.

Next cohort starts Jan 13. Use code NL599 at checkout.

If 2026 is the year you want Marketplace to become a real growth channel — this is the cleanest window to join at the lower rate.

What alumni are saying

“I wish I had this knowledge before I started my role in the GTM department last year.”

“As someone who has built AWS alliances twice, driven marketplace success, and led cross-functional GTM motions, this program elevated my perspective and sharpened my thinking around cloud co-sell programs, marketplace motions, channel strategy, and scalable GTM frameworks. Highly recommend.”

P.S. If you found these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.