Snowflake's $2B AWS Marketplace Year: The New Economics Behind It

Hi, it’s Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week:

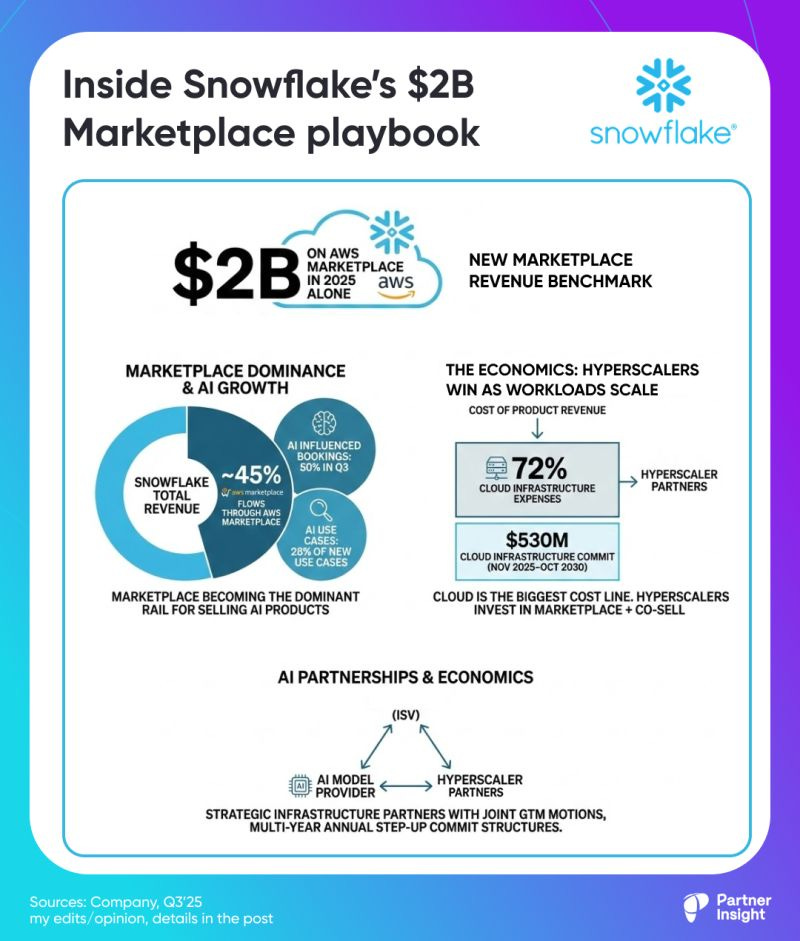

Snowflake crossed $2B on AWS Marketplace in 2025 — and now ~45% of revenue runs through a single marketplace (the playbook + economics behind selling AI on Marketplace).

Palo Alto hit $2B on Google Cloud Marketplace — adding +$500M in ~8 months (why the “$2B club” is forming fast — and resetting the benchmark).

AI partnerships are starting to mirror cloud partnerships — multimillion commit-style deals and joint GTM motions are becoming the norm for scaling enterprise AI ($200M is the example below).

Before we dive in:

If you want to turn these signals into a repeatable Marketplace GTM plan and make 2026 your Marketplace growth year, Cohort 14 of the Cloud GTM Leader course starts Jan 20. Details + the newsletter-reader promo code are below.

Inside Snowflake’s $2B Marketplace playbook

Snowflake hit $2B on AWS Marketplace in 2025 alone, setting a new benchmark.

Let’s look underneath: ~45% of Snowflake’s revenue now flows through a single marketplace, while the company has committed $730M upstream to cloud infrastructure and an AI model provider.

This is the new Cloud GTM playbook and economics in full view.

Marketplace is becoming the dominant rail for AI

As Snowflake grew 29% YoY in Q3, its CEO highlighted they “surpassed $2 billion in sales through AWS Marketplace in a single calendar year” and won 14 AWS Partner awards.

With ARR at $4.6B, $2B in AWS Marketplace sales positions Marketplace as the dominant rail for Snowflake. For many large enterprises, “buying Snowflake” is increasingly financially synonymous with buying it via AWS Marketplace. (They grow on other clouds too).

Snowflake also reported that AI influenced 50% of bookings in Q3, with 28% of new use cases incorporating AI.

Putting these together: Marketplace is becoming the commercial backbone for selling AI products.

The economics: hyperscalers win when the workload scale

Snowflake disclosed third-party cloud infrastructure expenses were 72% of cost of product revenue, up from 64% a year ago.

They just signed a new $530M cloud infrastructure commitment (Nov 2025–Oct 2030).

Translation: cloud is the biggest cost line for many software companies.

When Snowflake expands, underlying cloud consumption expands — which is why hyperscalers invest so heavily in Marketplace + co-sell.

AI agentic partnerships are starting to look like cloud partnerships

Snowflake announced an $200M Anthropic partnership that “brings native model availability into Snowflake and introduces a new joint go-to-market motion designed to accelerate enterprise AI adoption.”

Separately, they disclosed a renewed AI service provider agreement: $200M in commits over 3 years, ramping $50M → $70M → $80M per year.

The AI deal (Anthropic? given the matching amount) mirrors hyperscaler commit structures: multi-year, annual step-ups. It also signals the confidence and growth assumptions Snowflake is modeling in AI adoption.

This 3-way relationship — ISV commits to hyperscaler, ISV commits to AI provider, AI provider runs on hyperscaler — is becoming the standard.

Snowflake is treating foundation model providers the way they treat cloud providers: strategic infrastructure partners with joint GTM motions, not just API vendors.

