Your Marketplace Revenue Isn’t Scaling? Here’s the Org-Wide Fix.

Hi, it’s Roman Kirsanov from Partner Insight newsletter, where I deconstruct winning Cloud GTM strategies and the latest trends in cloud marketplaces.

This week:

How to Scale Marketplace Revenue in Your Org — in Plain English: The cross-functional playbook that turns marketplaces from a checkbox to a revenue engine.

Hyperscalers’ $255B+ AI capex creates an $800B partner opportunity: Recent analysis reveals why clouds need ISVs, SIs, and other partners to capture the AI-enabled services economy transformation.

Meet the $1B+ Marketplace practitioners in less than 72 hours: Mark Grigoletto from Presidio who led the first channel partner past $1B on AWS MP, Umang Shukla from Anthropic’s Strategic Partnerships on how AI products gain enterprise traction via MP, and Clazar’s CEO behind $2.5B in processed marketplace deals.

Just 3 days left: Join our biggest event “AWS Marketplace: Your 2026 Revenue Engine” — 14 speakers including Jay McBain, AWS leaders, and execs from Okta, Anthropic, Presidio, Pinecone, and Mission reveal their exact co-sell, channel, and marketplace growth strategies (Oct 30, 9-11:30 AM PT).

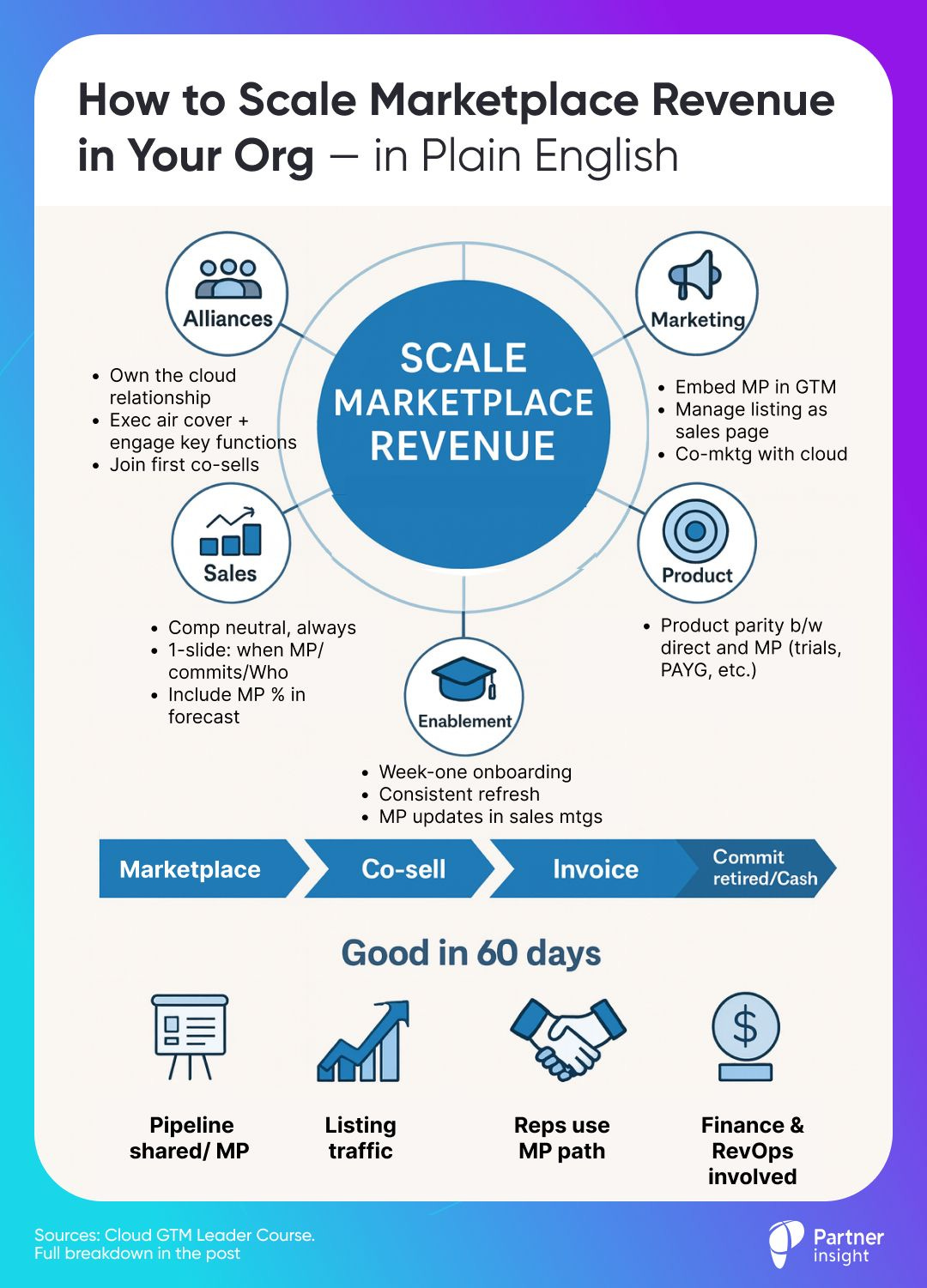

How to Scale Marketplace Revenue in Your Org — in Plain English

What makes Marketplace revenue scale beyond first transactions?

When Sales, Marketing, and Product see Marketplace as the fastest swim lane to reach customers—revenue follows.

Here’s the checklist to embed it across your org.

Alliances: set the pace

Own the cloud relationship, secure exec air cover, and build dotted line relationships with a point-person in each function below.

Orchestrate: bring cloud context inside, build internal Marketplace (MP) champions, keep teams unblocked, and make MP visible in leadership updates and team catch-ups.

Early on, be hands-on—join the first co-sell calls, shape positioning, help Sales handle cloud and customer commit conversations, and translate cloud incentives for internal teams.

Marketing: demand meets a procurement path

Embed Marketplace presence across your GTM—website, campaigns, everywhere. Customers should know they can buy via Marketplace.

Manage MP listings to reflect core messaging. Your listing is an additional sales page to optimize, measure, and drive traffic to.

Ask your cloud counterpart about co-marketing opportunities and MDF. Most ISVs leave joint promotions unclaimed.

Sales: execute to fast track deals

Keep Marketplace comp neutral—reps won’t adopt if it costs quota credit.

Give reps simple slides: when to use MP, how commit burn works, FAQ, and who to ping for quick questions.

Sales leadership - add MP targets or “% via Marketplace” to forecast reviews.

Create a Slack channel with Alliances to answer MP questions, share wins, and surface best practices.

RevOps: integrate with CRM so sharing deals to ACE/Partner center is effortless and trackable.

Finance: make cash flow transparent

Walk Finance through transaction flow: when cash lands, how commissions work. Discuss the first few deals so closing via MP isn’t a surprise.

Over time, build dashboards: MP cycle time vs. direct, win rate, time-to-cash. When Finance sees 30% faster closing or 50% larger deals, they become your loudest advocates

Product: list how buyers actually buy

Parity matters. If your site offers trial/PAYG but the listing is contract-only, you’re leaking pipeline.

Treat Marketplace as a product surface. Keep an eye on your listings and their tech requirements.

Enablement: cadence over one-off

Bake Marketplace into new-hire onboarding (week one). Run quarterly refreshes. Integrate MP and alliances updates in all key Sales meetings.

What “good” looks like in 60 days:

Marketplace shows up in pipeline reviews, not just PR

Marketing drives measurable listing traffic

Reps pitch MP in customer conversations, explain commit burn, help to navigate procurement

Listing mirrors primary sales motions and product lines

Finance knows “When paid?” without slacking Alliances (treat commission as COGS)

Marketplace and Co-sell accelerate deals. But embedding it in your org is what scales. Wire this now and your Marketplace motion pays back in following quarters.

The $1B+ Marketplace Club: 3 Days Until You Meet Them

3 days left. 14 speakers. 2.5 hours that could define your 2026 marketplace strategy.

In less than 72 hours, you’ll hear from people who’ve actually scaled AWS Marketplace to numbers most teams only forecast.

This week, meet four more practitioners joining us October 30th—each bringing battle-tested strategies you can deploy in Q4 and 2026

The Channel Partner Who Hit $1B on AWS Marketplace

Mark Grigoletto, Director of Cloud Marketplace at Presidio, led the first channel partner to surpass $1B in AWS Marketplace sales. Jay McBain called it “the largest route to market change in the 44-year history of the resell channel.”

Mark joins our Ecosystem Sales panel to break down:

How channel partners actually win on AWS Marketplace at scale

CPPO in practice: turning complexity into growth + continuous engagement

Building ISV ↔ partner alignment, services attach, ecosystem multiplier & more

Why Mark’s perspective is rare: He’s been building Presidio’s marketplace motion for 5 years after leading Business Development for Cloud Solutions—and before that, spent years at Microsoft. He understands both the vendor and partner sides.