New ‘$2B club’ is forming — and it changes the benchmark

Just 10 months ago, crossing $1B annually on a single marketplace was headline news. CrowdStrike hit it in Feb, Splunk in April, Salesforce crossed $2B in Q1 and $3B recently.

Now Snowflake is setting a $2B/year bar, as category leaders keep scaling.

This shows the power of joint GTM with hyperscalers, AI-fueled growth, and how transformative cloud marketplaces are for the software industry.

It changes how you design your GTM: Marketplace stops being “optional” and becomes the standard path.

Palo Alto x Google Cloud: $2B Marketplace crossed

Just as we’ve been tracking the “$2B Marketplace club”, Palo Alto Networks + Google Cloud announced a partnership expansion — and PANW crossing $2B in sales on Google Cloud Marketplace.

Here are the key insights I took from it:

1️⃣ The pace is accelerating as GCP is scaling a billion-scale Marketplace motion

Palo Alto Networks (PANW) $2B is cumulative — but it comes quickly after the $1.5B milestone shared at Google Cloud Next in April.

That’s +$500M in ~8 months, or roughly ~$750M/year annualized.

Not a “$1B/year club” yet — but it’s moving that way. Impressive.

2️⃣ Co-sell is downstream of co-build

The headline isn’t only the expansion — it’s also 75+ joint integrations.

Marketplace sales and co-sell don’t scale because you have a listing.

They scale when you ship pre-vetted, engineered customer outcomes — deeply integrated with the buyer’s stack and data.

3️⃣ The wedge is “secure agentic AI” (not generic AI)

The expansion is anchored to the agent stack: securing AI workloads on Vertex AI / Agent Engine, plus securing Google’s Agent Developer Kit (ADK), across posture, runtime, and model security.

Translation: partner roadmaps are being tied to cloud AI primitives — packaging security as an essential layer of the AI (and cloud) platform.

4️⃣ “Strategic partner” now includes consumption alignment

Alongside Marketplace growth, Palo Alto said it will migrate key internal workloads to Google Cloud under a new multi-billion-dollar agreement (Reuters reported a source calling it “approaching $10B,” though execs didn’t confirm it).

One proven data point: Palo Alto disclosed $6.38B in cloud infrastructure commitments on its books as of the end of October, with $2.5B extending to 2031 and later.

This gives you a sense of the size of deals being signed around cloud + AI — not just by hyperscalers, but by the largest ISVs.

PANW is ~$9.2B in revenue with $15.5B customer RPO.

Insight: the fact that their cloud commitments (~$6B+) are becoming comparable to PANW customer RPO (~$15B) is a fascinating ratio. It shows that for every $1 of software sold, there’s a significant underlying investment in compute/AI infrastructure.

5️⃣ The backdrop is driving this shift

Palo Alto’s newly published cloud security survey of enterprises reads like a cloud & AI tailwind:

7 out of 10 enterprises “operate in extensive cloud integration or fully cloud-native states”

Multicloud is default (65% use 3+ clouds)

75% already have AI systems in production (another 23% plan to within 12 months)

Enterprises want platformization, not more tools — which is exactly where PANW is pushing hardest

If you lead alliances, the question isn’t “do we have Marketplace presence?”

It’s: do we have joint outcomes, mapped to the hyperscaler narrative/AI stack, that a customer can buy (with commits) and deploy with minimal integration work?

Make 2026 Your Marketplace Growth Year: Join Cohort 14 Starting on January 20th

Enterprises have committed $531B to AWS, Microsoft, and Google Cloud — budgets you can tap into via cloud marketplaces. For SaaS and AI companies, Marketplace GTM can make or break scale in 2026.

The most advanced GTM orgs – from scaleups to public companies – are rewriting the rules. They’re using marketplaces and co-sell to scale revenue faster, compress sales cycles by 40-60%, and make buying frictionless.

Real results from real companies

Over the past two years, 300 alliance leaders have completed Cloud GTM Leader course and built this capability. Examples of what alumni have achieved:

Launched from zero marketplace motion to $200K revenue + $7M pipeline in 8 weeks

Closed their first $1M+ marketplace deal and turned it into a repeatable motion

Scaled marketplace revenue 4X YoY from an already high eight-figure base

These aren’t outliers.

They’re alliance leaders who invested 5 weeks to master the frameworks, tactics and relationships that drive cloud GTM success.

What we master in 5 weeks:

How to tap into cloud commits + marketplace buying processes

Co-sell patterns with hyperscaler field teams that actually create pipeline

How to position on marketplaces so sellers choose you among thousands of vendors

Frameworks to Align sales, product, finance, and ops around one cloud GTM plan

How to accelerate deals with smart co-marketing (and more)

What’s included

10 expert sessions with VP-level marketplace & alliance leaders from category-leading SaaS companies and hyperscalers

5 weekly masterminds to workshop your strategy and challenges with peers

Slack community with 300 alliance leaders

Frameworks, templates, and playbooks companies typically pay consultants to build

Newsletter reader price lock (through Dec 31)

As a thank-you to newsletter readers, I’m holding last year’s price for the January cohort: $599 (instead of $649) — valid through Dec 31 2025.

Next cohort starts Jan 20. Use code NLNY599 at checkout.

If 2026 is the year you want Marketplace to become a real growth channel — this is the cleanest window to join at the lower rate.

What alumni are saying

“I wish I had this knowledge before I started my role in the GTM department last year.”

“As someone who has built AWS alliances twice, driven marketplace success, and led cross-functional GTM motions, this program elevated my perspective and sharpened my thinking around cloud co-sell programs, marketplace motions, channel strategy, and scalable GTM frameworks. Highly recommend.”

P.S. If you found these insights valuable, please forward this newsletter to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.