Where AI Meets Enterprise Buying: The Anthropic Playbook

Umang Shukla, Strategic Partnerships at Anthropic, brings rare insight from one of the top AI companies.

Anthropic lists 4 solutions on AWS Marketplace, Claude for Enterprise, Financial Analysis Solution, Claude for Education, and the newly added Claude for Life Sciences —showing how fast-moving AI products grow on marketplace.

As he joins our Co-Sell panel, Umang will discuss:

How AI products gain adoption on Marketplace and why customers prefer buying there

“Better Together” positioning of AI products and co-sell with AWS

Which types of enterprise customers show fastest AI product adoption via Marketplace

Context: Anthropic earned AWS’s 2024 GenAI Foundation Model Partner of the Year and is gaining rapid enterprise traction. Last month, Anthropic’s CEO Dario Amodei highlighted: “Our revenue has increased by 10X a year… it’s now in the mid- to high-single-digit billions.”

ISV Operator → AWS Strategist: Co-Sell at Global Scale

Krista Damico, Principal Tech BD at AWS Marketplace Center of Excellence, has a perspective few people can offer—she built marketplace programs from the ground up as an ISV partner at LogicMonitor before joining AWS in 2021.

At LogicMonitor, she built global alliances and marketplace programs across AWS, Microsoft, GCP, and ServiceNow—earning recognition on CRN’s Women of the Channel. Now at AWS, she accelerates partner growth through operational excellence.

That operator-to-strategist path means she knows how to turn Marketplace from a checkbox into a revenue engine—and the internal obstacles that slow partners down.

Krista joins our Co-Sell panel with Josh Greene (Okta) and Umang Shukla (Anthropic) to cover:

Operationalizing & scaling co-sell: How top partners structure co-sell motions and what high performers do differently

International expansion as a growth multiplier: How to prioritize markets and leverage AWS Marketplace internationalization features

Building internal champions: The most common blocker is internal—sales defaults to old motions, legal redlines contracts, finance asks questions. Krista will show how to turn skeptics into supporters and build cross-functional alignment to move deals faster

Operations Leader Behind $2.5B in Transactions

Trunal Bhanse, CEO of Clazar, has helped companies process $2.5B across AWS, Azure, and GCP marketplaces. He’s seen every operational bottleneck that blocks ISVs from scaling.

On our Marketplace Operations panel with Adel Farahmand (VP Revenue, Pinecone—Top listing on AWS MP in Gen AI, Databases), Trunal will reveal:

How to automate co-sell registration without sales teams drowning in manual updates

Private offer and billing automation that eliminates deal velocity drag

Which automations deliver highest ROI based on your marketplace maturity

The proof: Using Clazar, Vectra AI grew 2.5X YoY on AWS Marketplace. Honeycomb achieved 100% opportunity approval from AWS.

The All-Star Lineup

Our “AWS Marketplace: Your 2026 Revenue Engine” event also features:

Keynote: George Maroulakos - WW Leader, AWS Marketplace CoE, Buyer Experience — how buyers actually purchase on AWS MP and where AI is changing behavior

Keynote: Jay McBain, Chief Analyst at Omdia — his $163B marketplace forecast, the agentic AI partner opportunity, and key partner ecosystem trends

Panel: AWS Growth with Co-Sell and Global Expansion — AWS and leaders from Okta, and Anthropic explain their top co-sell strategies

Panel: Driving Ecosystem Sales with Channel Partners — top ISVs, AWS, and partners on how to capture the shift to 59% partner-led Marketplace sales by 2030

Panel & Q&A: Marketplace Operations Playbook for Cloud GTM Growth with Pinecone and Clazar

Join us on October 30th, 9-11:30 AM PT

In just 2.5 hours, 10+ top leaders will break down how to turn AWS Marketplace into your revenue engine in 2026.

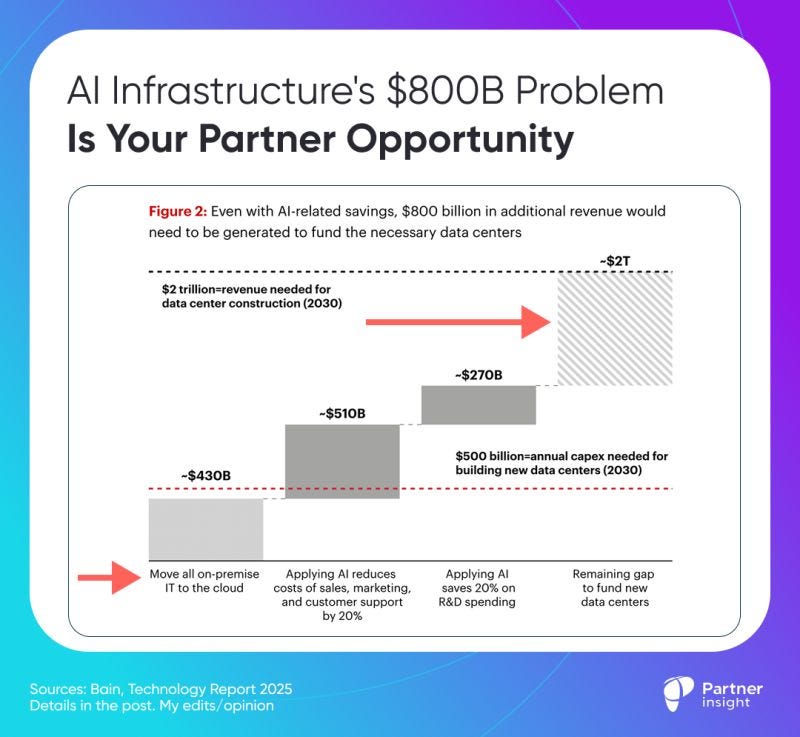

AI Infrastructure’s $800B Problem Is Your Partner Opportunity

Here’s a tricky math behind the AI build-out:

3 hyperscalers will spend $255B+ on AI infrastructure this year, but every $1 in capex requires ~$4 in revenue to justify it. That means they’re modeling >$1T/year in incremental ecosystem revenue.

Bain’s recent analysis breaks down this trajectory: It estimates the world will need ~$500B/year of new data-center capex to meet AI compute demand by 2030. To make it sustainable, this would require $2T/year in revenue—a 1:4 capex-to-revenue ratio.

And 2025 hyperscaler capex is already pointed there.

AWS is projecting $100B+, Microsoft $80B, and Google $75B for 2025 alone. Commitments keep escalating.

Headlines also pointed to OpenAI–Oracle capex deals worth ~$300B.

Plus a NVIDIA-OpenAI $100B partnership tied to 10GW of AI systems - signals of how much revenue hyperscalers and chipmakers expect to pull through their stacks.

The list goes on….

Revenue Reality Check

Even if enterprises:

move all on-prem IT to cloud (+$430B),

reinvest AI-enabled 20% savings in sales/marketing/support (+$510B),

and reinvest ~20% R&D savings (+$270B),

…there’s still an $800B annual gap to fund the build.

That’s Bain’s point: efficiency alone won’t pay for the new compute - new revenue streams must.

Where does that massive revenue shortfall come from?

One of the answers is Services. That is the next battleground where software gets rebuilt around AI agents to AI-enable jobs.

Services share of US GDP: ~72.3% (Q1’25, BEA)

The U.S. service economy alone is ~$24T annualized (Census), including:

Professional services ~$3T

Financial services ~$7.3T

Healthcare ~$4.3T

Information servicing ~$2.6T,

Admin/support ~$1.4T

I’m not saying AI replaces services; but many of these services will be increasingly AI-enabled or AI-delivered.

However, hyperscalers can’t capture this trillions in services economy transformation alone.

They need ISVs, SIs, and specialized partners to build AI-enabled solutions that convert traditional service delivery into cloud-consumed outcomes.

More good news - cheaper, more available services - higher the demand for them.

In fact, Microsoft’s research (Nov ‘24) argued that gen-AI could add $3.8T to the U.S. GDP by 2038, implying ecosystem-supported scenarios where AI’s revenue pull grows meaningfully beyond today’s models.

What this means for Alliance leaders

The math is clear: hyperscalers aren’t competing for just existing cloud budgets. They’re racing to capture revenue from AI-enabled service economy transformation.

The capex wave sets a revenue quota for ecosystems.

If your solution demonstrably pulls consumption and/or comes with services that compress time-to-value, the clouds need you to hit trillions of dollars of revenue they are implicitly committing while building this capacity.

If not, you’re maybe swimming against a very expensive AI tide.

Or underestimating the power of the ecosystems that are getting built.

Image: Research

P.S. If you found these insights valuable, please forward it to your alliance lead or cloud/GTM counterpart - it’s how this community shares what works.